-

Definition

-

Scope of the Study

- Research

- Assumptions

- Limitations

-

Introduction

-

Primary Research

-

Secondary

-

Market Size Estimation

-

Restrains

-

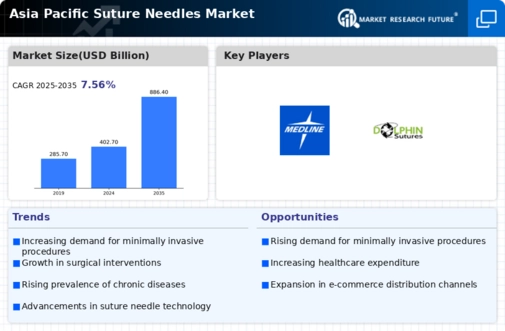

Opportunities

-

Challenges

-

Technology Trends & Assessment

-

Market Factor Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Buyers

- Threat of Substitutes

- Intensity of

-

Bargaining Power of Suppliers

-

Threat of New Entrants

-

Rivalry

-

Value Chain Analysis

-

Investment Feasibility Analysis

-

Pricing Analysis

-

Chapter 6. Asia Pacific Suture Needle Market, by

-

Type

-

Introduction

-

Skin-Prick Test

-

Market Estimates &

-

Forecast, 2020-2027

-

Atopy Patch Test (APT)

-

Market Estimates &

-

Forecast, 2020-2027

-

Blood Test

-

Market Estimates & Forecast, 2020-2027

-

Oral Food Challenge

-

Market Estimates & Forecast, 2020-2027

-

Others

-

Chapter 7. Asia Pacific Suture Needle Market, by Needle End Type

-

Introduction

-

Oral Immunotherapy (OIT)

-

Market Estimates &

-

Forecast, 2020-2027

-

Medication

-

Market Estimates & Forecast, 2020-2027

-

Others

-

Market Estimates & Forecast, 2020-2027

-

Chapter 8. Asia

-

Pacific Suture Needle Market, by Application

-

Introduction

-

General

-

Surgeries

-

Market Estimates & Forecast, 2020-2027

-

Gynecological

-

Surgeries

-

Market Estimates & Forecast, 2020-2027

-

Others

-

Market

-

Estimates & Forecast, 2020-2027

-

Chapter 9 Asia Pacific Suture Needle Market,

-

by End User

-

Introduction

-

Hospital

-

Market Estimates &

-

Forecast, 2020-2027

-

Clinics

-

Market Estimates & Forecast, 2020-2027

-

Ambulatory Surgical Centers

-

Market Estimates & Forecast, 2020-2027

-

Others

-

Chapter 10. Asia Pacific Suture Needles Market by Region

-

Introduction

-

Asia Pacific

- Japan

- China

- Republic of Korea

- Australia

- Rest of Asia

-

India

-

Pacific

-

Chapter 11 Company Landscape

-

Introduction

-

Market

-

Share Analysis

-

Key Development & Strategies

- Key Developments

-

Chapter 12 Company Profiles

-

3M Health Care

- Company

- Product Overview

- Financials

- SWOT

-

Overview

-

Analysis

-

Roboz Surgical Instrument

- Company Overview

- Product Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

Hu-Friedy Mfg. Co., LLC

- Company

- Product Overview

- Financial Overview

- SWOT Analysis

-

Overview

-

Key Development

-

Unimed Medical Supplies Inc.

- Company Overview

- Product/Business Segment Overview

- Key Development

- SWOT Analysis

- Company Overview

- Product Overview

- Financial overview

- Key Developments

-

Financial Overview

-

Medline Industries, Inc.

-

TNI medical

- Company Overview

- Product Overview

- Financial

- Key Developments

-

AG

-

Overview

-

Sutures India Private Limited

- Overview

- Product Overview

- Financials

- SWOT Analysis

-

Key Developments

-

Others

-

Chapter 13 MRFR

-

Conclusion

-

Key Findings

- From CEO’s View Point

- Unmet Needs of the Market

-

Key Companies to Watch

-

Prediction of Pharmaceutical industry

-

Chapter 14 Appendix

-

LIST OF

-

TABLES

-

Suture Needle Industry Synopsis, 2020-2027

-

Table

-

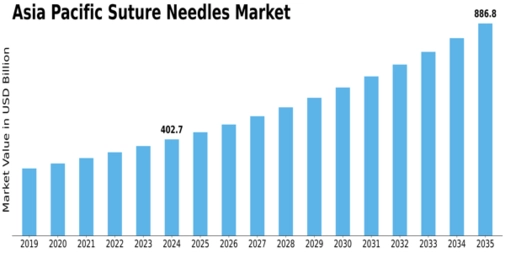

Asia Pacific Suture Needle Market Estimates and Forecast, 2020-2027, (USD Million)

