Artificial Nails Size

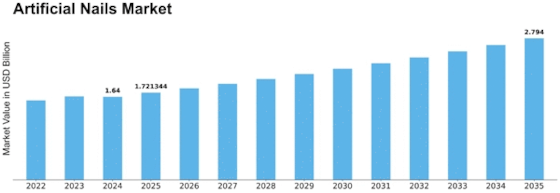

Artificial Nails Market Growth Projections and Opportunities

The artificial nails market operates within a dynamic landscape shaped by a combination of factors, including fashion trends, technological advancements, and consumer preferences. Artificial nails, also known as fake nails or nail enhancements, offer a convenient and customizable way for individuals to enhance the appearance of their nails, whether for aesthetic purposes or as a solution for nail-related issues.

Fashion trends play a significant role in driving the dynamics of the artificial nails market. As trends in beauty and fashion evolve, so do preferences for nail styles, shapes, and designs. From classic French manicures to intricate nail art and bold colors, artificial nails provide a canvas for self-expression and creativity. Additionally, celebrities, influencers, and social media platforms influence consumer perceptions of beauty and drive demand for specific nail trends, prompting manufacturers and nail technicians to innovate and offer products that cater to evolving tastes.

Technological advancements have revolutionized the artificial nails market, leading to the development of new materials, application techniques, and designs. Traditional artificial nails, such as acrylic and gel nails, have been supplemented by innovative options like dip powder nails, polygel nails, and press-on nails. These advancements offer advantages such as increased durability, faster application times, and reduced risk of damage to natural nails. Furthermore, advancements in 3D printing technology have enabled the creation of intricate and customizable nail designs, providing consumers with more options to personalize their nail enhancements.

Consumer preferences also shape the dynamics of the artificial nails market, with individuals seeking products that offer convenience, affordability, and long-lasting results. Artificial nails provide an alternative to salon manicures for consumers who lack the time or budget for regular salon visits. DIY nail kits and at-home application products allow consumers to achieve professional-looking results without the need for specialized skills or equipment. Additionally, the availability of artificial nails in various price ranges caters to consumers with different budgets, making nail enhancements accessible to a wide range of demographics.

Market competition within the artificial nails industry is intense, with numerous brands, manufacturers, and nail technicians vying for market share. Brands differentiate themselves through product innovation, marketing strategies, and partnerships with influencers and celebrities to promote their products. Additionally, the rise of e-commerce and online beauty retailers has expanded the reach of artificial nail products, allowing smaller brands and independent sellers to compete alongside established players in the market.

Furthermore, the COVID-19 pandemic has impacted the dynamics of the artificial nails market, with consumers prioritizing at-home beauty routines and seeking DIY solutions for nail care. As salons closed temporarily and social distancing measures limited in-person interactions, the demand for at-home nail enhancements surged, driving sales of artificial nails, nail kits, and related accessories. Additionally, the pandemic prompted manufacturers to innovate and adapt their product offerings to meet the changing needs and preferences of consumers, such as introducing antimicrobial nail products and contactless application methods.

In conclusion, the artificial nails market is characterized by dynamic forces driven by fashion trends, technological advancements, consumer preferences, and market competition. As the demand for customizable and convenient nail enhancements continues to grow, companies must stay agile and innovative to meet the evolving needs of consumers. By understanding and leveraging these market dynamics, businesses can capitalize on the popularity of artificial nails and contribute to the expansion and diversification of the beauty industry.

Leave a Comment