Aprotic Solvents Size

Aprotic Solvents Market Growth Projections and Opportunities

The Aprotic Solvents Market is influenced by various factors that collectively shape its trends and growth patterns. One significant driver is the increasing demand from diverse industries such as pharmaceuticals, paints and coatings, electronics, and automotive for aprotic solvents. Aprotic solvents, characterized by their ability to dissolve a wide range of materials and serve as excellent reaction mediums, find applications in various processes such as synthesis, extraction, and formulation. As industries seek efficient and versatile solvents for their manufacturing processes, the demand for aprotic solvents continues to grow.

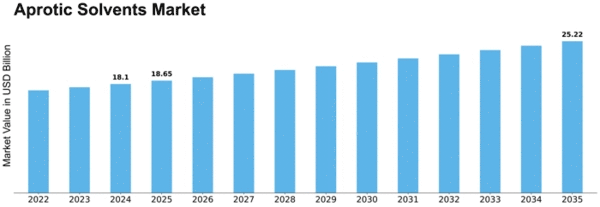

Aprotic Solvents Market Size was valued at USD 16.9 billion in 2022. The Aprotic Solvents market industry is projected to grow from USD 17.4915 Billion in 2023 to USD 23.03296527 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.50%

Global economic conditions play a pivotal role in the Aprotic Solvents Market. Economic growth and industrialization contribute to increased manufacturing activities, fostering the need for solvents in diverse applications. Developing economies, experiencing rapid industrial expansion, significantly drive the market's growth as they become integral players in the global manufacturing landscape.

Technological advancements in solvent formulations impact the market dynamics. Ongoing research and development efforts lead to innovations that enhance the performance, safety, and environmental friendliness of aprotic solvents. Companies investing in these technological advancements gain a competitive edge by offering solvents with improved properties, such as low toxicity, high boiling points, and compatibility with various chemicals and substrates.

Environmental considerations and regulatory measures are pivotal factors in the Aprotic Solvents Market. The industry faces increasing pressure to adopt sustainable and environmentally friendly practices. Aprotic solvents that are considered safer and less harmful to the environment gain favor among manufacturers and end-users. Companies in the market must comply with stringent environmental standards, invest in green chemistry practices, and communicate the eco-friendly attributes of their aprotic solvents to maintain a positive market position.

Geopolitical factors and trade dynamics also play a role in shaping the Aprotic Solvents Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of aprotic solvents. Companies need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Moreover, the pharmaceutical industry significantly contributes to the demand for aprotic solvents. Aprotic solvents are widely used in pharmaceutical manufacturing for various applications, including drug formulation, synthesis of active pharmaceutical ingredients (APIs), and extraction processes. The pharmaceutical sector's growth, driven by advancements in healthcare and increasing demand for pharmaceutical products, fuels the demand for high-quality and versatile aprotic solvents.

The electronics industry is another key driver of the Aprotic Solvents Market. Aprotic solvents find applications in electronic manufacturing processes, such as the production of semiconductors and electronic components. The electronics sector's continuous innovation and miniaturization trends drive the demand for solvents that provide precise and reliable results in manufacturing processes.

Raw material prices, particularly those of chemicals used in aprotic solvent formulations, play a role in shaping the Aprotic Solvents Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of aprotic solvents. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Leave a Comment