- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

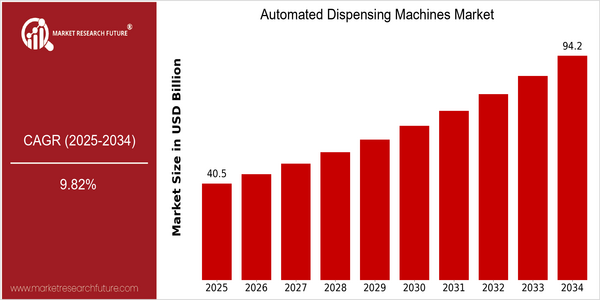

| Year | Value |

|---|---|

| 2025 | USD 40.54 Billion |

| 2034 | USD 94.18 Billion |

| CAGR (2025-2034) | 9.82 % |

Note – Market size depicts the revenue generated over the financial year

The market for vending machines is expected to grow from $ 40.54 billion in 2025 to $ 94.18 billion by 2034. The average annual growth rate during the forecast period is 9.82%. The main factor driving the market is the growing demand for automation in hospitals, which is due to the need for increased efficiency, accuracy and cost savings. Artificial intelligence and machine learning in dispensing systems, which increase the operational capabilities and improve patient safety, will also stimulate the market. The main players in the market for dispensing systems, such as Omnicell, McKesson, BD (Becton, Dickinson and Company), are investing in the development of new products and strategic alliances to strengthen their position. Recent product launches, which focus on the provision of a more friendly user interface and advanced inventory management systems, reflect the industry's transition to more complex dispensing solutions. Collaboration between technology companies and hospitals will further stimulate the development of a specialized dispensing system for the needs of each hospital, which will further accelerate the growth of the market.

Regional Market Size

Regional Deep Dive

The Automatic Dispensing Machines (ADM) market is growing at a fast pace in various regions of the world, owing to technological advancements, an increased demand for efficiency in the field of medical care, and the growing emphasis on patient safety. In North America, the market is characterized by a high uptake of automation in hospitals and pharmacies, whereas Europe is experiencing an increase in the regulatory support for medication management systems. The Asia-Pacific region is characterized by a rapid urbanization and the development of the healthcare sector, whereas the Middle East and Africa are slowly adopting ADMs to improve the quality of medical care. Latin America is also growing, but at a slower pace, owing to the lack of economic stability and the challenges in accessing health care.

Europe

- The European Medicines Agency (EMA) has introduced new regulations that encourage the use of automated systems in pharmacies, which is expected to boost the adoption of ADMs across member states.

- Innovations in telepharmacy are on the rise, with companies like Aster DM Healthcare implementing automated dispensing solutions that allow remote medication management, catering to the growing demand for healthcare accessibility.

Asia Pacific

- Countries like Japan and China are investing heavily in healthcare automation, with government initiatives aimed at modernizing healthcare infrastructure, thus creating a favorable environment for ADMs.

- The rise of e-pharmacies in India is leading to increased demand for automated dispensing solutions, with local companies like Medlife and PharmEasy exploring partnerships with technology providers to enhance their service offerings.

Latin America

- Brazil's Ministry of Health has launched programs aimed at digitizing healthcare services, which includes the promotion of automated dispensing machines in public hospitals to streamline medication distribution.

- The economic challenges in the region are prompting healthcare facilities to seek cost-effective solutions, leading to a growing interest in ADMs that can reduce labor costs and improve service delivery.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated guidelines for the use of automated dispensing systems, emphasizing the need for enhanced safety features, which is driving innovation among manufacturers like Omnicell and McKesson.

- A number of companies are developing ADMs with artificial intelligence and machine learning. The leading supplier is Swisslog Health Care.

Middle East And Africa

- The Gulf Cooperation Council (GCC) countries are implementing smart healthcare initiatives, with significant investments in automated dispensing technologies to improve patient care and operational efficiency.

- Regulatory bodies in South Africa are beginning to recognize the importance of ADMs in combating medication errors, leading to increased interest from local healthcare providers in adopting these systems.

Did You Know?

“Automated dispensing machines can reduce medication errors by up to 50%, significantly enhancing patient safety and operational efficiency in healthcare settings.” — Institute for Safe Medication Practices (ISMP)

Segmental Market Size

In the medical field, the automation of drug dispensing plays an important role in reducing the time and cost of medication administration. It is a growing market, driven by the need for inventory control, the need to improve patient safety, and the automation of hospital operations. The increasing number of patients with chronic diseases requires more efficient medication management, and the implementation of government regulations has led to a greater need for automation to reduce human errors in the dispensing of drugs. The current automation of drug dispensing has reached a stage of wide acceptance, with companies such as Omnicell and McKesson implementing these systems in hospitals across North America and Europe. These systems are used in hospitals, pharmacies and long-term care facilities. They optimize the dispensing of drugs, reduce waste and improve patient outcomes. The current pandemic of COVID19 has accelerated the trend towards automation, as health care institutions seek to reduce contact with patients and improve operational efficiency. This trend is driven by the development of new information technology, such as RFID and cloud-based management systems, which can provide real-time inventory control and data analysis capabilities.

Future Outlook

From 2025 to 2034, the market value for the automatic dispensing machines will increase from 40.54 billion to 94.18 billion, and the CAGR will be 9.82%. The main reason is that the accuracy and efficiency of the drugs in the hospitals are increasing, and the number of chronic diseases in the world is increasing. In 2025, the market penetration rate of the automatic dispensing machine in the hospital pharmacy and the community pharmacy is about 30%. By 2034, it is expected that the market penetration rate of the automatic dispensing machine will exceed 60%, and the automation degree of the medicine supply process will be further improved. Artificial intelligence and big data are expected to be integrated into the automatic dispensing machine, and the efficiency and safety of the operation will be further improved. It is expected to achieve real-time inventory, reduce medication errors, and optimize the working efficiency, and become an indispensable part of the medical equipment. The policy of reducing the cost of medical treatment and promoting the efficiency of medical treatment will also accelerate the development of the market. The trend of telehealth and home health care will also drive the demand for automatic dispensing machines, which will play a role in the remote medicine supply of patients. The automatic dispensing machine is expected to become a new type of industry that will develop rapidly with the development of science and technology, and will be able to meet the needs of the development of medicine.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 31.5billion Billion |

| Market Size Value In 2023 | USD 33.6105billion Billion |

| Growth Rate | 9.8%(2023-2032) |

Automated Dispensing Machines Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.