Automotive Wheel Coating Market Summary

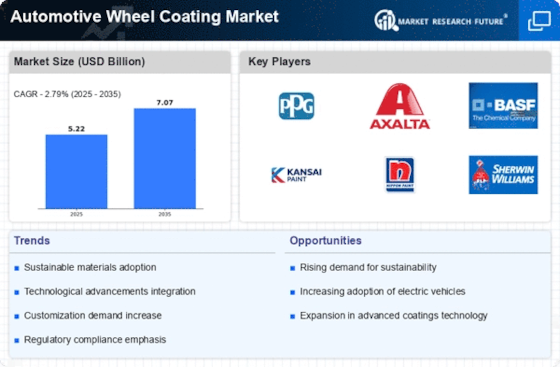

As per Market Research Future analysis, the Automotive Wheel Coating Market Size was estimated at 5.22 USD Billion in 2024. The Automotive Wheel Coating industry is projected to grow from 5.366 USD Billion in 2025 to 7.067 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 2.79% during the forecast period 2025 - 2035

Key Market Trends & Highlights

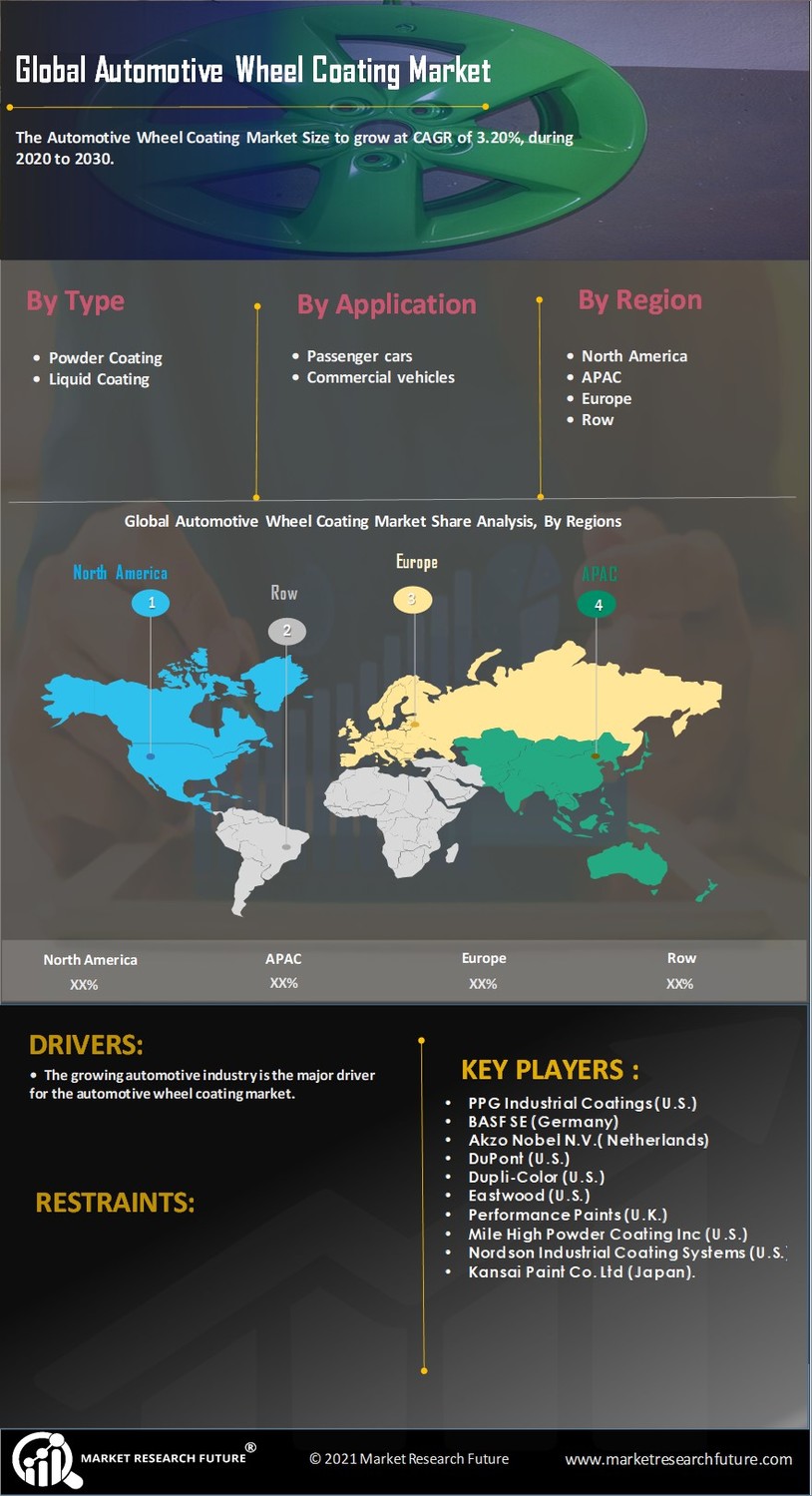

The Automotive Wheel Coating Market is poised for growth driven by technological advancements and increasing customization demands.

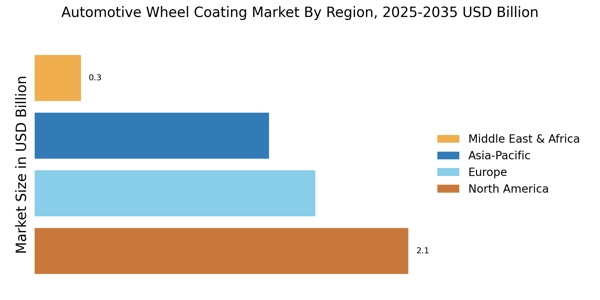

- Technological advancements in coatings are enhancing performance and durability, particularly in North America.

- Sustainability initiatives are gaining traction, influencing coating materials and processes across the Asia-Pacific region.

- Customization and aesthetic appeal are becoming increasingly important, especially in the passenger car segment.

- Market drivers include rising demand for lightweight materials and regulatory compliance, which are shaping the future of both powder and liquid coatings.

Market Size & Forecast

| 2024 Market Size | 5.22 (USD Billion) |

| 2035 Market Size | 7.067 (USD Billion) |

| CAGR (2025 - 2035) | 2.79% |

Major Players

PPG Industries (US), Axalta Coating Systems (US), BASF SE (DE), Kansai Paint Co., Ltd. (JP), Nippon Paint Holdings Co., Ltd. (JP), Sherwin-Williams Company (US), Tikkurila Oyj (FI), Hempel A/S (DK)