Top Industry Leaders in the Automotive Axle Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Gearing Up for Growth: Exploring the Competitive Landscape of the Automotive Axle Market

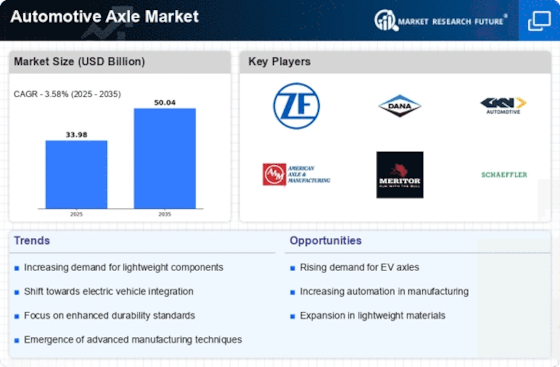

The automotive axle market, the silent partner propelling every car and truck down the road, hums with activity. This multi-billion dollar space pulsates with diverse players, from established giants to nimble innovators, all vying for a share in the critical link between engine and wheels. Let's navigate the key strategies, market dynamics, and future trends shaping this dynamic landscape.

Key Player Strategies:

Global Titans: Companies like Dana, GKN, and Meritor leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to major automakers, offering advanced axle solutions encompassing lightweight materials, fuel-efficient designs, and integrated safety features. Dana's Spicer Smart Axle exemplifies their focus on intelligent and efficient axle technologies.

Technology Disruptors: Startups like Divergent3D and Local Motors are disrupting the market with additive manufacturing techniques, enabling customization and lightweight axle designs. They cater to niche markets and early adopters seeking innovative solutions. Divergent3D's Blade technology showcases their focus on 3D-printed, lightweight axles for high-performance vehicles.

Cost-Effective Challengers: Chinese manufacturers like FAW and SAIC Motor are making waves with competitively priced axles, targeting budget-conscious carmakers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. FAW's wide range of affordable axles demonstrates their focus on cost-competitive solutions.

Niche Specialists: Companies like Meritor WABCO and ZF Friedrichshafen excel in specific axle segments, like heavy-duty trucks or all-wheel drive systems. They leverage deep understanding of specialized requirements and strong relationships with niche vehicle manufacturers. ZF's Traxon Advanced Driver Assistance Systems showcase their focus on integrated axle functions and driver assistance features.

Factors for Market Share Analysis:

Technology Innovation: Investing in R&D for next-generation axle technologies like electric drive axles, lightweight materials, and active suspension systems is crucial for staying ahead of the curve. Companies leading in innovation attract premium contracts and early adopters.

Fuel Efficiency and Emissions Reduction: Axles significantly impact vehicle fuel consumption and emissions. Offering lightweight, low-friction designs is paramount for meeting increasingly stringent environmental regulations. Companies demonstrating superior fuel efficiency gain an edge.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive markets. Companies offering affordable axles without compromising safety or performance stand out.

Safety and Reliability: Ensuring robust axle designs, high-quality materials, and stringent quality control measures is paramount for customer trust and regulatory compliance. Companies with strong track records of safety gain market share.

New and Emerging Trends:

Focus on Electric Vehicles: Adapting axles for electric powertrains and integrating them with electric motors and battery packs presents significant growth opportunities. Companies investing in EV-specific axle solutions stand out in this evolving market.

Lightweight Materials and Design: Utilizing aluminum, carbon fiber, and other lightweight materials can significantly reduce vehicle weight, improve fuel efficiency, and enhance performance. Companies focusing on lightweight axle designs cater to this growing trend.

Active Suspension Systems: Implementing electronically controlled suspension systems integrated with axles enables real-time ride and handling adjustments, improving comfort, safety, and off-road capability. Companies embracing active suspension technology cater to the demand for enhanced driving dynamics.

Connectivity and Data Analytics: Integrating sensors and data analysis platforms into axles allows for real-time monitoring of performance, predictive maintenance, and remote diagnostics. Companies offering connected axles cater to the increasing demand for vehicle data and remote management.

Overall Competitive Scenario:

The automotive axle market is a dynamic and exciting space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative solutions. Cost-effective challengers cater to budget-conscious buyers, and niche specialists excel in specific segments. Factors like technology innovation, fuel efficiency, affordability, and safety play a crucial role in market share analysis. New trends like EV integration, lightweight materials, active suspension, and connectivity offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse vehicle needs, embrace sustainable practices, and explore data-driven solutions. By constantly gearing up for growth and adapting to the changing landscape, they can secure a dominant position in this essential automotive ecosystem

ZF Friedrichshafen AG (Germany):

• October 2023: Launched eTrac, a new lightweight and compact electric drive axle for commercial vehicles, targeting the growing EV market. (Source: ZF Press Release)

American Axle & Manufacturing, Inc. (U.S.):

• December 2023: Announced a partnership with a major electric truck manufacturer to develop and supply lightweight axles for their heavy-duty EVs. (Source: American Axle Press Release)

Meritor, Inc. (U.S.):

• November 2023: Acquired a European axle manufacturer, expanding their global footprint and product portfolio. (Source: Meritor Press Release)

Showa Corporation (Japan):

• October 2023: Showcased a prototype electric axle for electric buses at a trade show, highlighting their commitment to electrification. (Source: Nikkei Asian Review)

Top listed global companies in the industry are:

ZF Friedrichshafen AG (Germany), American Axle & Manufacturing, Inc. (U.S.), Meritor, Inc. (U.S.), Showa Corporation (Japan), GKN Plc (U.K.) and ELBE Gelenkwellen-Service GmbH(Germany).