-

Asia Pacific Suture Needle Market by Region, 2020-2027, (USD Million)

-

Asia Pacific Suture Needle Market by Types, 2020-2027, (USD Million)

-

Asia Pacific Suture Needle Market by Needle end type, 2020-2027, (USD

-

Million)

-

Asia Pacific Suture Needle Market by Application, 2020-2027,

-

(USD Million)

-

Asia Pacific Suture Needle Market by End Users, 2020-2027,

-

(USD Million)

-

Japan Suture Needle Market by Types, 2020-2027, (USD

-

Million)

-

Japan Suture Needle Market by Needle end type, 2020-2027,

-

(USD Million)

-

Japan Suture Needle Market by Application, 2020-2027,

-

(USD Million)

-

Japan Suture Needle Market by End Users, 2020-2027,

-

(USD Million)

-

China Market by Types, 2020-2027, (USD Million)

-

Table

-

China Suture Needle Market by Needle end type, 2020-2027, (USD Million)

-

Table

-

China Suture Needle Market by Application, 2020-2027, (USD Million)

-

Table

-

China Suture Needle Market by End Users, 2020-2027, (USD Million)

-

Table

-

India Market by Types, 2020-2027, (USD Million)

-

India Suture Needle

-

Market by Needle end type, 2020-2027, (USD Million)

-

India Suture Needle

-

Market by Application, 2020-2027, (USD Million)

-

India Needle Market

-

by End Users, 2020-2027, (USD Million)

-

Republic of Korea Market by

-

Types, 2020-2027, (USD Million)

-

Republic of Korea Suture Needle Market

-

by Needle end type, 2020-2027, (USD Million)

-

Republic of Korea Suture

-

Needle Market by Application, 2020-2027, (USD Million)

-

Republic of

-

Korea Suture Needle Market by End Users, 2020-2027, (USD Million)

-

Table 24

-

Australia Market by Types, 2020-2027, (USD Million)

-

Australia Suture

-

Needle Market by Needle end type, 2020-2027, (USD Million)

-

Australia

-

Suture Needle Market by Application, 2020-2027, (USD Million)

-

Australia

-

Suture Needle Market by End Users, 2020-2027, (USD Million)

-

Rest of

-

Asia Pacific Market by Types, 2020-2027, (USD Million)

-

Rest of Asia

-

Pacific Suture Needle Market by Needle end type, 2020-2027, (USD Million)

-

Table

-

Australia Suture Needle Market by Application, 2020-2027, (USD Million)

-

Table

-

Rest of Asia Pacific Suture Needle Market by End Users, 2020-2027, (USD Million)

-

LIST OF FIGURES

-

Research Process

-

Segmentation

-

for Asia Pacific Suture Needle Market

-

Segmentation Market Dynamics

-

for Asia Pacific Suture Needle Market

-

Asia Pacific Suture Needle market

-

Share, by Type 2020

-

Asia Pacific Suture Needle market Share, by Needle

-

end type 2020

-

Asia Pacific Suture Needle market Share, by Application

-

Asia Pacific Suture Needle Market Share, by End Users, 2020

-

Asia Pacific Suture Needle Market Share, by Region, 2020

-

Figure

-

Asia Pacific Suture Needle Market Share, by Country, 2020

-

Asia

-

Pacific Suture Needle Market: Company Share Analysis, 2020 (%)

-

3M

-

Health Care : Key Financials

-

3M Health Care: Segmental Revenue

-

3M Health Care: Geographical Revenue

-

Roboz Surgical Instrument:

-

Key Financials

-

Roboz Surgical Instrument: Segmental Revenue

-

Figure

-

Roboz Surgical Instrument: Geographical Revenue

-

Hu-Friedy Mfg.

-

Co., LLC: Key Financials

-

Hu-Friedy Mfg. Co., LLC: Segmental Revenue

-

Hu-Friedy Mfg. Co., LLC: Geographical Revenue

-

Unimed

-

Medical Supplies Inc.: Key Financials

-

Unimed Medical Supplies Inc.:

-

Segmental Revenue

-

Unimed Medical Supplies Inc.: Geographical Revenue

-

Medline Industries, Inc.: Key Financials

-

Medline Industries,

-

Inc.: Segmental Revenue

-

Medline Industries, Inc.: Geographical Revenue

-

TNI medical AG : Key Financials

-

TNI medical AG : Segmental

-

Revenue

-

TNI medical AG : Geographical Revenue

-

Sutures

-

India Private Limited: Key Financials

-

Sutures India Private Limited:

-

Segmental Revenue

-

Sutures India Private Limited: Geographical Revenue

Leave a Comment