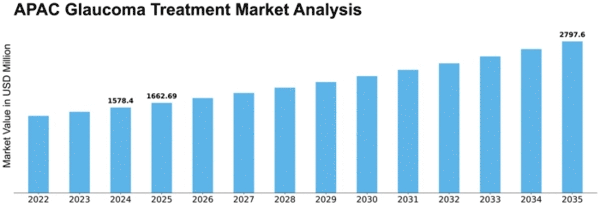

Asia Pacific Glaucoma Treatment Size

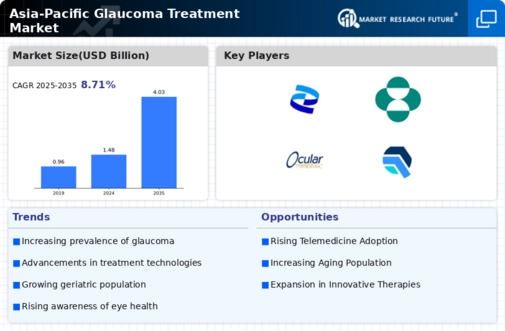

Asia Pacific Glaucoma Treatment Market Growth Projections and Opportunities

The Asia-Pacific glaucoma treatment market is extensively prompted by demographic elements, which include the growing older population. As the place stories a demographic shift in the direction of an older population, the superiority of glaucoma, a situation often related to aging, is on the upward thrust, using the demand for effective treatment options. The market is trended via the excessive occurrence of glaucoma inside the Asia-Pacific area. Factors inclusive of genetic predisposition, lifestyle changes, and accelerated recognition contribute to a growing number of glaucoma instances, prompting the want for a various range of treatment modalities. Continuous advancements in diagnostic technology play a pivotal role in the Asia-Pacific glaucoma treatment market. Improved imaging strategies, tonometry strategies, and early detection equipment enhance the accuracy of diagnosis, allowing for timely intervention and influencing the remedy landscape. Government initiatives aimed at improving eye care services and stopping imaginative and prescient loss have an impact on the glaucoma treatment market. National programs addressing eye fitness, subsidized treatments, and awareness campaigns contribute to the accessibility of glaucoma treatments throughout the Asia-Pacific area. The prevalence of open-attitude glaucoma, the most common shape of the circumstance, shapes the market panorama. Treatment options are tailor-made to cope with the precise characteristics of open-perspective glaucoma, influencing the development of prescription drugs, surgical interventions, and different therapeutic approaches. The economic boom of emerging nations in the Asia-Pacific place contributes to the improvement of healthcare infrastructure. Improvements in healthcare centers, extended accessibility to medical services, and advancements in glaucoma treatment alternatives are extremely good market elements. Cultural factors and way of life impact the prevalence and management of glaucoma within the place. Ongoing research and development investments with the aid of pharmaceutical agencies and healthcare establishments force innovation in glaucoma treatments. Efforts to develop novel drugs, surgical strategies, and medical devices make contributions to the competitive panorama and market expansion. Collaborations and partnerships between global and neighborhood healthcare entities affect the Asia-Pacific glaucoma treatment market. Alliances aimed at understanding change, generation switch, and joint studies initiatives contribute to advancements in treatment options. The regulatory environment, which includes approval strategies and compliance standards, performs a sizeable position in shaping the market. Stringent regulatory measures ensure the safety and efficacy of glaucoma treatments, influencing market entry techniques and product development.

Leave a Comment