Automotive Pumps Market Summary

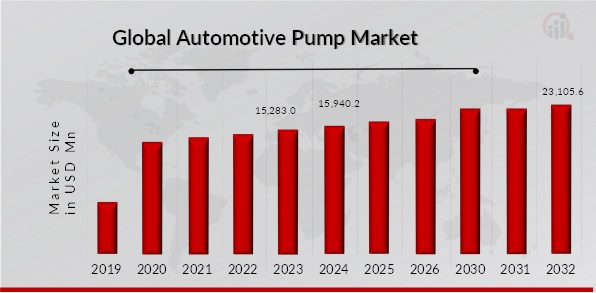

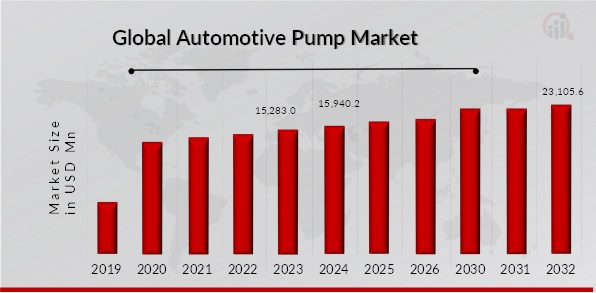

As per Market Research Future Analysis, the Global Automotive Pump Market was valued at USD 15,283.0 million in 2023 and is projected to grow to USD 23,105.6 million by 2032, reflecting a CAGR of 4.7% from 2024 to 2032. The increasing demand for fuel-efficient vehicles and stringent emission norms are driving market growth. However, the shift towards electric vehicles poses a threat to traditional automotive pumps. Manufacturers are focusing on mergers, acquisitions, and technological innovations to enhance efficiency and meet evolving market demands.

Key Market Trends & Highlights

The automotive pump market is witnessing significant trends driven by sustainability and technological advancements.

- Market Size in 2023: USD 15,283.0 million.

- Projected Market Size by 2032: USD 23,105.6 million.

- CAGR from 2024 to 2032: 4.7%.

- Largest Market Share in 2023: Passenger Cars segment.

Market Size & Forecast

2023 Market Size: USD 15,283.0 million

2024 Market Size: USD 15,940.2 million

2032 Market Size: USD 23,105.6 million

CAGR (2024-2032): 4.7%

Major Players

Continental AG, Valeo, Bosch, Mahle GmbH, Rheinmetall Automotive

As the use of fuel efficient automobiles increases, the need for automotive fuel pumps is also increasing. Besides, the stringently set emission norms drive innovation and growth in the automotive pump market and the trend of engine downsizing leads to the increased demand for improved automotive pumps. But shift to electric vehicles act as a threat to the automotive pump market and shift to electric power steering also a threat to the hydraulic pumps market for automotive pump market.

Certain measures taken by the manufacturers such as merger and acquisition along with integration of new technologies to enhance efficiency is expected to open up huge opportunities for the market in future.

The increasing demand for more fuel-efficient vehicles is a significant factor driving the automotive pump market growth in coming years. Due to the increased fuel efficiency resulting from the continually developing engine technology as well as the transmission passing on and hybrid techniques, the pump’s automotive technology is of greater importance in the deserving function of the motor. Fuel-efficient vehicles require sophisticated fuel delivery, cooling, and lubrication systems to run efficiently, and all these use automotive pumps.

FIGURE 1: AUTOMOTIVE PUMP MARKET SIZE 2019-2032 (USD MILLION)

Source: Secondary Research, Primary Research,

Market Research Future Database, and Analyst Review

Automotive Pump Market Opportunities

Growing focus on vehicle sustainability fuels demand for advanced automotive pumps

The demand for enhancing the sustainability of vehicles for both passengers and goods is becoming a huge business opportunity for the automotive pump market in the future years. This has led to increased concern in the reduction of carbon emissions and improvement of fuel efficiency in transport which has led to the adoption of cleaner technology and fuels. This shift towards more environmentally friendly solutions is increasing the need for high performance automotive pumps that can will improve vehicle performance while reducing on fuel consumption.

However, there is limited evidence showing how ‘sustainability’ applies to passenger and freight vehicles with particular focus on fuel efficiency. Emission standards and fuel economy standards continue to pose stricter requirements for the automakers to meet meaning that new technologies such as turbocharging, hybrid powertrains as well as EVs need special pumps to operate. For instance, turbo charged engines need high performance fuel and oil pumps so as to deal with high pressure and high temperature which are useful for getting better combustion and therefore, less pollution emissions.

Some of the functions served by electric pumps include battery cooling in hybrid and EV systems and circulation of fluids within electric drivetrain as a determiner of trims and durability.

Furthermore, the EU policy focus on the electrification and the use of alternative fuels such as hydrogen in freight transport that call for special types of pumps. For instance, while hydrogen assembly in vehicles requires fuel pumps that include characteristics of hydrogen; electrical trucks require competent cooling assemblages to manage the temperature of the battery while on long-distances.

