Market Share

Automotive Active Body Panel Market Share Analysis

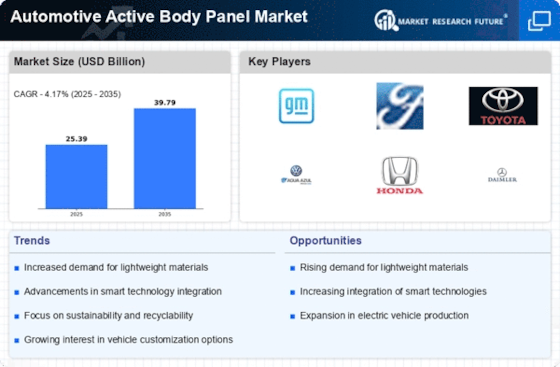

Dynamic changes in the vehicle Active Body Panel market reflect changing vehicle technology and consumer preferences. Active body panels in automobiles are a market trend. Smart actuators and sensors in these panels actively modify their shape or location to improve aerodynamics, fuel efficiency, and vehicle performance. This trend follows the automobile industry's quest of novel solutions to fulfill strict fuel economy and pollution criteria while improving driving.

Weight reduction is also gaining popularity in Automotive Active Body Panels. Lightweight active body panels are becoming more popular as automakers decrease vehicle weight to enhance fuel economy and fulfill regulations. Carbon fiber and advanced composites are used in active panels to reduce weight without compromising structural integrity. This trend supports the industry's greener automobile solutions.

Automotive body panels with active safety measures are another trend. Aerodynamics and safety are improved with active panels. On collision, pedestrian protection system-equipped active hoods can raise to decrease damage severity. This trend shows the automobile industry's dedication to safety technology and worldwide safety standards. Active safety panels are a major market trend because consumers value automobiles with enhanced safety features.

Electric and driverless car development is boosting the Automotive Active Body Panel industry. Active body panels optimise vehicle performance as the automotive industry shifts towards electrification and autonomous driving. Electric and driverless cars can benefit from active panels' aerodynamic efficiency, range optimization, and safety. This trend shows how dynamic body panels may adapt to changing automobile needs.

Automakers are investigating active body panels for dynamic and adjustable car designs. These panels may change shape or color in reaction to numerous conditions, enabling customized vehicle designs. This trend emphasizes the importance of active body panels in functionality and vehicle aesthetics to meet consumer desire for unique and personalized car experiences.

The Automotive Active Body Panel industry is also affected by sensor and V2X communication advances. Intelligent sensors and communication technologies allow active body panels to adapt to traffic, ambient conditions, and driver preferences. These innovations increase active panel performance and safety by improving their reactivity.

Leave a Comment