Aseptic Automatic Filling Machine Size

Aseptic Automatic Filling Machine Market Growth Projections and Opportunities

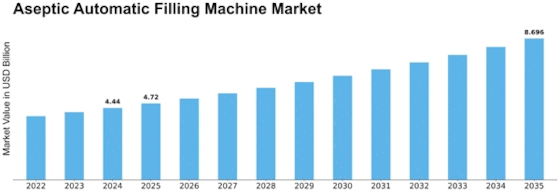

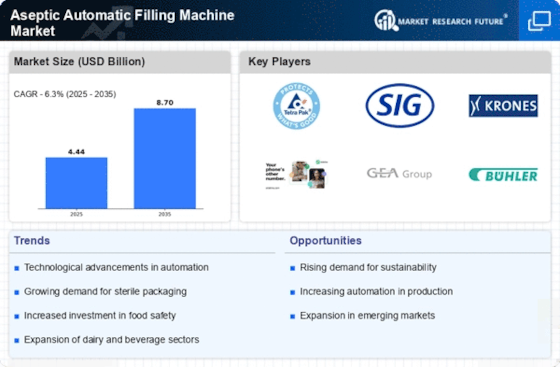

In 2021, the aseptic automatic filling machine market was worth USD 3.70 billion. The Aseptic Automatic Filling Machine industry is expected to grow from USD 3.93 billion in 2022 to USD 6.4064 billion in 2030, a 6.3% CAGR.

Many market aspects define the Aseptic Automatic Filling Machine Market's elements and development orientation. One important factor is the growing demand for packaged food and drinks. Comfort and ready-to-eat products are becoming more popular as buyers lead busier lives. This change in purchasing behavior has driven the market for aseptic automatic filling machines by increasing demand for aseptically filled juices, dairy, and fluid foods.

Mechanical advancements shape the market. Continuous filling machine improvements for robotization, precision, and competency have driven aseptic automatic filling machine use. Manufacturers love coordinating fantastic features like ongoing monitoring and data analysis to boost gear viability and meet aseptic filling process cleanliness standards.

Unofficial legislation and industry standards also impact the Aseptic Automatic Filling Machine Market. Administrative organizations enforce strict aseptic packing and filling requirements to improve food handling and quality. These standards are essential for market players to ensure product honesty and customer trust. Administrative body confirmations help makers stand apart in the market.

The geological and sectoral scene also shape the market. Rapid urbanization and rising incomes are driving demand for bundled food and drinks in emerging economies. This encourages aseptic automatic filling devices in certain locations. Additionally, the global inventory network and exchange arrangements affect market aspects and important participants' assembly and distribution processes.

Important market factors include serious powers. In the Aseptic Automatic Filling Machine Market, key players compete fiercely to gain an edge. Continuous growth, essential partnerships, and consolidations and acquisitions are common ways companies strengthen their market position. The cutthroat scenario is also shaped by producers' efforts to solve environmental issues and meet the growing demand for eco-friendly packaging.

Market factors depend on buyer preferences and behaviors. As health and wellness become more important, aseptically handled products with longer use and low additive use are in demand. This shift in client preferences affects filling machine selection, favoring those that ensure the highest levels of cleanliness and item respectability.

Leave a Comment