Market Trends

Key Emerging Trends in the Automotive Remote diagnostics Market

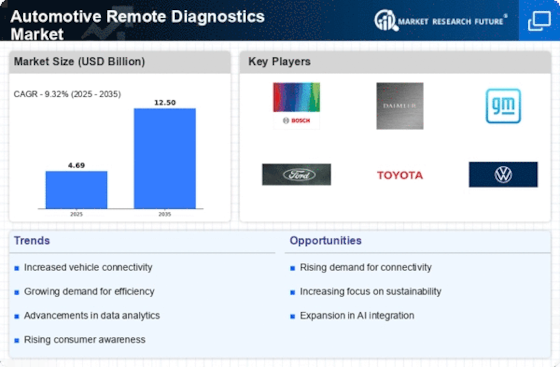

Cars are getting smarter, and it's all about using digital technology. The latest trend in the car world is all about advanced vehicles, like electric ones, self-driving cars, and connected vehicles. These advanced vehicles are changing how cars work, moving from regular engines to things like batteries, fuel cells, and electronic systems. This shift is creating new challenges and opportunities, making cars more high-tech and in demand. For example, one exciting development is connected vehicles. These cars are making it easier for people to share rides, like car-sharing and bike-sharing. As cars become more advanced, there's a growing need for digital systems and software. Electric cars, especially, are driving the use of electronic systems, creating lots of opportunities to make cars better and more affordable. This shift towards advanced vehicles is not just a trend; it's a wave of change in the automotive industry. Today's cars are like computers on wheels, having more than 10 million lines of important software code. This is because there's a growing need to share information about how cars are performing, both for drivers and the companies that make the cars. To make sure everything runs smoothly, companies are using Internet of Things (IoT) devices. These devices help cars operate better by connecting different systems in the car through wireless connections. Companies like Robert Bosch, Continental AG, Delphi Technologies, and Magneti Marelli are installing remote diagnostic systems to keep an eye on these devices after the cars are sold. Remote diagnostics and other connected technologies are making life easier for everyone involved—the car makers, the suppliers, and the people who drive the cars. These technologies help track any issues with the IoT devices and let everyone know when maintenance is needed. This means fewer surprises and less risk of sudden problems. However, as cars become more advanced, it's becoming a bit tricky for some people to understand how everything works. This confusion is creating a higher demand for remote diagnostics in cars all around the world. The demand for automotive remote diagnostics is growing more in developed countries because they have better services for fixing cars after they're sold. As the use of smart devices in cars keeps growing, we expect the impact on the global automotive diagnostics market to go from moderate to high in the coming years. It's an exciting time for cars, with technology making them smarter and more connected than ever before!

Leave a Comment