Automotive Pump Market Segment Insights

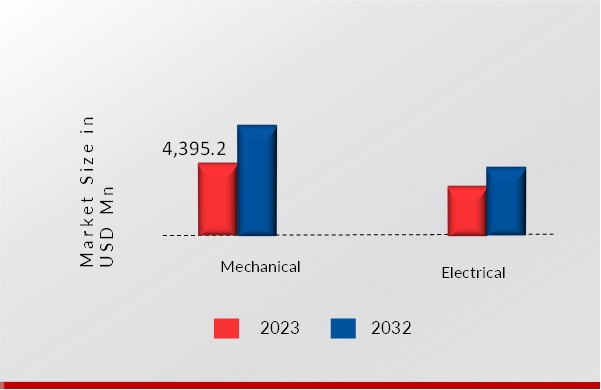

Automotive Pump Technology Insights

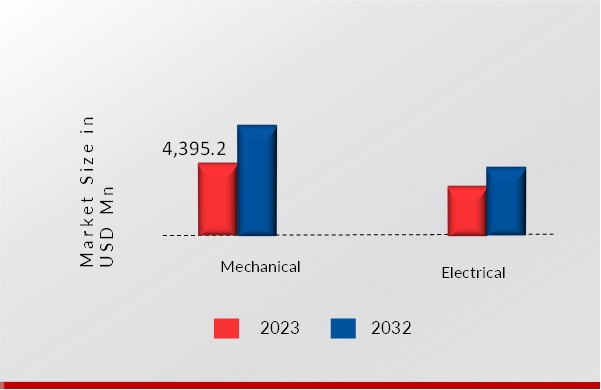

Based on technology, the Automotive Pump Market has been segmented into Mechanical, and Electrical. Mechanical account for the largest market share. Mechanical pumps work for various purposes, such as delivering fuel, circulating coolant, and lubricating oil. The strong points that mechanical pumps boast of are their reliability and simplicity; hence, they find a broad application base in many vehicles. They can work effectively under high pressures and temperatures for optimum performance under strenuous conditions. They are, however, relatively less efficient at lower engine speeds when compared to electrically driven pumps.

The market for mechanical automotive pumps sees regular demand in view of continued application for internal combustion engines, even though electrification in the automobile industry remains a factor affecting its course. Besides, it is also a critical part of modern automotive engineering because of continued innovations in design and materials that are significantly contributing to improving performances and increasing the lifespan of mechanical pumps.

FIGURE 2: AUTOMOTIVE PUMP MARKET, BY TECHNOLOGY, 2023 VS 2032 (USD MILLION)

Source: Secondary Research, Primary Research,

Market Research Future Database, and Analyst Review

Automotive Pump Product Insights

Based on Product, the Automotive Pump Market has been segmented into Fuel Pump, Oil Pump, Steering Pump,

Water Pump

, Fuel Injection Pump, and Other. The Oil Pump segment is further classified into Electric Oil Pump, and Others. In 2023, fuel pump segment accounted for the largest market share. The fuel pump is one of the most critical components in the automotive industry, as it pumps the fuel from the tank to the engine. Due to increasing vehicle production and new developments regarding fuel pump technology, as well as the latest generation of electric and mechanical pumps, the global automotive fuel pump market is likely to experience remarkable growth.

Market estimates predict that the demand will have a progressive increase due to the shift toward fuel systems that are more efficient, coupled with increasing electrification of vehicles. Improvements in the design and functionality of the fuel pump are forecasted innovations from 2018 to 2032 for better performance within the market.

Automotive Pump Vehicle Type Insights

Based on vehicle type, the Automotive Pump Market has been segmented into Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle, and Others. Passenger Cars account for the largest market share in 2023. The growth in the passenger car segment is driven by increased consumer demand for personal vehicles, combined with ongoing improvement in automotive technologies. In passenger cars, pumps are applied in a number of ways, including the supply of fuel, cooling systems, and distribution of oil.

The developing trend of using electric vehicles will have an impact on the market since these cars require specialized pumps to suit the various cooling needs and fluid management involved. Also, strict regulations about fuel efficiency and emissions encourage manufacturers to develop and integrate an effective pumping solution. Growing urbanization and increasing disposable incomes will raise passenger car demand and drive the growth of the automotive pump market further in the segment

Automotive Pump Application Insights

Based on technology, the Automotive Pump Market has been segmented into Body Interior, Engine HVAC, and Powertrain. In the year 2023, powertrain account for the largest market share. The powertrain segment supports the operation and efficiency of the engine with fuel-injection pumps, oil pumps, and water pumps. These water, oil, and fuel-injection pumps are very vital in terms of maintaining the performance of an engine at an optimum level by ensuring proper fuel delivery and lubrication. The demand for advanced power train pumps is increasing as the automotive industry is shifting toward greener, more fuel-efficient technologies.

Innovations in high-pressure fuel pumps and variable-speed oil pumps are being made for better performance and to reduce emissions. Again, the increasing adoption of electric and hybrid vehicles needs sophisticated pumping solutions to cater to the peculiar needs of such powertrains. This would lead to solid growth in the powertrain segment, driven by advances in technology, growing regulatory pressures for emission reductions, and finally, the ongoing transition towards electrification in the automotive sector.

