Market Share

Automotive Exhaust Sensors Market Share Analysis

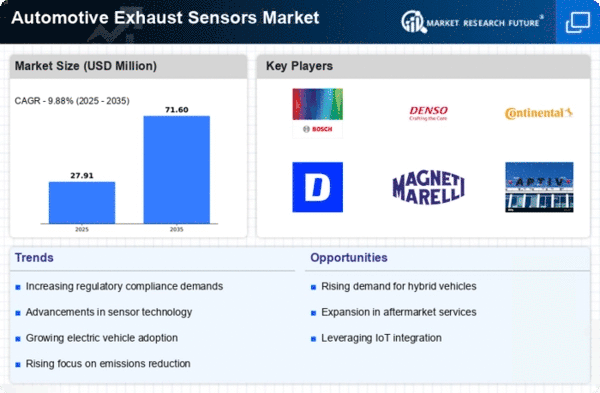

Market share positioning strategies for exhaust sensors in the automotive market are critical for companies looking to establish a strong foothold and outpace competitors. In this highly competitive industry, where technological advancements and regulatory requirements continuously evolve, companies must deploy effective strategies to capture and retain market share. One prominent approach is differentiation, where companies focus on offering unique features or functionalities in their exhaust sensors to distinguish themselves from rivals. For instance, companies may invest in research and development to develop sensors with enhanced durability, accuracy, or compatibility with different vehicle models. By emphasizing these distinguishing factors, companies can attract customers who value innovation and superior performance, thereby gaining a competitive edge.

Another key strategy is cost leadership, wherein companies strive to become the low-cost provider of exhaust sensors without compromising on quality. Achieving economies of scale, optimizing production processes, and sourcing materials efficiently are common tactics employed to reduce manufacturing costs. By offering competitively priced sensors, companies can appeal to cost-conscious customers and gain market share, especially in price-sensitive segments of the automotive market. Additionally, cost leadership strategies can help companies penetrate new markets or expand their customer base, further solidifying their market position.

Furthermore, companies may pursue a niche market strategy, targeting specific segments or applications within the automotive industry. For example, focusing on sensors designed for electric vehicles or heavy-duty trucks can allow companies to tailor their products to the unique requirements of these markets. By concentrating their efforts on niche segments, companies can position themselves as experts in specialized applications, attracting customers seeking specialized solutions and reducing direct competition. This strategy can be particularly effective for smaller companies or startups looking to enter the market with limited resources, as it allows them to carve out a niche where they can excel.

In addition to product-focused strategies, companies can also differentiate themselves through branding and marketing efforts. Building a strong brand identity and effectively communicating the value proposition of their exhaust sensors can influence customer perceptions and drive purchase decisions. For instance, companies may leverage endorsements from automotive manufacturers or industry experts to enhance their credibility and visibility in the market. Similarly, targeted marketing campaigns that highlight the benefits of their sensors, such as improved fuel efficiency or reduced emissions, can resonate with target customers and drive demand.

Collaboration and strategic partnerships with other companies in the automotive ecosystem can also be instrumental in gaining market share. By partnering with vehicle manufacturers, aftermarket suppliers, or technology providers, companies can access new distribution channels, tap into existing customer bases, and leverage complementary expertise. For example, forming alliances with automotive OEMs can lead to preferred supplier status and long-term contracts, providing a steady stream of revenue and market share stability. Likewise, collaborating with technology companies specializing in data analytics or connectivity can enable companies to offer advanced sensor solutions that meet emerging market needs, such as predictive maintenance or autonomous driving.

In conclusion, market share positioning strategies for exhaust sensors in the automotive market encompass a range of approaches aimed at gaining a competitive advantage and capturing a larger portion of the market. Whether through product differentiation, cost leadership, niche targeting, branding, or strategic partnerships, companies must carefully evaluate their strengths, market dynamics, and customer preferences to develop effective strategies. By continuously innovating, adapting to market trends, and delivering value to customers, companies can enhance their market position and thrive in this dynamic and highly competitive industry.

Leave a Comment