Market Share

Automotive Electric Power Steering Market Share Analysis

With the passing of many years, car companies' competition increased. Automakers created various value and component contributions to lose their loyal customers and boost their market position. After then, automakers focused on balancing decisions and style to provide customers a better experience. This particular issue usually involved patching the person's plan and upholstery. The basic idea was that the more useful the seating area and interior, the better the client's mood and comfort. However, the driver's riding comfort wasn't advanced.

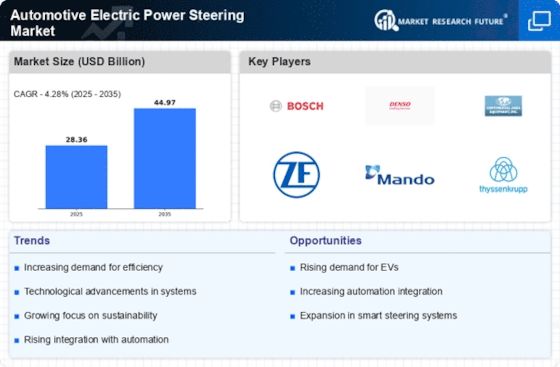

The automobile Electric Power Steering (EPS) market has changed rapidly, reflecting the automobile industry's larger shifts. One trend is the rise of electric power steering systems over water-powered ones. This trend is driven by the need for more eco-friendliness, lower emissions, and better vehicle performance.

The growing emphasis on manageability and environmental awareness is helping Automotive Electric Power Steering rise. States have strict discharge rules, so manufacturers must study eco-friendly options. Electric power steering is more energy-efficient than pressure-driven frames, making it desirable to manufacturers following strict environmental rules. Due to global concerns about air quality and environmental change, the industry is moving toward cleaner and greener technologies.

Innovation is also crucial to Automotive Electric Power Steering market trends. Electric power steering systems are more accurate and responsive thanks to smart sensors, human brainpower, and current control calculations. This has made driving smoother and more distinctive for buyers, increasing EPS's popularity in modern cars.

Automotive Electric Power Steering market trends depend on cost-viability. Electric power steering systems have greater upfront costs, but their total ownership cost is far cheaper. Electric power steering is durable and efficient, needing minimal maintenance. The moderateness and reliability of electric power steering systems promote market growth as buyers become more cost-conscious and seek automobiles with fewer long-term costs.

Globalization and market interconnection have also influenced Automotive Electric Power Steering. Sharing automobile stages and components between districts has normalized electric power steering frameworks. Automakers and buyers benefit from this normalization, which streamlines assembly and accounts for economies of scale. Normalization in the market reflects the company's efforts to improve assets and efficiency.

Leave a Comment