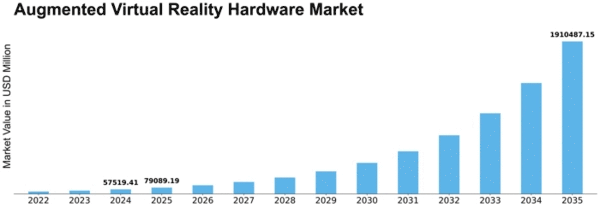

Augmented Virtual Reality Hardware Size

Augmented Virtual Reality Hardware Market Growth Projections and Opportunities

The augmented and virtual reality (AR/VR) hardware market is impacted by a huge number of market factors that add to its development and development. One of the essential variables molding this market is the rising demand for vivid and intuitive encounters across different ventures. AR/VR devices are being utilized by companies, educational institutions, healthcare providers and entertainment industry to create live reproductions of training modules as well as games. This need comes from the desire to improve customer satisfaction, better learning outcomes and provide new experiences that blur boundaries between physical world.

In addition, the advances in display and sensor technologies play a critical role in shaping AR/VR hardware market. The rise of high-resolution displays, high amusement optics and precise motion following sensors has substantially enhanced the visual capabilities of AR/VR devices. These disruptive breakthroughs have resulted in cost-effective, immersive and aesthetically pleasing AR/VR experiences which are driving the adoption of AR/VR hardware on both consumer as well as enterprise applications.

Additionally, the emerging focus on remote collaboration, telepresence and virtual meetings is influencing AR/VR hardware demand. The growth of homework and the need for remote correspondence, audit devices are going to AR/VR solutions that will help in cooperating with virtual gatherings. The companies that supply AR/VR hardware are advancing to provide solutions allowing realistic virtual interactions, spatial audio and immersive settings for remote collaboration needs.

Additionally, the increasing compatibility of AR/VR technology in medical sector as well as education and training is an important market driver that increases within demand for hardware. The AR/VR hardware is used by the medical professionals for clinical assessments, simulated operations and patient education, whereas teachers bring their usage to life in mind-opening experiencesand virtual tours. This combination of AR/VR hardware in non-deflection zones is analogous to the growing acceptance that its efficacy can enhance learning outcomes, improve performance make significant training experiences.

Also, the increasing adoption of 5G technologies is influencing the capabilities and applications of AR/VR hardware. The high bandwidth, low latency and uninterrupted quality of 5G networks enable smooth AR/VR experiences that are opening up use cases in gaming, live events, telemedicine remote aid as well industrial applications. Along with the progressing expansion of 5G organizations, demand for AR/VR gadgets that can exploit 5G availability to its maximum point is expected and consequently improvement of superior VR hardware arrangements.

In addition, the influence of Covid-19 pandemic has accelerated acceptance for AR/VR hardware in teleworking space as well as virtual events and immersive entertainment environments. The requirement for virtual arrangements that empower far off cooperation, virtual preparation, and connecting with diversion content has prompted expanded interest in AR/VR hardware as a way to connect the actual distance and convey convincing virtual encounters.

Leave a Comment