Asphalt Additives Size

Asphalt Additives Market Growth Projections and Opportunities

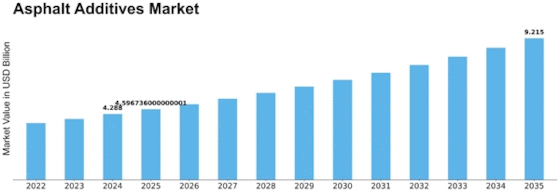

The Asphalt Additives Market is essentially impacted by different market factors that shape its elements and development direction. One vital variable is the heightening interest for further developed street framework all around the world. As urbanization and industrialization keep on ascending, there is a squeezing need for strong and superior execution street surfaces to endure weighty traffic loads. This request energizes the reception of asphalt additives, which improve the quality and life span of asphalt asphalts. The Asphalt Additives industry is projected to develop from USD 4.0 Billion out of 2023 to USD 6.9 Billion by 2032, displaying a build yearly development rate of 7.20%

Another key market factor is the rising spotlight on practical and harmless to the ecosystem arrangements. States and administrative bodies overall are underscoring eco-accommodating development materials to moderate the natural effect of framework projects. Asphalt additives add to this drive by empowering the development of warm-blend asphalts, which decrease energy utilization during assembling and lower ozone harming substance outflows. As maintainability turns into a focal worry in development practices , the Asphalt Additives Market observers a developing inclination for such ecologically capable arrangements.

The unpredictability in natural substance costs likewise assumes a crucial part in molding the Asphalt Additives Market. Asphalt additives are gotten from different materials, including polymers, synthetics, and hostile to stripping specialists. Vacillations in the costs of these natural substances straightforwardly influence the general creation cost of asphalt additives. Makers and providers in the market need to adjust to these cost varieties, affecting item valuing and, subsequently, market seriousness.

Besides, headways in innovation contribute altogether to the development of the Asphalt Additives Market. Progressing innovative work endeavors lead to the presentation of imaginative additives that proposition improved execution attributes. These mechanical headways not just work on the solidness and strength of asphalt asphalts yet additionally address explicit difficulties, for example, rutting, breaking, and stripping. Market players that put resources into innovative work to present state of the art asphalt additives gain an upper hand and add to the general market development.

Government framework improvement drives and ventures likewise shape the Asphalt Additives Market scene. Numerous nations are apportioning significant financial plans for the extension and support of their transportation framework. Subsequently, the interest for asphalt additives encounters a significant lift, driven by enormous scope street development ventures and recovery endeavors. The Asphalt Additives Market is, accordingly, intently attached to government arrangements and subsidizing allotments for framework improvement.

Worldwide financial circumstances and development exercises likewise influence the Asphalt Additives Market. During times of monetary development, there is an expanded interest for new development projects, prompting a surge in the necessity for asphalt additives. Alternately, monetary slumps can bring about decreased development exercises, influencing the market adversely. Market players need to intently screen monetary pointers and adjust their methodologies to explore through these changes.

Leave a Comment