Barium Nitrate Size

Barium Nitrate Market Growth Projections and Opportunities

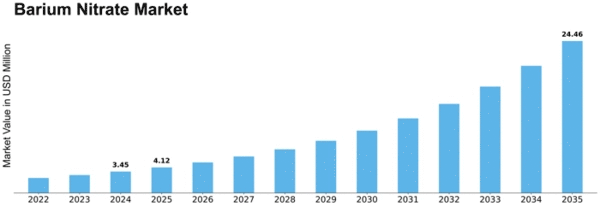

The size of the Barium Nitrate market depends on several market factors that shape its dynamics. The fireworks industry has always been a significant source of demand for Barium Nitrate as it is used in the manufacture of green-colored fireworks. The use of Barium Nitrate in glass and ceramics production is another important market factor. This compound acts as a purifying agent, thereby enhancing the optical and mechanical properties of glass. It is especially applicable to manufacturing television screens and specialty glass. The Barium Nitrate Market size will grow from USD 2459.3 million In 2020 to USD 3513.6 million by 2030. The agriculture sector also contributes to the market dynamics of Barium Nitrate. The chemical is used to manufacture certain types of fertilizers that help crops grow better and yield higher. As global agricultural practices evolve and demand for efficient fertilizers increases, the corresponding shifts occur within the Barium Nitrate market. Moreover, geopolitical factors play a role in shaping the barium nitrate market. The overall production cost of barium nitrate is affected by the availability and pricing of raw materials, especially barite ore. Environmental regulations are increasingly becoming significant in this regard, thus becoming one major factor within the barium nitrate market today. Strict regulations about air pollution and waste management affect how manufacturers process this compound, forcing them to adopt eco-friendly means for its production. This not only affects the cost structure but also caters to the growing demand for environmentally responsible products. Also, world economic scenarios can significantly influence the state of things in this field, such as fireworks demands, and thus affect buying patterns about this application. Barium nitrate's role in these technological advances does not go unnoticed either. Initially, there was no knowledge about all these applications mentioned until research work proved their viability; hence, they have come up with so many ways through which barium nitrate can be used. However, the barium nitrate market is influenced by a combination of factors, including demand from the fireworks industry, applications in glass and ceramics manufacturing, agriculture, geopolitical considerations, environmental regulations, economic conditions, and technological advancements. Succeeding in this business environment requires understanding and adapting to these market factors for companies that operate in the Barium Nitrate sector.

Leave a Comment