Market Share

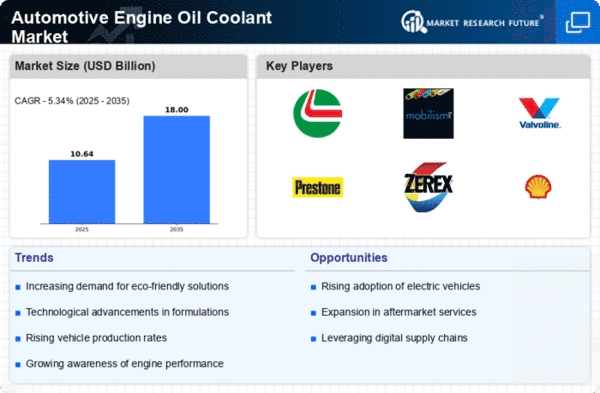

Automotive Engine Oil Coolant Market Share Analysis

The Automotive Engine Oil Coolant sector is undergoing significant trends that demonstrate that it has become more dynamic within the greater car industry. One major trend relates to enhanced fuel economy and thermal management of engines. Cooler solutions have become increasingly important in today's advanced environments, where engines are becoming more powerful and complicated. The transition towards electric vehicles (EVs) is another key factor shaping the automotive engine oil coolant market. Although EVs are seen as futuristic, conventional internal combustion engines (ICEs) play a significant role, especially within hybrids that comprise a significant part of the contemporary auto landscape. Materials used in manufacturing are also driving changes in the automotive engine oil coolants business environment. Many companies are developing new materials that enhance the thermal conductivity and durability of their engine oils, such as surfactants or Teflon surfaces like those found on frying pans, which have high thermal resistance properties, protecting them from burning up while cooking at high temperatures, etc. Furthermore, there is an increasing demand for smaller, lighter designs necessitated by weight reduction efforts in this industry aimed at achieving better fuel economy. The engine oil coolants market is also affected by the integration of smart technology in motor vehicles. Systems for cars that have been integrated with smart technologies have affected the engine oil coolant market. Coolant solutions should be intelligent in order to cope with the rise of connected vehicles and advanced driver assistance systems (ADAS). Toward this end, automakers are currently adopting innovative coolant solutions that can change their cooling capacities based on live information from various sensors, hence making it easy to regulate temperatures and prevent overheating. Besides, as the automotive industry becomes more focused on sustainability, demand for environmentally friendly and biodegradable coolant solutions has increased in the engine oil coolant market. Manufacturers are now seeking alternatives that minimize the environmental impacts associated with disposing of coolants and still provide high performance. Rather, they fall in line with the industry's commitment to environment-friendly practices and increasing consumers' consciousness of environmentally sustainable products. Another trend impacting the auto engine oil coolant market is moving towards self-driving vehicles. Autonomous vehicle systems such as cooling need different cooling requirements. The continuous operation of autonomous vehicles requires robust and reliable coolant systems to prevent overheating and ensure uninterrupted performance. In other words, we conclude that due to its focus on engine efficiency, electrification, material innovation & design, smart technology sustainability, and the advent of autonomous vehicles, the automotive engine oil coolant market has undergone a transformational phase. Automotive system transformations meant to meet new landscape demands have made engine oil coolants very important in realizing better industry performance efficiency and sustainability goals.

Leave a Comment