- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

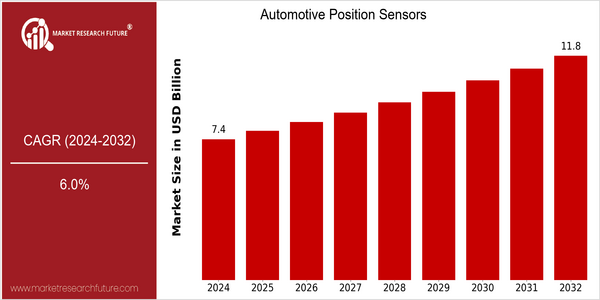

| Year | Value |

|---|---|

| 2024 | USD 7.42 Billion |

| 2032 | USD 11.85 Billion |

| CAGR (2024-2032) | 6.0 % |

Note – Market size depicts the revenue generated over the financial year

The market for automobile position sensors is growing at a steady rate, from $ 7.42 billion in 2024 to $ 11.85 billion in 2032. CAGR of 6.0% from 2024 to 2032. The main driving force is the increasing demand for ADAS and the increasing emphasis on vehicle safety and automation. The more complex sensors are introduced into the vehicle to enhance its performance and safety, the more position sensors are needed. In addition, the development of MEMS sensors and the integration of IoT capabilities will also drive the market. Also, leading companies such as Continental, Denso, and Bosch are investing heavily in research and development to provide more efficient and reliable sensors. Also, strategic alliances and cooperation are formed to enhance the product portfolio and increase the market share. The automobile industry is moving toward electrification and automation, and the demand for high-performance position sensors is expected to rise, which will further strengthen the position of position sensors in future vehicle design.

Regional Market Size

Regional Deep Dive

The position sensors market is experiencing considerable growth in the region, driven by technological advancements, rising demand for electric vehicles, and stringent safety regulations. Every region has its own characteristics that affect the market. The regions have different levels of technological adoption, regulatory framework, and consumer preferences. As the automotive industry moves towards automation and connectivity, the demand for reliable and precise position sensors is expected to rise, which will drive innovation and investments in the market.

Europe

- Europe is in the forefront of the electric car revolution. In Norway and Germany, electric cars are gaining ground. The shift is generating a brisk demand for position sensors, which are essential for battery management systems and electric powertrains. Companies like Continental and Robert Bosch are investing heavily in R&D.

- The European Union’s stricter emissions regulations are forcing the car industry to think about new developments. As a result, hybrid and electric cars are integrating more and more position sensors. In this way, car manufacturers and technology companies are working together to develop the next generation of position sensors.

Asia Pacific

- The region of Asia-Pacific, especially China, is experiencing a rapid growth of the automobile industry. This growth is being caused by the rising population, the growing urbanization, and the rising consumption. Major automobile manufacturers such as Honda and Toyota are concentrating on integrating advanced position sensors in their vehicles to improve performance and safety.

- Governmental initiatives in India and other countries are encouraging the use of electric vehicles, which will increase the demand for position sensors. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme is a notable example of this.

Latin America

- Brazil and Mexico, the leading countries in Latin America, are slowly catching up with the automobile. They are putting in a growing number of position sensors to comply with international safety standards and to improve vehicle performance.

- The region's difficult economic situation is pushing manufacturers to focus on cost-effective sensors. Local companies are collaborating with global players like Valeo and Delphi to develop the most advanced positioning systems at an affordable price.

North America

- The North American market is experiencing a rapid growth in the use of ADAS, which are based on the position sensors for the lane-keeping function and the Adaptive Cruise Control. These functions are based on the technology of the lateral and vertical cameras, which are a key component of the system. In order to meet the increasing demand for ADAS, the major players such as Honeywell and Texas Instruments are developing new sensors.

- In the United States, in particular, the emergence of new standards for vehicle safety is driving the manufacturers to integrate increasingly complex positioning sensors in their vehicles. In this, the National Highway Traffic Safety Administration (NHTSA) has played a leading role.

Middle East And Africa

- The market for motor cars is developing rapidly in Africa and the Middle East. The demand for smart mobility solutions is growing. Companies such as Al-Futtaim Motors are investigating the integration of position sensors in their vehicle offerings in order to improve the customer experience and safety.

- The economic factors in the region, such as the fluctuating price of oil and the diversification of economies, have an impact on the car market. As governments invest in smart city and infrastructural projects, the demand for advanced automobile components, such as position sensors, is expected to increase.

Did You Know?

“Did you know that position sensors are critical for the functionality of over 70% of modern vehicles' safety and performance systems?” — Automotive Industry Association

Segmental Market Size

The position sensors market is a critical market in the auto industry, and is presently experiencing a steady growth, due to the rising demand for ADAS and the shift to EVs. This is also being driven by the increasing demand for comfort and safety among consumers, as well as the stricter regulations aimed at improving vehicle safety standards. Also, the improvements in the accuracy and miniaturization of position sensors are enabling the development of more sophisticated applications in vehicles. The use of position sensors in vehicles is currently in the mass-production stage, with the likes of Continental and Robert Bosch introducing them into their platforms. Among the main applications of position sensors in vehicles are the measurement of the steering angle, throttle position and wheel speed. These are critical for features such as stability control and the implementation of ADAS. These are being accelerated by macro-economic factors such as the push towards greater sustainability and the lowering of CO2 emissions. This is, in turn, boosting the demand for EVs, which in turn is boosting the demand for position sensors. MEMS and the Internet of Things are also reshaping the evolution of the position sensors market, as they enhance the performance and integration of position sensors in vehicles.

Future Outlook

The market for vehicle position sensors is set to grow at a steady CAGR of 6.0% from 2024 to 2032, with the value of the market rising from $7.42 billion to $11.85 billion. This growth is largely driven by the increasing adoption of ADAS and the transition to electric vehicles. The demand for precise position sensors is set to rise as manufacturers seek to improve the safety and performance of their vehicles. The sensors are likely to be used in both conventional and electric vehicles in greater numbers. By 2032, it is expected that the position sensors will be installed in more than 80% of new vehicles, compared with 60.0% in 2024, thus confirming their critical role in the modern automobile. Further key developments in technology, such as the development of MEMS (Micro-Electro-Mechanical System) sensors and improvements in the fusion of different sensors, are expected to help to drive the market forward. These developments not only increase the accuracy and reliability of the position sensors, but also help to improve the efficiency of the vehicle’s systems. In addition, supportive government policies, such as those promoting the electrification of vehicles and the raising of safety standards, will also help to create a favorable environment for the market. And the advent of driverless cars and the integration of IoT (Industrial Internet of Things) into automobiles will also help to shape the market, making it an important area for investment and development in the years to come.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 6.5 Billion |

| Market Size Value In 2023 | USD 6.95 Billion |

| Growth Rate | 6.90% (2023-2032) |

Automotive Position Sensors Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.