Top Industry Leaders in the Automotive Hydraulics System Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Hydraulics System industry are:

JTEKT Corporation (Japan)

ZF Friedrichshafen AG (Germany)

WABCO Holdings Inc. (U.S.)

Aisin Seiki Co. Ltd. (Japan)

Schaeffler Technologies AG & Co. KG (Germany)

BorgWarner Inc. (U.S.)

Robert Bosch GmbH (Germany)

GKN plc (U.K.)

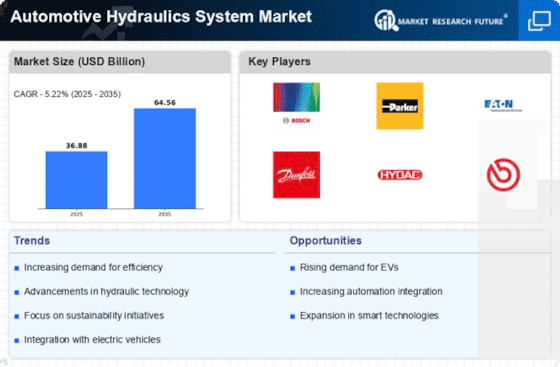

The automotive hydraulics system market, valued at approximately USD 7.5 billion in 2021, finds itself at a crossroads. While established players reign supreme, the horizon buzzes with the murmurs of innovation and disruption. Understanding the competitive landscape, therefore, becomes crucial for both incumbents and new entrants.

Key Players and Their Strategies:

Global Giants: Bosch, ZF Friedrichshafen AG, BorgWarner Inc., and Continental AG lead the pack, leveraging their extensive product portfolios, brand recognition, and established OEM partnerships. They prioritize R&D in areas like energy efficiency and electromechanical hybrids, while maintaining a strong presence in high-growth regions like Asia-Pacific.

Regional Contenders: AISIN Seiki Co. Ltd. and JTEKT Corporation from Japan carve a niche in advanced hydraulic components, catering to the demands of domestic automakers. Mando Corporation from Korea also makes strides, capitalizing on its cost-competitive offerings.

Tier 2 Specialists: Companies like Eaton Corporation, Wabco, and Schaeffler focus on specific segments like brakes, suspensions, and transmissions. They excel in technical expertise and cater to specialized applications, often partnering with larger players for OEM integrations.

Factors for Market Share Analysis:

Product Portfolio Breadth and Depth: Offering a range of hydraulic systems for diverse vehicle types and applications grants an edge. Comprehensive aftermarket support further strengthens market position.

Technological Prowess: Continuous innovation in areas like lightweight materials, noise reduction, and intelligent control systems fosters competitive advantage. Early adoption of electrification trends like hybrid hydraulic drives is crucial.

Geographical Footprint and Customer Relationships: Strong presence in emerging markets like China and India, coupled with established partnerships with major OEMs, ensures market share dominance.

Cost Optimization and Value Proposition: Balancing quality with affordability, particularly in cost-sensitive regions, attracts budget-conscious buyers and expands market reach.

Emerging Trends and Company Strategies:

Electrification Integration: Companies like Bosch and ZF are actively developing hybrid hydraulic systems that combine the power of hydraulics with electric motors, aiming for improved efficiency and emission reduction.

Smart Hydraulics and Sensor Integration: Integrating sensors and electronic controls into hydraulic systems enables real-time performance monitoring, predictive maintenance, and adaptive functionalities, attracting automakers focused on advanced driver assistance systems (ADAS).

Sustainable Materials and Processes: Adoption of bio-based fluids, lightweight components, and energy-efficient manufacturing processes are gaining traction, appealing to environmentally conscious customers and regulators.

Overall Competitive Scenario:

The automotive hydraulics system market is witnessing a dynamic interplay between established players, regional contenders, and niche specialists. Innovation in electrification, intelligent control systems, and sustainability hold the key to unlocking future growth. While global giants leverage their scale and resources, smaller players have the agility to seize opportunities in specific segments and emerging markets. Collaborations and strategic partnerships are likely to shape the competitive landscape, as companies seek to combine expertise and resources to navigate the evolving technological landscape.

Latest Company Updates:

JTEKT Corporation (Japan):

- December 2023: JTEKT signed a strategic partnership with Hyundai Motor Group to develop and supply next-generation hydraulic steering systems for electric vehicles. (Source: JTEKT Press Release)

ZF Friedrichshafen AG (Germany):

- August 2023: ZF collaborated with the University of Stuttgart to develop a new AI-powered hydraulic control system for improved handling and safety in off-road vehicles. (Source: ZF website)

WABCO Holdings Inc. (U.S.):

- September 2023: WABCO launched a new range of modular hydraulic valves for heavy-duty trucks, offering faster installation and easier maintenance. (Source: WABCO website)

Aisin Seiki Co. Ltd. (Japan):

- December 2023: Aisin Seiki partnered with a European supplier to develop electric hydraulic power steering systems for passenger cars, reducing energy consumption. (Source: Nikkei Asian Review)