- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

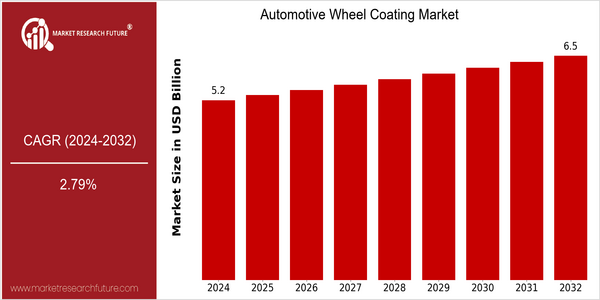

Automotive Wheel Coating Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 5.22 Billion |

| 2032 | USD 6.505 Billion |

| CAGR (2024-2032) | 2.79 % |

Note – Market size depicts the revenue generated over the financial year

The market for wheel-repair paints is expected to grow steadily, with a current value of $ 5.22 billion in 2024, and an expected value of $ 6.505 billion in 2032. This growth is reflected in a CAGR of 2.79% over the forecast period. The growth of the market is attributed to several factors, including the growing demand for lightweight and durable materials in the automotive industry and the growing demand for aesthetic enhancements in the design of vehicles. Also, the development of new coatings, such as the development of eco-friendly and high-performance coatings, is expected to drive market growth. The leading companies in the industry, such as PPG Industries, Axalta Coating System and BASF, are actively involved in strategic activities to take advantage of these opportunities. For example, the establishment of new strategic alliances to develop new products and the increase in R & D expenditure are becoming increasingly common. Moreover, the launch of new products focusing on the concept of sustainability and performance will play an important role in reshaping the market and driving its growth in the coming years.

Regional Deep Dive

The wheel-lacquer market is a dynamic growth market driven by the increasing production of cars and the growing demand for the aesthetics of cars. Each region has its own characteristics, which are mainly influenced by the development of car production, the preference of consumers and the regulatory framework. The development of the wheel lacquer market is mainly driven by the development of advanced coatings and new products, and it will be greatly developed in regions with a strong car industry.

North America

- The North American market is a hotbed of demand for eco-friendly coatings, driven by the regulatory pressure of organizations such as the EPA, which imposes the implementation of sustainable practices in the automobile industry.

- The market is expected to grow at a CAGR of 4.6% to 2021, with PPG Industries and Axalta Coating System among the biggest players investing in R&D to develop new coatings that will be both durable and aesthetically pleasing, responding to the growing demand for personalization and performance.

- In the same way, the growth of electric vehicles in the region is influencing the coating industry. The manufacturers are looking for lightweight and high-performance materials to improve the energy efficiency and range of these vehicles.

Europe

- REACH regulations, which are the subject of a special directive, are driving the development of low-VOC wheel coatings.

- The companies BASF and AkzoNobel are leading the way in developing advanced coating solutions that not only meet the regulatory requirements but also respond to the growing demand for aesthetic individualization from European consumers.

- The European car market is increasingly orientated towards sustainability, and the European Green Vehicles Initiative is promoting the use of sustainable materials and processes in the production of cars.

Asia-Pacific

- The Asia-Pacific region is experiencing strong growth in the wheel-coating market, as the region is home to the world’s largest vehicle markets, China and India.

- And in the meantime, the paint industry has been developing new coatings, such as the nanoscopic paint developed by Nippon Paint and Kansai Paint, which not only enhance the performance of wheels, but also prolong their service life.

- Government initiatives promoting the use of electric vehicles and reducing emissions are pushing manufacturers to use advanced coatings that are compatible with their own sustainable development goals.

MEA

- The Middle East and Africa (MEA) region is witnessing a growing demand for wheel coatings. The rising vehicle ownership and a growing aftermarket are driving the market.

- A new local industry has begun to develop, and companies such as Al Jazira Paints have begun to produce paints that are suited to the harsh climate of the region.

- A new law regulating vehicle safety and reducing emissions is causing manufacturers to adopt better paints, which will boost growth.

Latin America

- Latin America is a region where the resurgence of the automobile industry is reflected in the development of the wheel coatings market. The countries of Brazil and Mexico are among the most important for local production.

- The demand for cheap and durable coatings is increasing, and Sherwin-Williams has been expanding its production of coatings to meet the needs of local manufacturers and consumers.

- Culture influences the market, and people are looking for wheels with a special, decorative finish.

Did You Know?

“The car wheel paint market is also a major market for nanotechnology, which can enhance the scratch resistance and hardness of the coating, and thus prolong the beauty of the car.” — Market Research Future

Segmental Market Size

The Wheel Coatings Market is currently experiencing steady growth, owing to the growing demand for aesthetics and longevity in the vehicle components. This is primarily due to the increasing focus on vehicle personalization and the need for protective coatings that can resist abrasion and corrosion. Also, regulations to promote the use of eco-friendly materials are influencing manufacturers to adopt advanced coatings that align with the company's green goals.

At the present time, the market is in its final stage of development, with companies like P.G.I. and Axalta Coating Systems leading the way in the development of new products. The main applications are in the field of refinishing, and the main products are powder coatings and liquid coatings. The trends towards electric vehicles and the implementation of the so-called circular economy are promoting growth, as manufacturers are aiming to reduce their impact on the environment. Nano-coatings and polymer formulations are shaping the evolution of the market, with the aim of improving performance and lifespan.

Future Outlook

The market for the coating of wheels for motor cars will grow steadily from 2024 to 2032, increasing from $ 5.2 billion to $ 6.5 billion, at a CAGR of 2.79%. This is due to the growing demand for the visual appearance of the vehicle and its protection against the environment, which has led to the development of new coatings. Among these are those based on ceramic and eco-friendly materials.

It is hoped that the high-performance coatings which will offer increased resistance to rust, to the action of the sun, and to chemical attack, will play a leading role in this market. The regulation of the industry, with a view to a more sustainable development, will also encourage the use of these more environment-friendly products. And the development of new trends, such as the incorporation of smart coatings that can change color or which have self-cleaning properties, will also be of great importance in this market, which is aimed at a growing number of consumers with a very high level of technology. The evolution of the automobile wheel coatings market is expected to increase the penetration of these products, in line with the regulatory framework and the consumers’ preferences.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.9 Billion |

| Market Size Value In 2023 | USD 5.0568 Billion |

| Growth Rate | 3.20% (2023-2032) |

Automotive Wheel Coating Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.