Market Share

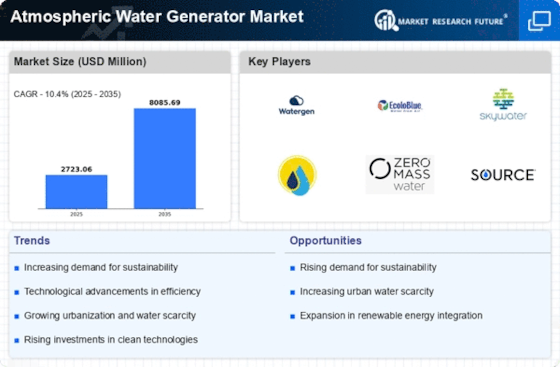

Atmospheric Water Generator Market Share Analysis

The atmospheric water generator (AWG) industry is witnessing a surge in research and development (R&D) activities, paving the way for more efficient and environmentally friendly models. Generator manufacturers are increasingly incorporating on-board power generation equipment, such as wind turbines and solar panels, into their new product development initiatives. This integration allows AWGs to operate independently of conventional power sources, further enhancing their sustainability credentials. The relative simplicity of the AWG manufacturing process has attracted a wave of new entrants into the market, with companies like Akvo Atmospheric Water Systems Pvt. Ltd. and Drinkable Air focusing primarily on producing household AWGs. This influx of new players is expected to intensify competition and drive down prices, making AWGs more accessible to a broader consumer base.

Government investments in water infrastructure are also anticipated to boost demand for AWGs in residential applications. As governments recognize the potential of AWGs to provide a reliable and sustainable source of potable water, they are expected to allocate resources to support the adoption of this technology in homes. Strategic partnerships between AWG manufacturers are also playing a role in advancing the technology. In February 2022, World Environmental Solutions Pty Ltd and Net Zero Renewable Energy Inc. entered into an agreement to develop the Sola Hydra Cube design for residential and commercial AWGs. This collaboration aims to leverage the expertise of both companies to create a highly efficient and environmentally friendly AWG system.

In addition to these industry developments, government initiatives to promote water conservation and address water scarcity are also contributing to the growth of the AWG market. In March 2022, the Central Railway of India announced plans to install AWGs at 14 locations across its eight stations in the Mumbai Division. This initiative demonstrates the growing recognition of AWGs as a viable solution for providing clean drinking water in water-stressed regions. Overall, the AWG industry is poised for significant growth, driven by a combination of innovation, investment, and government support. As R&D efforts lead to more efficient and environmentally friendly models, and government initiatives promote the adoption of AWGs, these generators are expected to play an increasingly important role in addressing global water scarcity challenges.

Leave a Comment