Baby Food Packaging Size

Baby Food Packaging Market Growth Projections and Opportunities

So many factors affect and shape the dynamics and growth trajectory of the baby food packaging market. The increase in world population, especially among infants and toddlers, is one of the main drivers. Consequently, this has led to high demand for appropriate efficient packaging solutions as more families adopt packed baby foods. That’s why food manufacturers in this market have developed packaging innovations that can sustain both nutritional quality as well as parents’ ease while using these products.

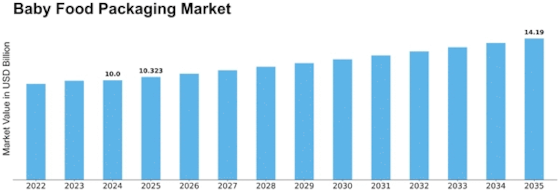

In 2022, the size of the baby food packaging market was estimated at USD 9.3 billion. The industry is expected to grow from USD 9.64 Billion in 2023 to USD 12.89 Billion by 2032, at a CAGR of 3.70%

Consumer awareness and preferences concerning health and safety are critical elements influencing the design of baby food packaging today. Today’s parents are becoming more refined on differences in packing materials used and thus opting for environmental friendly options with higher sustainability indexes. They are emphasizing on packaging that maintains freshness or purity of children’s dishes without discharging dangerous chemicals or contaminants into them .This trend has resulted into an uptake for innovative materials made through environment-friendly processes supporting environmentally conscious consumption.

Life style changes as a result of urbanization rate being very high and dual income family system increasing have influenced it significantly too..Parents also want convenient way to feed their child when they do not have time to cook themselves hence convenience is paramount for baby food packages.Packing bags designed like pouches , single servings or resealable stands have become common because they fit well with people who live fast lives.The busy nature of parenthood has necessitated new ways of ensuring that kids eat well despite everyone’s tight schedule.One such solution came in form of pouch juice which became increasingly popular over time.The young families with double income earners also leads to increased expenditure on baby foods.

The competitive landscape within the world infant nutrition products packaging market is dynamic and it also characterized by incessant innovations and strategic partnerships. Packaging companies are investing in research and development so as to come up with innovative materials and designs that will fit the specific needs of baby foods. Such collaborations between packaging firms and baby food makers has become increasingly common, enabling an effective product development program.

The global economic conditions and fluctuations in prices of raw material also affect the baby food packaging industry. The availability of plastics, glass or metals along with their rates does affect overall production costs for all package manufacturers. Economic factors may alter consumer purchasing power thereby affecting demand for premium or low-cost package solutions.

Leave a Comment