Top Industry Leaders in the Automotive Disc Brake Market

*Disclaimer: List of key companies in no particular order

Automotive Disc Brake Latest Company Updates:

ompetitive Landscape of the Automotive Disc Brake Market: A Comprehensive Analysis

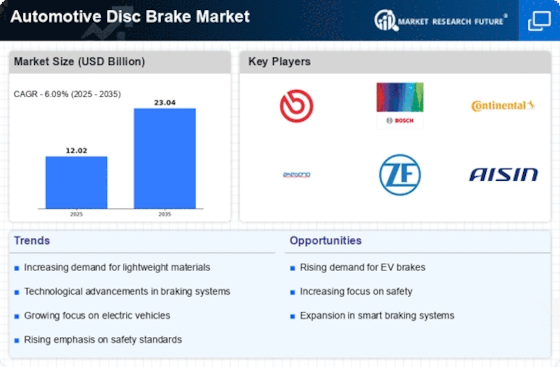

The automotive disc brake market is a dynamic and fiercely competitive space, witnessing steady growth fueled by factors like rising vehicle demand, increasing safety regulations, and technological advancements. This landscape is populated by a diverse range of players, each employing unique strategies to gain a foothold. Understanding these strategies and the overall competitive scenario is crucial for navigating this market successfully.

Key Player Strategies:

Tier 1 Suppliers: Major players like Bosch, Continental, and Brembo hold strong positions through strategic partnerships with automakers, vertical integration in manufacturing, and aggressive investments in R&D for advanced braking technologies. Their focus lies on developing lightweight, energy-efficient brakes for electric vehicles and autonomous driving systems.

Tier 2 & 3 Suppliers: These players often specialize in specific brake components like calipers, pads, or rotors. They compete on cost, operational efficiency, and product customization to secure contracts with Tier 1 suppliers and aftermarket retailers. Companies like Akebono and Mando are prominent examples in this segment.

Emerging Players: Start-ups and technology companies are entering the fray with innovative braking solutions, leveraging sensors, data analytics, and AI to offer predictive maintenance, enhanced safety features, and improved braking performance. Companies like Ottowa-based eABS and German start-up Brake Fluid Systems represent this trend.

Factors for Market Share Analysis:

Product Portfolio: Offering a diversified range of brakes for different vehicle segments, price points, and performance levels is crucial for attracting a wider customer base. Leaders like Brembo boast high-performance brakes for premium cars, while companies like Aisin Seiki cater to mid-range segments.

Geographical Presence: Having a strong global presence with manufacturing facilities and distribution networks in key markets like China, Europe, and North America is essential for capturing regional growth opportunities. Continental excels in this aspect, with a robust global footprint.

Technological Innovation: Investing in R&D for next-generation braking technologies like electric brakes, regenerative braking systems, and advanced materials ensures future market relevance. Tier 1 players are actively pushing these boundaries, while start-ups offer disruptive solutions for specific niches.

Brand Reputation: Building a strong brand reputation for quality, reliability, and safety creates customer loyalty and attracts new business. Established companies like Akebono have built their market presence through this approach.

New and Emerging Trends:

Electrification: The burgeoning electric vehicle market demands efficient and regenerative braking systems that can recover energy during deceleration. Companies like Bosch and Nissin Kogyo are focusing on this segment with dedicated product lines.

Autonomous Driving: Advanced driver-assistance systems (ADAS) and autonomous vehicles require highly responsive and automated braking solutions. Players like TRW and Wabco are actively collaborating with automakers to develop these technologies.

Lightweighting: Manufacturers are looking for lightweight brake components to improve fuel efficiency and vehicle performance. Materials like carbon fiber and advanced composites are increasingly being explored in this regard.

Data-Driven Solutions: Integrating sensors and data analytics into brakes enables predictive maintenance, personalized braking profiles, and enhanced safety features. Start-ups like eABS are pioneers in this area.

Overall Competitive Scenario:

The automotive disc brake market is characterized by intense competition across all segments. While established players dominate market share, smaller players and innovative start-ups are carving out niches with specialized offerings and technology-driven solutions. The market is expected to remain dynamic, driven by factors like electrification, autonomous driving, and ongoing technological advancements. Success in this landscape will hinge on adaptability, strategic partnerships, and a proactive approach to embracing new trends.

This analysis provides a snapshot of the competitive landscape in the automotive disc brake market. To gain a deeper understanding, it's important to delve into specific player strategies, regional variations, and the evolving technological landscape.

EBC Brakes (UK):

- Dec 12, 2023: Announced development of next-generation "Redstuff+" brake pads offering improved high-temperature performance and reduced dust compared to standard Redstuff pads. (Source: EBC Brakes press release)

TRW Automotive (US):

- Nov 29, 2023: Unveiled advanced brake-by-wire system with integrated sensors for improved safety and autonomous driving applications. (Source: Motor Trend)

Aisin Seiki Co., Ltd (Japan):

- Sep 21, 2023: Successfully completed testing of next-generation lightweight brake caliper design for improved fuel efficiency and reduced unsprung weight. (Source: Aisin Seiki press release)

Mando Automotive India Private Limited (India):

- Oct 20, 2023: Launched online configurator tool for Indian customers to select and purchase compatible brake discs and pads for their specific vehicles. (Source: Mando Automotive India website)

Top listed global companies in the industry are:

EBC Brakes (UK)

TRW Automotive (US)

Nissin Kogyo Co., Ltd (Japan)

Aisin Seiki Co., Ltd (Japan)

Mando Automotive India Private Limited (India)

Haldex AB (Sweden)

Federal-Mogul Motorparts LLC. (US)

Knorr-Bremse AG (India)

Akebono Brake Corporation (Japan)

Brembo SpA (Italy)