Automotive Terminals Size

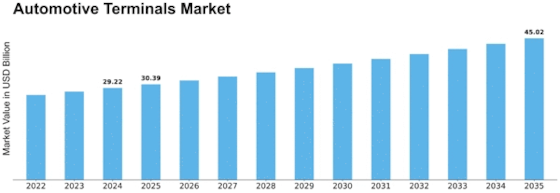

Automotive Terminals Market Growth Projections and Opportunities

Electronic or physical automotive terminals link load or charger to cell or battery. Automotive connectors vary in form, size, and style. Terminal types and sizes depend on automotive usage. A clip or plug is on the wire's end. Links between terminals might be temporary or permanent. Many factors impact auto terminals market growth, trends, and competitors. Car terminals make it simple for lines or cables to join electrically, ensuring that numerous electrical systems operate effectively. Technological advances drive automobile connector market developments. Terminal design, materials, and manufacturing have improved, making connectors more dependable, durable, and effective. Modern automotive connectors employ rust-resistant metals, superior closure mechanisms, and precision engineering to provide safe and long-lasting electrical connections. The vehicle connectors market varies according to industry demand. These components are popular with automakers, including those that create passenger cars, industrial trucks, electric automobiles, and parts. High-quality leads that ensure electrical linkages operate consistently are in demand as automobile technology advances and adds more electrical elements and sophisticated systems. Compliance and regulatory criteria shape the car connections industry. The Society of Automotive Engineers (SAE) and government agencies define safety, efficiency, and quality standards that impact terminal design, production, and sales. Following these tight regulations ensures that vehicle connections fulfill safety standards and may be utilized. Economic factors including raw material prices, the worldwide market, and auto industry improvements impact the vehicle terminals market. Price variations for terminal materials like copper, aluminum, and alloys may impact production costs, pricing, and market competition. Terminal demand is also impacted by the economy and auto industry expenditure, which inhibits market expansion. The vehicle connectors market also varies according to key companies' competing strategies. Due to competition, manufacturers invest in R&D to improve terminal items' functionality, reliability, and versatility. Acquisitions, strategic technological partnerships, and collaborations are frequent approaches to reach additional consumers, develop new products, and beat the competition. Auto industry developments like electric vehicle (EV) adoption and improved automotive technology effect market circumstances. As the auto industry progresses toward electric cars and more complicated electrical systems, high-quality leads that can tolerate greater voltages and ensure secure connections are needed. Regulatory requirements, economic shifts, new technology, industry demand, and competitive strategies impact the auto port market. As electric cars become more popular, automobile connections must be dependable and efficient. Manufacturers must adapt to these market factors to meet industry demands, promote innovation, and supply dependable automotive electrical connections.

Leave a Comment