Barium Derivatives Size

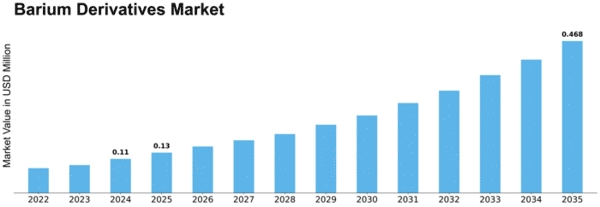

Barium Derivatives Market Growth Projections and Opportunities

The Barium Derivatives Market is influenced by various factors shaping its dynamics and growth. Barium derivatives are formed from barium compounds and are used in numerous sectors like Electronics, Chemicals, Health Care and so forth. Demand for these industrial products continues to be driven by global economic conditions, raw material availability, technology advancements and regulatory considerations in the market of the barium derivatives industry. These chemicals have a huge application: for instance they can be used in mining, chemical as well as metallurgy industries among others. Key players in every part of the world endorse wetting agents made from barium derivatives that are effective particularly in drilling mud within oil and gas sector. In this context, barium derivatives serve as drilling fluids which contribute to wide range applications across different elements of derivates offered by the market. Sales performance varies with regional demand as well as industry requirements where major players adjust their production levels accordingly. Industrial demand is a key determinant of trends in the Barium Derivatives Market; one example is how it moves from applications such as barium sulfate used in the oil and gas industry to barium titanate commonly used in electronics sector. For instance, BaCO3 may be synthesized into other chemicals such as BaSO4 which has many applications especially for petroleum drilling muds. Typical barytes contains up to 85% BaSO4 that is generally employed during drilling operations in petroleum industry but on a limited scale. As industrial activities continue to grow it’s expected that diversity of usage will drive an increase in demand for these derivatives. The development of technological capacities related to the production or use of barium derivatives holds significant implications for market economics hereof. The great part of modernizing efforts mainly focuses on more efficient manufacturing techniques enhancing product quality and widening its range of application areas which includes innovation programs aimed at developing new technologies based on ionizable substances like BaO or BaTiO3 for electronic and healthcare industry. It is important to acknowledge that regulatory concerns play a great role when it comes to shaping the barium derivatives market. For barium compounds, there are some environmental as well as safety regulations which should be put in place during their manufacture and use. This requires companies in this sector to adhere to sustainable practices, reduce pollution and adhere by safety protocols. In terms of sustainability and environmental responsibility, the industrial response to emerging regulatory norms could be seen as an indicator of the market health at large for barium derivatives businesses.

Leave a Comment