Market Share

Aviation MRO Software Market Share Analysis

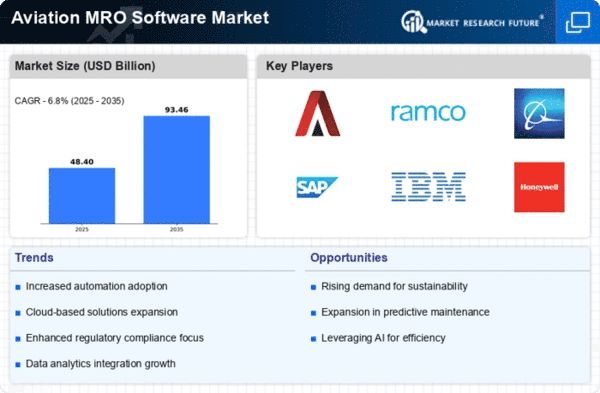

The MRO software is an important tool in aviation, helping to organize aircraft maintenance operations effectively. In this competitive environment, organizations utilise several market share positioning strategies in order to have a positive presence and achieve an advantage over competition. A key strategy in the aviation MRO software market is product differentiation. Companies aim at differentiating their software solutions by developing a range of highly sophisticated features, intuitive interfaces and strong functionalities. Differentiation is essential when it comes to attracting airlines, MRO service providers and aircraft operators looking for comprehensive software solutions with unique predictive maintenance capabilities, inventory optimization tools or seamless integration chances over other aviation systems. Another key strategy among companies in the aviation MRO software market is cost leadership. Since there are strict financial limitations that can be found in the aviation industry, companies stay focused on optimizing their software development processes and lowering implementation costs while offering scalable solutions at the same time. With this cost-effective approach, it not only appeals to budget conscious customers but also a wider audience such as smaller airlines and MRO facilities with limited resources. The dynamics of market share development in the aviation MRO software industry greatly rely on strategic partnerships and collaborations. Companies frequently establish partnerships with aircraft manufacturers, technology suppliers and industry associations to keep up-to-date on innovations in technologies and emerging standards. These partnerships make MRO software solutions more credible and help the market to spread out into aviation maintenance ecosystem with high level of integration. Companies adopt the market segmentation approach to target niche needs in the aviation MRO software industry. Since different aviation sectors have distinctive needs, companies design software solutions for certain segments of the market. As a result of offering specialized features for various types of aircraft and the maintenance operations, companies can become real industry leaders in certain market niches. A major strategy that companies can employ to increase their market share in the aviation MRO software sector is global expansion.

Leave a Comment