Automotive Capacitors Size

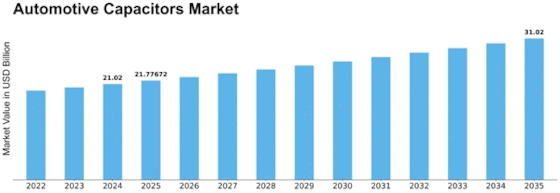

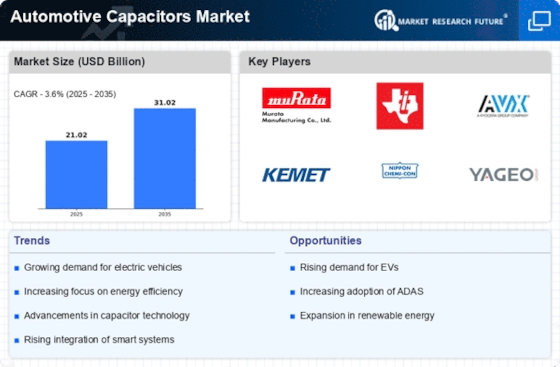

Automotive Capacitors Market Growth Projections and Opportunities

A variety of factors that together determine the nature and momentum of growth for The Automotive Capacitors Market work as an influence. A very important element is the rising technology of automobiles. With the development and advancement of vehicles, the need for electronic content increases which leads to higher requirements for capacitors with higher capabilities. This necessitation is enhanced by the automotive industry’s transition to electric and hybrid cars, which are dependent heavily on electronic materials for excellent workability. The automotive capacitors market continues to grow, aimed at contributing its product portfolio and performance parameters as the autonomous driving features, connectivity, and electrification are pushed forwards. Another major market driver is government regulation and environmental issues The need for stringent emission standards, global efforts towards the promotion of environmentally friendly modes of transportation have led to development of EVs. Particularly, capacitors are essentially necessary components of energy storage and distribution system in the electric vehicles due to their substantial role.

The focused demand for automotive capacitors gathers momentum not only by the increasing need for an electric vehicle but also through the riposte grant slow-motion IV incentives and support regulations that encourage acceptance understood of disadvantage drivers. The market also bears considerable external pressure from the global economic situation. Increased in GDP and its stability change the purchasing power of consumers maintain or destroy their confidence about buying automobiles. The entire consumption of automotive capacitors is largely driven by the economic growth and consumer sentiments since vehicle demand reduces during economic downturns due to the inclination on investment that consumers may delay or reconsider purchases. On the contrary, high rates of economic are linked to higher demand for vehicles leading to a higher supply end. In this case advancements in technology and innovations have led to the molding of automotive capacitors market. Various development and research efforts result in the creation of capacitors with higher energy content, increased reliability, and much better performance specifications. Innovation like printed solid-state capacitors and material science focused development to profit from examples determined by the mechanical vehicle industry fuel development on this advertise. There are important factors that determine market dynamics on the supply chain and raw material availability.

Assuming that capacitors are specifically produced from certain materials then any interruption within the supply chain will signal to either a halt of production processes or an unstable market phenomenon. In terms of raw material prices, market value form does not include valuable cargo where fluctuations in price and geopolitical factors could be put into consideration. The market competition and industry consolidation add up to those factors that make the layout of the automotive capacitors market. The competition rate between necessary factors is perpetually generating innovations, product developments as well as cost-effective production. Internal changes to the industry such as mergers and buyouts lead firms out of companies possessed by a competition may change market dynamics which will determine customers’ pricing strategies in terms of product variety or cost, incorporating value for money.

Leave a Comment