Market Share

Automotive Diagnostic Tool Market Share Analysis

In developed nations worldwide, there is a prevailing inclination towards the acquisition of premium-category automobiles equipped with more precise, efficient, and speedy diagnostic instruments. This surge in the market for luxury cars can be attributed to several factors, including a substantial increase in the availability of genuine luxury features in vehicles, a shift in consumer preferences from sedans to Sports Utility Vehicles (SUVs), and a rise in disposable incomes.

The landscape of automotive technology is evolving, with a notable integration of emerging technologies in vehicles to enhance efficiency and sustainability. In this context, there remains a sustained demand for On-Board Diagnostics (OBD) solutions, both in personal and commercial vehicles. Notably, as automobiles embrace advancements such as connected cars, big data analytics, human-machine interfaces, and electric vehicles, the need for sophisticated diagnostic tools becomes increasingly pronounced. These tools play a crucial role in managing and regulating the intricate components of high-tech vehicles.

A significant contributor to the escalating demand for cutting-edge automotive diagnostic tools is the global shift towards sustainable practices. The automotive industry is witnessing a paradigm shift with a heightened focus on eco-friendly and energy-efficient alternatives. Electric vehicles, in particular, are becoming increasingly prevalent, necessitating advanced diagnostic solutions to ensure their seamless operation and maintenance.

Moreover, the rise in purchasing power in emerging markets like China, France, Germany, Italy, and Spain is steering the trajectory towards the adoption of newer and more modern automotive diagnostic tools. As these markets experience economic growth and an improvement in living standards, there is a growing appetite for high-end passenger cars and commercial vehicles, which further propels the expansion of the global automotive diagnostic tool market.

The emphasis on connectivity and data-driven insights in the automotive sector is reshaping the dynamics of vehicle diagnostics. Connected cars, with their ability to gather and process vast amounts of data, demand sophisticated diagnostic instruments to interpret and respond to the intricacies of modern vehicle systems. This trend is not limited to personal vehicles; commercial fleets are also increasingly relying on advanced diagnostic tools to ensure the efficient and reliable operation of their vehicles.

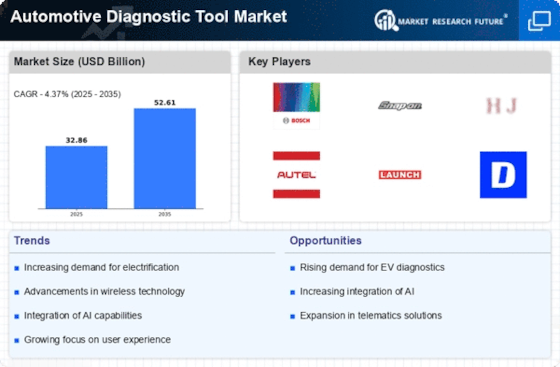

The surge in demand for premium automobiles, coupled with the integration of advanced technologies in the automotive sector, is steering the global automotive diagnostic tool market towards significant growth. As consumer preferences evolve, and new technologies become integral to vehicles, the need for precise, efficient, and fast diagnostic solutions will continue to be a driving force in the automotive industry. The expanding influence of emerging markets and the ongoing shift towards sustainability further underscore the importance of sophisticated automotive diagnostic tools in the contemporary automotive landscape.

Leave a Comment