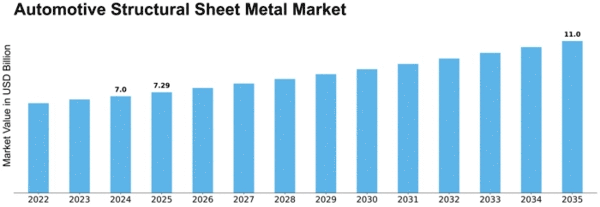

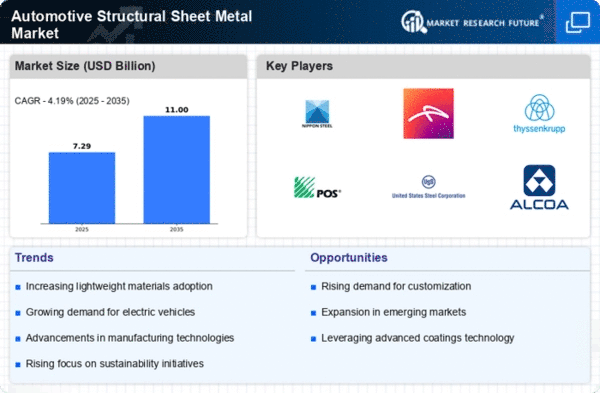

Automotive Structural Sheet Metal Size

Automotive Structural Sheet Metal Market Growth Projections and Opportunities

Automotive Structural Sheet Metal market dynamics are driven by the automotive industry's search of lightweight, durable, and cost-effective vehicle building components. Structural sheet metal shapes car frames and bodies, affecting safety, fuel efficiency, and performance. Market dynamics depend on design trends, regulatory standards, technology advances, and the car industry's dedication to structural integrity.

The automotive structural sheet metal market is driven by the industry's focus on lightweighting. Automakers reduce vehicle weight to increase fuel efficiency, pollution, and performance. Due to its strength-to-weight ratio, structural sheet metal is essential for these goals. The market offers innovative alloys and high-strength steel sheets that preserve structural integrity while reducing weight, supporting lightweight vehicle designs.

Material science and industrial innovations affect the Automotive Structural Sheet Metal industry. Automakers may increase strength and durability without increasing weight with improved high-strength steel, alloys of aluminum, and composite materials. These materials improve crash performance, corrosion resistance, and formability, meeting industry demands for safer, fuel-efficient cars. To meet car manufacturers' changing demands, the market innovates and introduces new structural sheet metal materials.

Automotive Structural Sheet Metal market dynamics are also affected by safety and regulatory norms. Vehicle design requires sturdy and lightweight materials due to stricter safety, crash test, and emissions norms. To protect passengers and promote automobile industry sustainability and compliance, structural sheet metal must meet or exceed certain criteria. The market advances by offering materials that fulfill strict safety and regulatory standards, encouraging novel structural solutions.

The global trend toward electric and hybrid electric vehicles (EVs) also shapes the Automotive Structural Sheet Metal industry. EVs' battery location and crash safety regulations affect structural component design and material choices. The market offers structural sheet metal solutions for electric and hybrid vehicle platforms, helping electrify the automotive sector.

Automotive Structural Sheet Metal market dynamics are driven by competition. Industry leaders spend in R&D to create new materials, manufacturing techniques, and structural designs. The market offers improved high-strength steels, aluminum alloys, and composite materials. Customization possibilities, comprehensive service offerings, and strategic automotive collaborations also shape the competitive environment.

Leave a Comment