Automotive Fuel Injection Pump Size

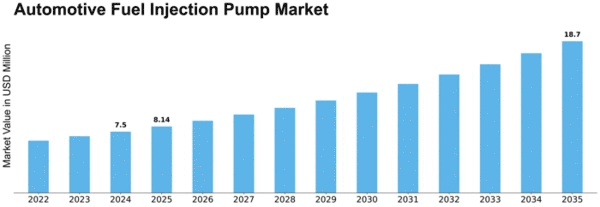

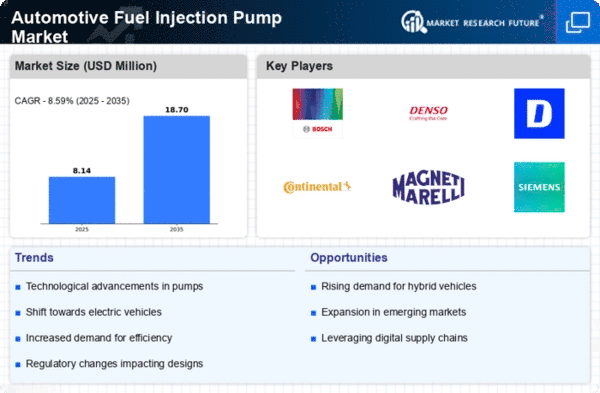

Automotive Fuel Injection Pump Market Growth Projections and Opportunities

The automotive fuel injection pump market operates within the broader automotive industry, serving as a pivotal component in delivering fuel to an engine. Its dynamics are shaped by a multitude of factors, ranging from technological advancements to regulatory policies and consumer preferences.

One of the significant driving forces behind the market dynamics is the constant evolution of automotive technology. Advancements in fuel injection systems, aiming for higher efficiency, reduced emissions, and improved performance, stimulate the demand for innovative fuel injection pumps. Manufacturers continually strive to develop pumps that offer better precision, higher pressure capabilities, and compatibility with alternative fuel sources like electric or hybrid vehicles, contributing to the ever-changing landscape of the market.

Furthermore, regulatory standards and environmental concerns play a vital role in shaping the dynamics of this market. Governments worldwide implement stringent emission norms, compelling automakers to adopt cleaner and more efficient fuel injection systems. This necessitates the development of pumps that meet these regulatory requirements, thereby influencing the market dynamics by promoting eco-friendly and sustainable technologies.

The market dynamics are also significantly influenced by the demand and preferences of consumers. With a growing emphasis on fuel efficiency, performance, and reduced maintenance costs, consumers seek vehicles equipped with advanced fuel injection systems. As a result, there's a continuous push for innovation and improvement in fuel injection pump technology to meet consumer expectations, which further fuels the market dynamics.

Moreover, the global economic scenario and fluctuations in fuel prices also impact the automotive fuel injection pump market. Economic stability or instability can affect consumer purchasing power, leading to fluctuations in vehicle sales and, consequently, the demand for fuel injection pumps. Similarly, volatile fuel prices can influence the market dynamics, as consumers may opt for more fuel-efficient vehicles that rely on advanced fuel injection systems.

The competitive landscape within the automotive fuel injection pump market is another significant factor shaping its dynamics. Numerous companies vie for market share, driving innovation and competitive pricing strategies. Key players invest heavily in research and development to introduce cutting-edge technologies, engage in mergers and acquisitions, and expand their product portfolios, all of which contribute to the shifting dynamics of the market.

Additionally, the geographical distribution of automotive manufacturing and consumption also influences the market dynamics. Regions with a higher concentration of automotive production tend to drive demand for fuel injection pumps. Factors such as infrastructure development, government policies, and economic growth in these regions play a crucial role in shaping market dynamics.

The dynamics of the automotive fuel injection pump market are multifaceted and constantly evolving. Technological advancements, regulatory standards, consumer preferences, economic factors, competition among manufacturers, and regional influences collectively contribute to the ever-changing nature of this market. As the automotive industry continues to progress, the dynamics of the fuel injection pump market will remain responsive to these various forces, shaping its future trajectory.

Leave a Comment