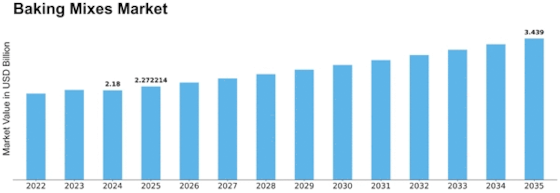

Baking Mixes Size

Baking Mixes Market Growth Projections and Opportunities

A variety of market variables impact the Baking Mixes Market, shaping its trends and future trajectory. One of the main factors of this industry is growing customer desire towards easy and efficient baking solutions. As people's schedules get busier, they search out simple and rapid baking solutions, and these has increased the popularity of baking mixes. These mixes allow consumers to prepare baked goods without needing devote time measuring and acquiring ingredients.

Furthermore, changing consumer dietary habits and health-conscious purchasing decisions are influencing the Baking Mixes Market. The desire for without gluten, environmentally friendly, and healthier options has driven producers to invent and launch baking mixes that meet these particular demands. As a consequence, the industry is shifting towards the manufacture of mixes that meet a variety of nutritional needs, therefore appealing to a larger customer base.

The environment for rivalry additionally serves as an important factor in developing this Baking Mixes Market. The existence of various participants, ranging from major global firms to young startups, promotes competition and creative thinking about products. Market participants are continually looking for ways to differentiate their goods by using distinct tastes, packaging, and marketing methods to obtain a competitive advantage. This rivalry not solely helps customers by giving a diverse range of alternatives, but it also drives market growth as firms spend in R&D to stay competitive.

Another important aspect driving the Baking Mixes Market includes the worldwide shift to e-commerce. The proliferation of internet shopping sites makes baking mixes readily available to customers, allowing them to explore and buy items from the convenience of their own homes. E-commerce gives a chance for both existing and fresh competitors to communicate with a larger audience, helping the industry grow overall. Furthermore, internet platforms provide a forum for user evaluations and comments, which influence purchase decisions and shape market trends.

Governmental rules and policies can have an influence on the baking mixes market. Stringent rules governing food security, categorization, and quality requirements have an impact on industry businesses' manufacturing operations and marketing activities. Adherence to these standards is not simply a legal necessity; it is also critical for establishing customer confidence. As customers grow more aware of the significance of food security and quality, adhering to these standards becomes increasingly important for business success. Additionally, economic variables that include financial resources along with purchasing power affect consumer expenditure on premium and specialized baking mixes. When the economy is growing, people are more inclined to invest on high-end and creative items. On the flip side, amid recessions, there might be a preference for more cost-effective solutions. As a result, the Baking Mixes Market becomes subject to macroeconomic volatility.

To summarize, the Baking Mixes Market is influenced by a variety of customer preferences, fierce competition, technical breakthroughs, regulatory environments, and economic variables. As these market forces vary, the industry must change and create solutions to satisfy changing customer needs and preserve long-term success.

Leave a Comment