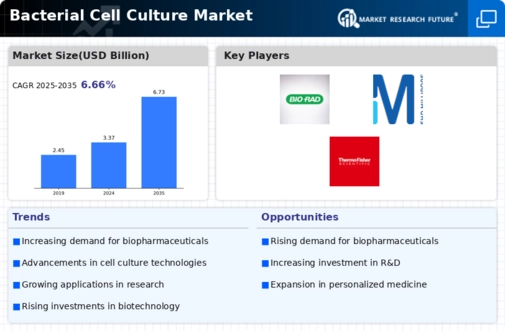

Market Share

Bacterial Cell Culture Market Share Analysis

The microbiology and life sciences field for growing bacterial cells is very important. Companies in the bacterial cell culture sector use a range of methods to get known and increase their market share. This is because there is a growing need for their products and services. It is important for culture media growth to keep coming up with new ideas. Companies spend money on improved bacterial growth medium that has the right nutrients to help cells grow quickly and strongly. Adding cutting-edge culture media to a product makes it more appealing and increases its market share. For market placing, it's important to have links with reputable study groups. Collaborations let people share information, get access to cutting-edge study, and come up with their own ways to grow bacterial cells. This plan might help a company's research image and market share. Different organizations have different specialized cultural systems. Expert researchers are interested in customizing bacterial cell culture products for making vaccines or finding new drugs. This method meets the needs of science, which grows the market share. Because of worries about drug resistance, companies make antibiotic-free growth medium on purpose. Giving alternatives to antibiotics that encourage bacterial growth is in line with global health and legal trends, which is good for business. To grow bacterium cells, automation is very important. Companies create and sell automatic culture tools that make work more efficient, accurate, and easy to repeat. High-throughput labs can get a bigger piece of the market with the help of automated technologies. Quality control and strict adherence to rules are very important. Companies get certificates and have strict quality control measures in place. Following the rules makes customers believe you more, improves your market image, and affects their choices to buy. Organizations actively support the education of lab workers and researchers. Webinars, educational tools, and training events all help to improve the ways that bacterial cells are grown. This approach makes the company look like an expert, which boosts its market impact. Providing customized customer service and professional support in a planned way. Long-term relationships are formed between companies that put customer happiness first by providing quick help, fixing, and product training. company trust and market share go up when customers have good experiences with the company. Setting up marketing networks around the world is important for breaking into new markets. Companies work together with wholesalers to make their bacterial cell culture products available to a wide range of people. The company becomes a world leader in bacterial cell culture by getting more users. Businesses are becoming more interested in being environmentally friendly. Green methods, eco-friendly packing, and less trash in the environment all help the market's image. Customers who care about the environment respond to this approach, which changes what they buy and where they place in the market.

Leave a Comment