Market Share

Arrhythmia Monitoring Devices Market Share Analysis

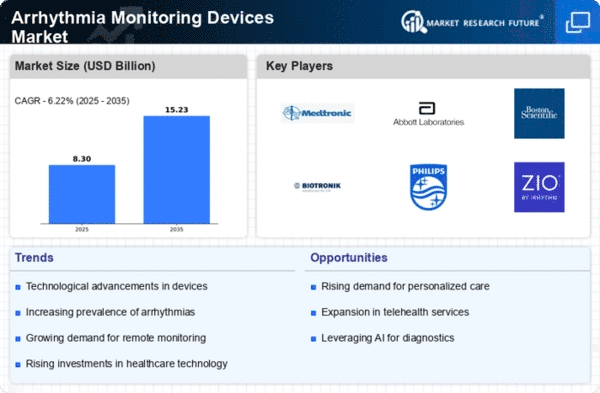

The Arrhythmia Monitoring Devices Market is a dynamic sector within the broader healthcare industry, which is evolving continuously due to the increasing prevalence of cardiovascular diseases and a greater focus on preventive healthcare. Firstly, product differentiation is a crucial factor in market share positioning. Innovations and technological improvements are constantly being made so that monitoring devices can be more different from each other depending on their accuracy levels. By doing this, companies can attract specific customer groups that require such products, not any other kind in the market. For example, some organizations are currently focusing on wearable devices that have real-time monitoring capabilities, while others are integrating AI for better arrhythmia detection. Secondly, strategic partnerships and collaborations are vital in gaining a competitive advantage as well as expanding market share. For instance, companies often forge partnerships with healthcare organizations, research institutions, or other industry participants to access their combined competencies. In addition, aggressive marketing and promotional activities undertaken by players in the market lead to improved brand visibility and customer awareness. By doing so, a strong presence is built that results in trust among end-users as well as healthcare providers, thereby influencing their purchase decisions. Effective marketing strategies involve taking part in medical conferences, educational programs, and online promotions through which a wider target audience can be reached. Additionally, pricing strategies play an essential role in market share positioning within the Arrhythmia Monitoring Devices Market. This may involve a discounted price that will enable a firm to gain a cost advantage over its competitors, thus attracting more customers. Furthermore, entering new markets forms part of market share positioning strategies where firms want to expand their geographical coverage into untapped territories, resulting in new customer types being acquired by them. This might necessitate compliance with local regulations and bureaucracy surrounding healthcare delivery systems while at the same time having products that meet regional standards. Moreover, continuous Research & Development (R&D) initiatives are necessary for competitive advantage maintenance in view of rapid technology changes and healthcare practices that have seen the need for continuous innovation to address emerging complexities.

Leave a Comment