Market Share

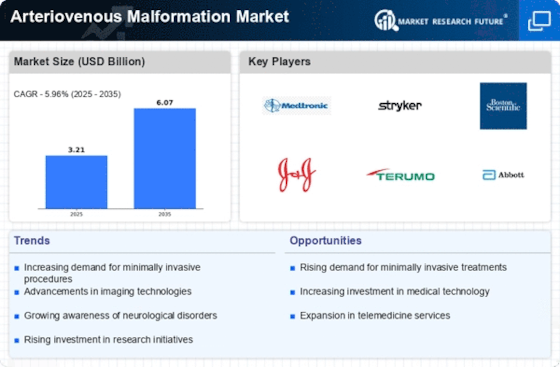

Arteriovenous Malformation Market Share Analysis

The Arteriovenous Malformation (AVM) Market includes a complex condition with faulty artery-vein connections. AVM detection and treatment companies use a variety of strategies to succeed in this niche industry. Advanced diagnostic imaging is a key strategy. MRI, CTA, and DSA are advanced imaging modalities that companies invest in. Diagnostic excellence ensures AVM identification and market leadership. Strategic cooperation with interventional radiologists and neurosurgeons are essential. The company's AVM treatments are adopted through partnerships with prominent doctors. Medical expert relationships boost market reputation and referral networks. Because individuals choose less invasive AVM treatments, companies develop and promote these. Endovascular embolization, stereotactic radiosurgery, and other catheter-based treatments are examples. Giving patients fewer unpleasant options fits changing medical tastes and grows the industry. Companies participate in consumer and healthcare worker training. Knowledge of AVM, its symptoms, and treatment options improves understanding. Teaching clinicians about AVM therapies' benefits increases their utilization and market share. AVM market participants must follow tight legal requirements and participate in clinical investigations. Companies prioritize approvals and clinical trials to prove their AVM treatments are safe and effective. Following the guidelines and participating in clinical research boosts trust and market position. Targeting global markets is wise. Companies aim to have a significant presence in AVM-prone locations. Expanding to various countries improves market share and customers due to diverse healthcare systems and legislation. Telemedicine for AVM diagnosis and talks is modern. Companies are developing online specialist meetings for patients. Thus, patients can consult experts wherever. This strategy matches the telemedicine trend and simplifies patient care. Marketing must emphasize the urgency of finding and treating AVMs. Companies launch campaigns targeting healthcare professionals and the general public to raise awareness. Highlighting early evaluation's benefits affects the market's perception and increases early action. The strategy is to provide affordable AVM therapy. Businesses improve production methods, talk to suppliers, and consider economies of scale to lower pricing. This method attracts healthcare practitioners and organizations seeking reliable and cost-effective AVM treatment. We must provide healthcare personnel with continuing training. Through classes, webinars, and training materials, companies teach doctors about novel AVM treatments and equipment. Well-trained healthcare workers promote the company's products, changing the market's perception. Preventative measures include patient support and lobbying. Businesses create educational, resource, and mental support platforms for AVM sufferers and their families. This patient care boosts the company's reputation and keeps customers coming back.

Leave a Comment