Automotive Pump Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, Middle East and Africa and South and Central America. North America consists of the U.S, Canada, and Mexico.

The market for automotive pumps is fast-growing in the Asia-Pacific region, owing to the booming automotive industry, especially in countries like China, Japan, and India. The increasing middle class and high disposable incomes in these countries are sustaining the demand for vehicles, consequently driving up production volumes higher to meet the rising demand and thus giving rise to the need for efficient automotive pumps. Besides, there is more penetration of electric and hybrid vehicles in the region. This also encourages manufacturers to invest in newer pumping technologies offering better performance and lower emissions.

Several crucial automotive manufacturing and supply companies keep the environment in the Asia-Pacific region quite competitive, forcing innovation and cost-effective solutions. Additionally, government initiatives on electric vehicles and stringent emission regulations also favor the demand for specialty pumps. The growth of urbanization and infrastructure development is likely to support the expanding Asia-Pacific automotive pump market, besides technological advancements and a growing emphasis on sustainability in the automotive sector.

FIGURE 3: AUTOMOTIVE PUMP MARKET SIZE BY REGION 2023 VS 2032

Source: Secondary Research, Primary Research,

Market Research Future Database, and Analyst Review

Further, the major countries studied in the market report are the U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, and India.

Automotive Pump Key Market Players & Competitive Insights

Companies in the automotive pump market, such as Continental AG, Valeo, Bosch, Mahle GmbH, and Rheinmetall Automotive, are adopting various growth strategies to strengthen their market share. These players are focusing on long-term collaborations with OEMs and establishing strong trade relations for long-term, ensuring a steady demand for their products in both the ICE and electric vehicle market. Additionally, they are actively involved in innovations and strategic partnerships to enhance their product offerings and align with the industry's shift toward sustainable and energy-efficient mobility.

For instance, Denso recently transferred its fuel pump module business and equity stake in KYOSAN DENSO to Aisan. This move is part of a strategy to boost their powertrain competitiveness and contribute to the development of sustainable mobility solutions. Aisan's acquisition of these assets is expected to fortify its position in the powertrain market, supporting the growing demand for efficient fuel systems.

Key Companies in the Automotive Pump Market include.

Automotive Pump Industry Developments

- In June 2024, Rheinmetall has secured a major multi-million-euro order for electric coolant pumps from an international car manufacturer, with production ongoing until 2030 and a service contract extending to 2045. These pumps, used in hybrid vehicles, enhance emission control, reduce fuel consumption, and support Rheinmetall’s e-mobility commitment. The Power Systems division is integral to this, focusing on advanced automotive and energy solutions.

- In April 2023, TRICO, a subsidiary of First Brands Group, won GM’s 2022 Overdrive award, recognizing its excellence in sustainability, innovation, cost, and safety. The award celebrates TRICO's century-long partnership with GM.

Automotive Pump Market Segmentation

Automotive Pump Technology Outlook

Automotive Pump Product Outlook

Automotive Pump Vehicle Type Outlook

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Others

Automotive Pump Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

|

Attribute/Metric

|

Details

|

|

Market Size 2023

|

USD 15,283.0 million

|

|

Market Size 2024

|

USD 15,940.2 million

|

|

Market Size 2032

|

USD 23,105.6 million

|

|

Compound Annual Growth Rate (CAGR)

|

4.7 % (2024-2032)

|

|

Base Year

|

2023

|

|

Market Forecast Period

|

2024-2032

|

|

Historical Data

|

2019- 2022

|

|

Market Forecast Units

|

Value (USD Million)

|

|

Report Coverage

|

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

Technology, Product, Vehicle Type, Application

|

|

Geographies Covered

|

Europe, North America, Asia-Pacific, Middle East & Africa, and South and Central America

|

|

Countries Covered

|

US, Canada, Mexico, Germany, U.K., Italy, France, Japan, China, India, South Korea, Saudi Arabia, UAE, South Africa Brazil, Argentina, and Others.

|

|

Key Companies Profiled

|

· Continental AG

· Valeo

· Robert Bosch

· BorgWarner

· Aisan

· Mahle

· Aisin Corporation

· Rheinmetall AG

· Trico

· Milkuni Corporation

|

|

Key Market Opportunities

|

· Rising ethanol fuel adoption drives demand for specialized automotive pumps

· Growing focus on vehicle sustainability fuels demand for advanced automotive pumps

|

|

Key Market Dynamics

|

· Growing demand for Fuel-Efficient vehicles fuels

· Stringent emission regulations drive innovation and growth in automotive pump market

· Engine downsizing trends boost demand for advanced automotive pumps

|

Automotive Pumps Market Highlights:

Frequently Asked Questions (FAQ):

The Automotive Pump Market size is expected to be valued at USD 15,283.0 Million in 2023.

The global market is projected to grow at a CAGR of 4.7% during the forecast period, 2024-2032.

Asia-Pacific had the largest share of the global market.

The key players in the market are Continental AG, Valeo, Robert Bosch, BorgWarner, Aisan, Mahle, Aisin Corporation, Rheinmetall AG, Trico, Milkuni Corporation and Others.

The Mechanical dominated the market in 2023.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review