Research Methodology on Autonomous Trucks Market

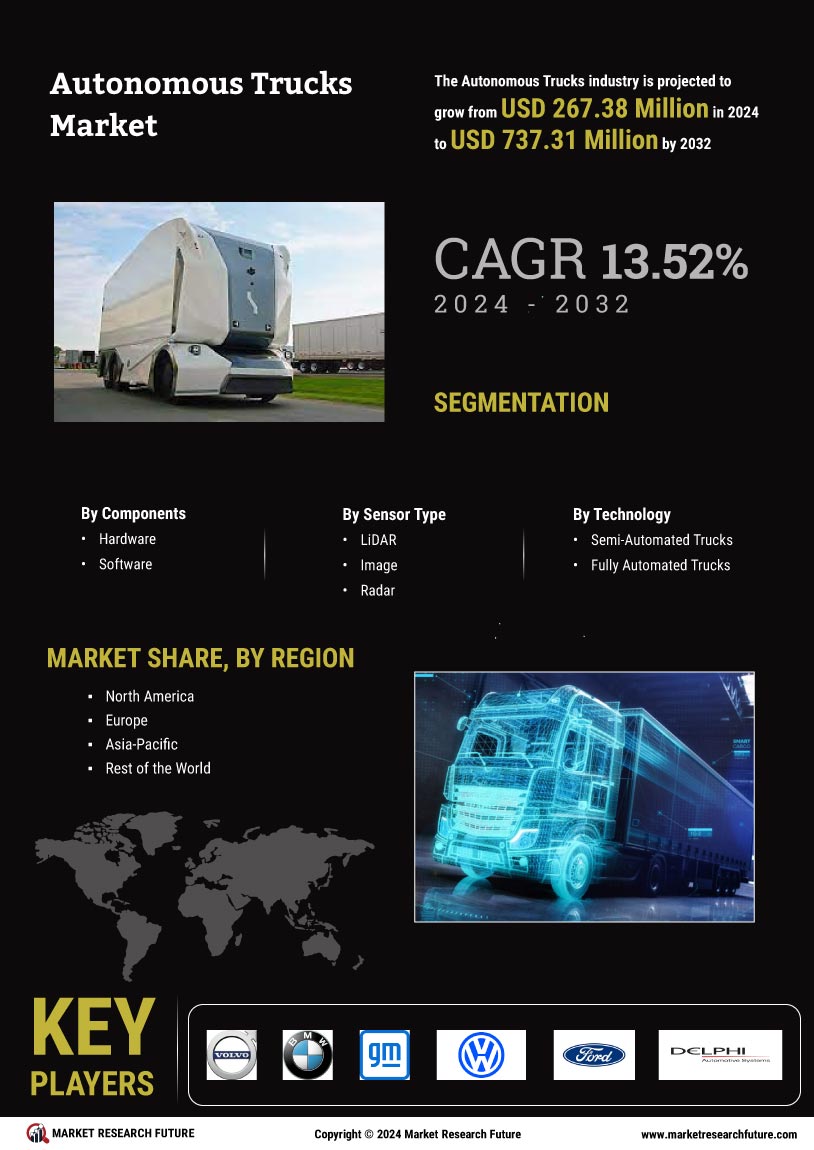

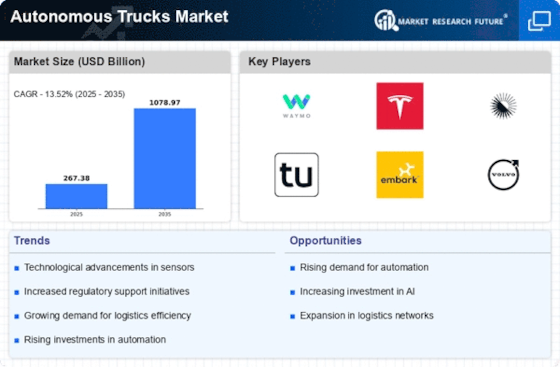

With the need to increase efficiency, attain better optimization in operations, and reduce stress on truck drivers, the Autonomous Trucks Market has gained wide traction. Autonomous, or self-driving, trucks require no direct human interactions and are powered by Artificial Intelligence (AI), sensors, and other advanced technologies. Autonomous Trucks are making a major shift in the transportation industry and are expected to accelerate the digital transformation of the logistics system.

Autonomous Trucks are expected to have a radical and transformative impact on the industry that may not just result in significant fuel savings and impend operational velocity but will also have significant impacts on the environment and truck drivers' job security. As a result, the Autonomous Trucks Market is expected to witness significant growth from 2025 to 2035.

The main objective of this research is to understand the current market scenario, drivers, restraints, segments, trends and opportunities and projects of the Autonomous Trucks Market.

Research Methodology

A detailed research methodology is adopted for researching the Autonomous Trucks Market, which includes primary research, secondary research, and company visits. The research process has been conducted in three phases - Fact Finding, Research Validation, and Market Estimation.

Primary Research

Primary research includes in-depth interviews with key opinion leaders in the Autonomous Trucks industry. We undertake interviews with experts and consumers to gather data about the market. We also undertake surveys with industrial stakeholders to gain insights into the market.

The primary data collected through interviews, surveys, and consumer observation is validated through secondary research. Secondary research includes industry publications, magazines, market reports, and white papers. Non-public and public sources such as industry magazines, trade journals, organizations, and market research reports have also been used. The secondary research has also been conducted through web-based surveys.

To supplement and validate the data received from both primary and secondary sources, a team of industry experts, domain experts, and analysts' views were incorporated into the research process. Their views and insights have been incorporated diligently into the research report.

Market Estimation

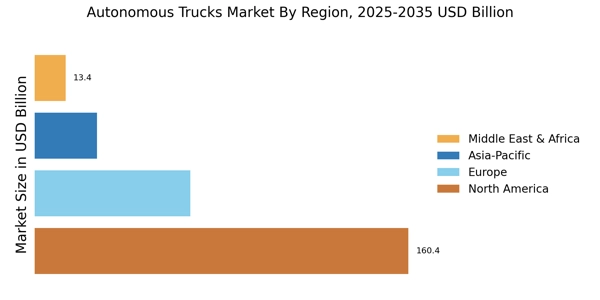

Market estimation was done with the help of a bottom-up approach and a top-down approach. The data was collected from reliable publicly available sources and also through primary sources. The market figures have been estimated by analyzing the market shares, by region and by different segments. The market figures have been validated through experts' views and have been verified through Triangulation Methodology.

Data Analysis

The data collected from the primary and secondary sources is analyzed and stratified based on geographic location, product type, technology advancements, pricing level, and other market dynamics. All the analysis and projections have been made by taking into account regional markets, key trends, and customer-based analysis.

Finally, a comprehensive market report is prepared based on the analyzed data. The report provides a detailed market outlook, along with insights into the market dynamics such as drivers, restraints, value chain, competitive landscape, and prospects. The market report also provides detailed segmentation and projection of the Autonomous Trucks market. The report further provides strategic recommendations for the industry stakeholders.