Market Analysis

In-depth Analysis of Automotive Ignition Coil Aftermarket Market Industry Landscape

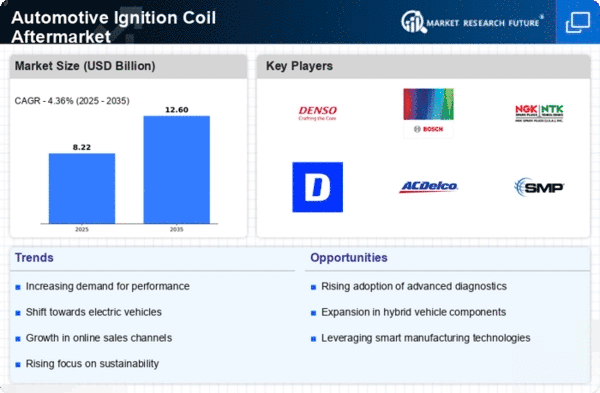

The global automotive ignition coil aftermarket is experiencing robust growth, propelled by the rising demand for efficient fuel combustion and the implementation of stringent government emission norms and regulations. In addition to environmental concerns, there is an increased focus on sustainability, leading to a surge in demand for ignition coils that contribute to lower fuel consumption and reduced emission rates. This heightened emphasis on eco-friendly solutions is driving manufacturers to invest significantly in the development of ignition coils, positioning the aftermarket for substantial growth during the forecast period.

The evolving landscape of next-generation vehicles, which require high-voltage ignition systems and demand space-efficient solutions in the engine compartment, presents lucrative opportunities for ignition coil manufacturers. As vehicle designs continue to advance, the need for innovative ignition coils becomes imperative to meet the changing requirements of modern automotive systems.

Major Industry Standards for Ignition Coils

In this context, adherence to industry standards becomes crucial for ignition coil manufacturers. Meeting or exceeding Original Equipment Manufacturer (OEM) specifications is a fundamental requirement. Each ignition coil must be meticulously designed and optimized for specific applications concerning fit, form, and function. Outstanding mechanical stability and corrosion protection are non-negotiable aspects of ignition coil development. Moreover, the coil must meet specified length, operating temperature, and voltage parameters, as outlined by regulatory bodies such as the Environmental Protection Agency (EPA).

According to EPA standards, ignition coils must have a length ranging from 50 mm to 200 mm, operate within a temperature range of -40 °C to 140 °C, and maintain a voltage of 9 V to 16 V. These criteria, combined with or without connection cables, are essential for the manufacture of engines in motor vehicles.

Impact of Stringent Government Regulations

Government and regulatory bodies globally are increasingly stringent regarding emission norms, covering various factors such as heat transfer, vibrations, insulation, contact breaker, and high-voltage connections. Deviations from these specifications may result in critical issues such as short circuits or severe engine breakdowns. In response to these regulations, end-users of ignition coils are actively seeking products that meet industry standards, often opting for similar aftermarket alternatives to the original equipment at a lower cost.

The shifting consumer preference from original equipment to cost-effective aftermarket products has significantly driven the demand for ignition coils. Verified manufacturers specializing in automotive ignition coils are witnessing an upsurge in demand from end-users who prioritize compliance with industry standards. Major industry players like BorgWarner and Beru Parts attribute the growth of the automotive ignition coil aftermarket to the impact of stringent government regulations, particularly those related to vehicle emissions.

Future Outlook

Looking ahead, the demand for ignition coils is poised to rise as governments worldwide continue to tighten emission regulations, pushing the automotive industry towards greater environmental responsibility. Ignition coil manufacturers are expected to play a pivotal role in providing solutions that not only meet these regulations but also contribute to the efficient and sustainable operation of vehicles.

Leave a Comment