Market Analysis

In-depth Analysis of Audit Software Market Industry Landscape

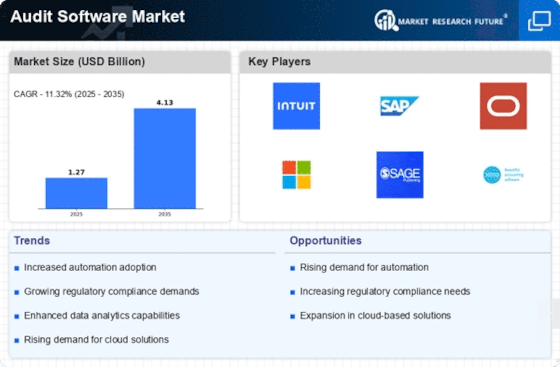

The global audit software market is set to reach US$ 2.48 BN by 2030, at a 13.50% CAGR between years 2022-2030. The market is changing a lot because of new technology and rules. Recently, companies in all types of jobs have understood the need for strong check procedures to make sure they're open and following rules. This also helps manage any dangers or risks. This recognition has made people want better audit software solutions, leading to a lively and changing market.

One important factor that affects market activities is the growing complexity of businesses and more data being created. As companies grow around the world and use digital tools, getting good audit tools is very important. Audit software with strong data analysis and automatic features helps auditors look through huge sets of information, find patterns, do full risk reviews. This ability not only improves the precision of checks but also makes the whole process smoother. Also, the constant changes in rules affect a lot how the market for audit software works. Groups always have to follow lots of rules and measures like SOX Act, GDPR or ISO standards.

The skill of auditing software to adjust for these changes and make sure rules are followed is very important. Sellers in the audit software market need to give flexible answers that can be quickly changed for new rules. This creates a competitive place where fresh ideas and speed matter most. Cloud technology is another big factor in how the market for audit software works. Moving to cloud services gives many benefits. They are easy to grow, can be reached anytime and save money too. Software for audit in the cloud lets people work together anytime, access things from anywhere and easily join with other business tools.

As more companies use cloud services, software audit tool sellers need to match their products with these changes. This is important in a tough market and helps them stay popular over time. Becoming more aware of cyber threats has also affected the market for audit software. As hacking and online attacks get smarter, companies see that they need to protect secret details. People are looking for audit software that has strong security things like encryption and multi-factor confirmation. Businesses want software that helps audits and keeps their information safe. Vendors who focus on keeping data secure have an advantage since companies care about it too.

Leave a Comment