Top Industry Leaders in the Automotive Ultrasonic Sensors Market

*Disclaimer: List of key companies in no particular order

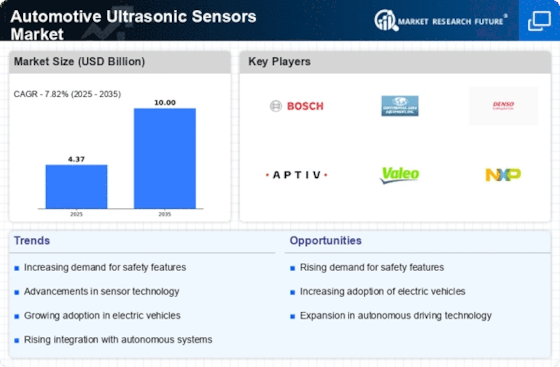

Top listed companies in the Automotive Ultrasonic Sensors industry are:

Texas Instruments Inc, Magna International Inc, Elmos Semiconductor AG, TE Connectivity Ltd, Baumer Holding AG, Honeywell International Inc, TDK Corp, and Autoliv Inc.

Key Player Strategies:

Innovation Frenzy: Leading players like Aptiv, Autoliv, and Continental are aggressively investing in R&D, pushing the boundaries of sensor technology. Expect miniaturization, enhanced range and accuracy, and integration with other ADAS systems.

Strategic Partnerships: Collaboration is key. Partnerships with OEMs, tier-1 suppliers, and tech startups are accelerating development and market penetration. Look for joint ventures and technology licensing deals to reshape the competitive landscape.

Regional Focus: The Asia-Pacific region, led by China and India, is a growth engine. Companies are tailoring their offerings to regional needs, focusing on affordability and cost-effective solutions.

Vertical Diversification: Players are not limiting themselves to cars. Expect to see ultrasonic sensors employed in commercial vehicles, motorcycles, and even off-road vehicles, opening new avenues for growth.

Market Share Analysis:

Technology Leadership: Companies with cutting-edge technology and intellectual property hold an edge. Expect patent wars and fierce competition for technological supremacy.

Production Capacity and Cost Efficiency: Efficient manufacturing, economies of scale, and access to raw materials play a crucial role. Cost-competitive players, especially from Asia, will challenge established players.

Brand Reputation and Customer Relationships: Long-standing partnerships with OEMs and a strong reputation for quality and reliability will hold sway.

Distribution Network and After-Sales Service: Robust global distribution networks and efficient after-sales service will be crucial for market share gains.

New and Emerging Trends:

Multi-Sensor Fusion: Integrating ultrasonic sensors with cameras, radar, and LiDAR is creating a robust perception system for autonomous vehicles. Expect increased focus on sensor fusion algorithms and data processing capabilities.

Advanced Materials and Manufacturing Techniques: New materials like Piezoelectric Micromachined Ultrasonic Transducers (PMUTs) are enabling smaller, more efficient sensors. Additive manufacturing holds potential for customized sensor designs.

Cybersecurity: With increased vehicle connectivity, ensuring sensor data security and preventing cyberattacks is becoming paramount. Expect advancements in data encryption and intrusion detection systems.

Overall Competitive Scenario:

The automotive ultrasonic sensors market is a dynamic and fragmented space. While established players retain significant clout, new entrants and disruptive technologies are constantly challenging the status quo. Innovation, strategic partnerships, and regional focus will be key differentiators. Expect continued consolidation, technological leaps, and an increasingly competitive landscape as the race towards autonomous driving intensifies.

Latest Company Updates:

Texas Instruments Inc:Announced the launch of a new family of ultrasonic sensors with improved range and accuracy for parking assistance and blind-spot detection applications. (Source: TI press release, October 26, 2023)

Magna International Inc: Partnering with a leading automaker to develop ultrasonic sensor-based obstacle detection systems for commercial vehicles. (Source: Magna press release, September 20, 2023)

Elmos Semiconductor AG: Introduced a new low-power ultrasonic sensor chipset optimized for battery-powered electric vehicles. (Source: Elmos press release, November 8, 2023)

TE Connectivity Ltd: Acquired a manufacturer of miniaturized ultrasonic sensors for advanced ADAS applications. (Source: TE Connectivity press release, August 1, 2023)