Market Analysis

In-depth Analysis of Automatic Elevator Inverter Market Industry Landscape

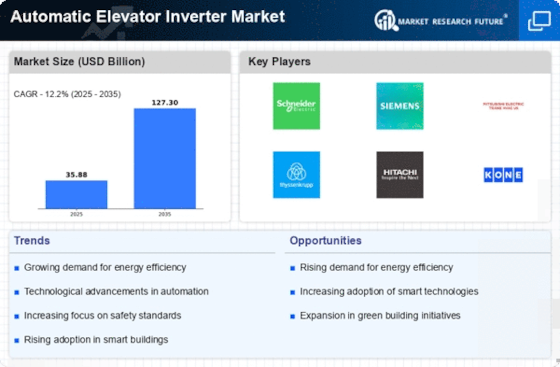

The global automatic elevator inverter market is set to reach US$ 78.88 BN by 2032, at a 12.20% CAGR between years 2023-2032. The dynamics of the market for automatic elevator inverter are over-emphasized by the ability to show that issues between manufactory and propulsion of elevator control systems have complex interactions. Elevators make perfect use of automatic inverters as critical components, ensuring that elevation operates seamlessly while harnessing the efficiency of energy utilization. It can be mentioned that one of the main factors promoting this market is increasing urbanization and high-rise buildings consist construction underway in all parts of the world. Since cities continue to grow from the ground up, the purchase of automatic elevator inverters is apt to soar out of proportion because elevators have now become a necessity. The technological developments are essential to establish the market behaviour of automatic elevator inverter. The advancements in the fields of power electronics, control algorithms, and antenna technologies have resulted in the emergence of advanced inverter solutions designed to optimize the effectiveness and energy-saving qualities of elevator systems.

Manufacturers in this market make the targeted product to be an energy saver and correspond with the safety standards of products to use by a person on existence. Besides, the global economic functions are a major factor of the dynamics in market for automatic elevator inverters. However, the demand for elevator systems is dependent on economic conditions and construction activities all these factors contribute to energy efficiency development. Therefore, the market of inverters and other engine components both are altered simultaneously by this factor negatively or positively. Many of the economic growth that come with it a lot of elevators which contribute to more construction projects and automatic elevator inverters. One of the main qualities that characterizes the competitive landscape in automatic elevator inverter market is several players showing their presence with several solutions. With competition among inverter manufacturers, elevator system integrators and automation companies to provide reliable advanced technology solutions, first thing I need is to improve the performance of elevators which are used for industrial.

Distinction takes place via the variations in the performance of product, energy economy, safeguarding properties as well as seamless adaptation with different lifts types. The desire to improve quality performance in response to intense competition continues innovation and enhances automatic elevator inverter technology. The rules and standards set by government for safety of automatic elevator inverters are extremely influential in structuring the market pattern. Such manufacturing and supplier parties are simply required to observe safety regulations whilst complying with industry standards as a condition. Elevator systems come under high safety regulations and automatic elevator inverters have to comply with such quality standards that ensure the security of the transportation systems. The need to stick to the rules does not only stem from being law but also represents an integral essence of market approval.

Leave a Comment