Research Methodology on Freight and Logistics Market

1. Introduction

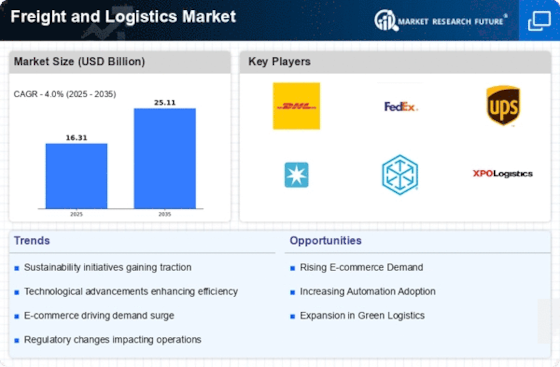

The published research report by Market Research Future aims to provide insight into the prospects of the freight and logistics market, at a global and regional level. The research assessed the freight and logistics industry according to its market size, trends, and regulations, and provided market share and trends, with a forecast ranging from 2023 to 2030. Market Research Future (MRFR) employed a rigorous research methodology to generate reliable, timely, and accurate data for this research report.

2. Research Methodology

This research study deploys a multiple-stage approach to generate data and forecast the growth of the global freight and logistics market, which begins with the exploration of secondary and primary sources to determine the market size. MRFR took the extensive and latest market dynamics into account while conducting primary and secondary research, further supported by an in-depth analysis of Porter’s Five Forces, PESTEL analysis, and cost analysis.

2.1 Primary Research

MRFR’s primary research process includes conducting interviews with key players in the freight and logistics market, such as leading international industry veterans, executives, managers, and other industry participants. Secondary research is reinforced by interviews, along with dedicated desk research, to generate reliable and accurate data and forecast the freight and logistics market.

2.2 Secondary Research

MRFR employs a rigorous secondary research process to garner information from reliable trade and business magazines, professional journals, and other authoritative sources. Furthermore, extensive web studying is undertaken to get access to up-to-date information, as well as published reports, annual reports, and records, along with relevant documents for data triangulation purposes. Additionally, MRFR scrutinized the freight and logistics market through numerous country-level databases to capture essential insights.

3. Market Segmentation

MRFR segments the freight and logistics market into four dimensions, including transportation mode, type, services, and region.

3.1 Transportation Mode

The transportation mode segment is broken down into air, road, rail, and marine.

3.2 Type

The type segment is further categorized by service providers and freight forwarders.

3.3 Services

The services segment is fragmented into logistics, global supply chain management, and others.

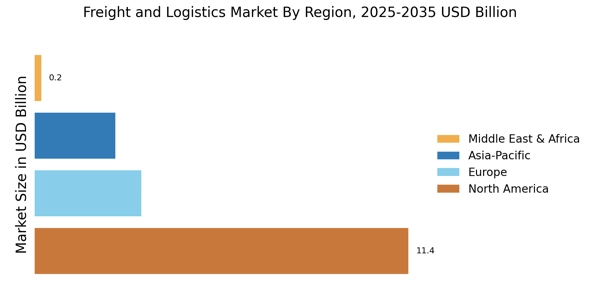

3.4 Region

MRFR splits the market into five regional segments, including North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

4. Assumptions

MRFR made certain assumptions while conducting research for this report. They are listed below:

- The freight and logistics market is expected to grow in line with global economic growth.

- The freight and logistics market issues are addressed within the foreseeable future.

- The cost structure of the freight and logistics market is likely to remain unchanged.

- Political and economic stability of various regions will not have much impact on the freight and logistics market.

5. Data Collection and Validation

MRFR applied a combination of quantitative and qualitative estimates, along with primary and secondary research, to accumulate data for this study. Additionally, validation of derived market data is also conducted to ensure reliability.

In the feedback stage, a 40-point cross-sectional validation is performed to validate market numbers, associated assumptions, and other estimates employed to acquire the market size and forecast. Cost analysis, key company analysis, market opinion, current trends and industry growth models are also taken into account to manifest the estimated numbers.

6. Report Description

The report contains a detailed overview of the freight and logistics market, analyzed for 2023-2030, to provide correct market information. Furthermore, the market size and expected growth rate, with both historic and current market dynamics and value chain analysis, are thoroughly examined to provide a more accurate market forecast. The overview of the market includes an analysis of the market share and trends, along with a country-wise evaluation of the market, to identify the regions and sub-regions exhibiting a prominent market presence.

7. Expert Opinion

Experts have expressed their opinion regarding the freight and logistics market, their overall impressions, and future opportunities. They have also provided valuable advice and directives concerning major industry decisions. This section of the report further validates the market segmentation and market size, along with the forecast figures.