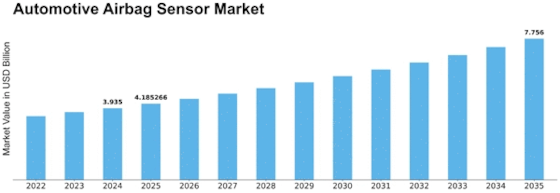

Automotive Airbag Sensor Size

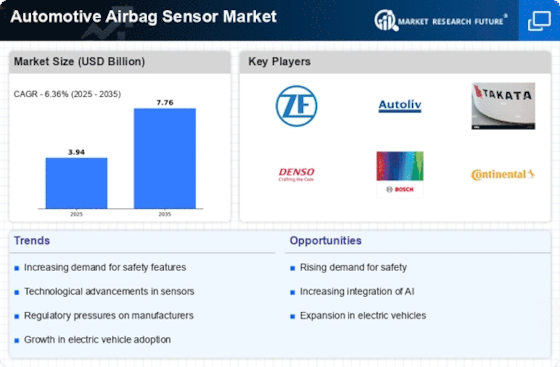

Automotive Airbag Sensor Market Growth Projections and Opportunities

The automobile airbag sensor market is dependent upon different elements that altogether characterize its growth and elements. One of the key drivers is the worldwide accentuation on vehicle wellbeing and the ceaseless development of auto security guidelines. As state run administrations overall order the execution of advanced safety highlights in vehicles, the interest for airbag systems and, subsequently, airbag sensors intensify. These sensors assume a basic part in distinguishing impact powers and setting off convenient airbag deployment, adding to vehicle security. The critical scene is a basic variable impacting the auto airbag sensor market. Serious competition among sensor makers prompts consistent advancement and the improvement of high-execution sensor systems. Organizations endeavor to separate their items by offering advanced highlights, further developed precision, and similarity with different vehicle types. This serious climate benefits consumers by giving a scope of choices and driving progressions in airbag sensor innovation. Buyer awareness and inclinations contribute essentially to showcase patterns. As car clients become more educated about wellbeing elements and request upgraded security execution, the significance of compelling airbag sensor systems develops. Producers answer by integrating easy to use highlights, for example, versatile airbag deployment and multi-stage airbags, to meet buyer assumptions and further develop by and large vehicle wellbeing. Fluctuations in the car market, remembering changes for vehicle creation volumes and customer buying conduct, impact the interest for airbag sensor systems. Financial nosedives might prompt a fleeting stoppage in vehicle creation, influencing the market for airbag sensors, while times of growth and expanded vehicle deals stimulate interest. As the car business moves towards sustainability, makers are investigating harmless to the ecosystem materials and creation processes for sensor systems. Moreover, the coordination of sensors in advanced driver assistance systems (ADAS) and autonomous vehicles adds to the general objective of lessening mishaps and further developing street safety.

Leave a Comment