Market Trends

Key Emerging Trends in the Automotive Fuel Cell Market

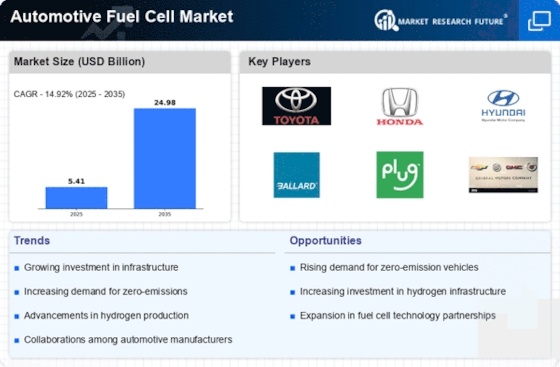

The automotive fuel cell market is an intriguing scene of positioning strategies in each company’s quest to establish a foothold in the emerging sector of hydrogen powered vehicles. Technological innovations and R&D investments are central here and such companies concentrate on improved fuel cell technologies that provide better efficiency, longer life and lower costs. This approach helps them present their products in different ways, giving them a competitive advantage over others through having better performing fuel cell systems. In addition, market positioning is highly influenced by partnerships and collaborations. As a result alliances are being formed among car manufacturers, fuel cell makers and infrastructure developers so as to take advantage of each other’s capabilities, combine resources and speed up the production and use of fuel cell vehicles including refueling facilities.

Additionally, they intentionally focus on particular segments within the auto FC market with the objective of maximizing their share in such markets. Some go into commercial vehicles examples being trucks, buses, or fleets as their adoption potential is higher than other sectors. Other brands concentrate on personal cars that would bring consumers into accepting this type for vehicles thus making it popular among the people at large. It provides firms with room to develop methodologies depending on customer needs as well as demands for different sections thus gaining some form of competitive edge.

Furthermore setting up a robust supply chain for such important components like stacks used during FC process ,hydrogen storage systems and catalysts play a critical role in market share positioning within automobile fuel cells . Companies also have to ensure that there is stable source of these materials besides coming cheaply whenever they are needed so that it can be possible for them to grow without limitation or getting inconsistent performances during manufacturing processes. For example this approach aids businesses in meeting the soaring demand for FCEVs whilst still keeping costs low enough to remain competitive against rivals.

In addition ,market power plays within the auto FC industry depend heavily upon infrastructural growth efforts made by companies . Hence there are partnerships between companies and governments in order to set up hydrogen refueling stations thus creating a conducive environment for FCV uptake. These businesses investing on infrastructure development have the advantage of growing the hydrogen economy as well as having adequate refuelling facilities for their cars which ultimately leads to high consumer confidence with increased uptake.

Leave a Comment