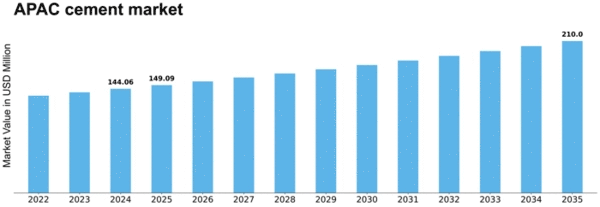

Asia Pacific Cement Size

Asia Pacific Cement Market Growth Projections and Opportunities

The Asia Pacific cement market is dynamic and evolving due to many key dynamics. Industrialization and urbanization in populous countries like China and India have boosted the region's economy. These nations continue to expand and invest extensively in infrastructure, driving cement demand. The construction of roads, bridges, residential structures, and commercial areas uses cement, driving market expansion.

Government regulations also impact the Asia Pacific cement market. Many regional governments have ambitious infrastructure development plans to support economic growth and living standards. Cement, a building material, is in demand due to government investments in huge projects. Alternative materials and technologies have increased due to regulatory frameworks that encourage sustainable and eco-friendly construction, affecting the cement business.

The Asia Pacific cement market depends on raw material prices and availability. Limestone, clay, and gypsum are essential to cement manufacture. Cement producers' production costs depend on these raw materials' availability and pricing. Supply chain disruptions from global commodity pricing, geopolitical events, and environmental concerns can affect market dynamics.

Innovation and technology are changing the Asia Pacific cement market. Advanced manufacturing technologies include dry and semi-dry production improve efficiency and reduce environmental impact. Additionally, digital technology in production and logistics optimize processes and boost productivity. As cement makers adopt new technologies, they gain a competitive edge and shape the market.

Infrastructure construction and development depend on the Asia Pacific cement market. City growth, population increase, and the need for modern infrastructure drive regional construction initiatives. Megaprojects like high-speed railroads, smart cities, and mixed-use buildings boost cement consumption. The cyclical construction industry, impacted by economic cycles and government investment, highlights the link between infrastructure development and the cement market.

Trade and global market dynamics affect the Asia Pacific cement market. Cement manufacturers export to neighboring countries and abroad. Global cement prices, trade policies, and geopolitical concerns affect market movements. International rivalry and currency rate swings complicate the industry, forcing local businesses to be flexible.

The Asia Pacific cement market is being influenced by climate change and sustainability. As building faces environmental scrutiny, cement makers are investigating greener options and embracing eco-friendly methods. Consumer choices and regulatory forces are driving low-carbon and sustainable cement product demand. Companies who address environmental issues early may have an advantage in the changing market.

Leave a Comment