- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

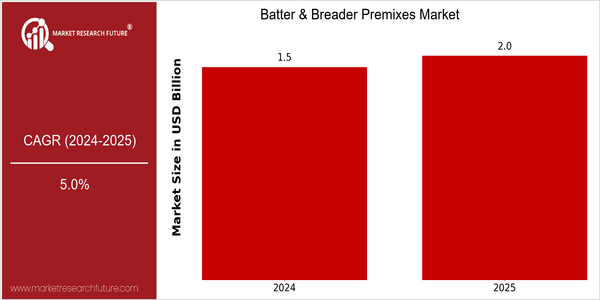

Batter Breader Premixes Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 1.5 Billion |

| 2025 | USD 2.0 Billion |

| CAGR (2017-2025) | 5.0 % |

Note – Market size depicts the revenue generated over the financial year

The Batter & Breading Premixes Market is set for substantial growth with a current market size of $ 1.5 billion in 2024, projected to reach $ 2 billion by 2025. This is a CAGR of 5.0% from 2017 to 2025, indicating a strong demand for these products in the food processing industry. This growth is largely attributed to the growing preference for convenience food and the rising popularity of ready-to-eat meals. The development of new products in the form of breadings and batters is also a major growth driver. In this market, the major players such as the Kerry Group, Associated British Foods, and Ingredion are pursuing growth strategies. These companies are investing in research and development to develop healthier and more versatile premixes. Moreover, they are establishing strategic alliances to expand their distribution network. Recent launches of premixes such as gluten-free and organic have catered to changing consumer preferences and positioned these companies well in the market. Generally, the Batter & Breading Premixes Market is set to thrive, driven by innovation and changing consumer trends.

Regional Deep Dive

Batter and breading mixes have been gaining a strong foothold in the market, driven by the rising demand for convenient foods and the growing popularity of fried foods. In North America, the market is characterized by the strong presence of established food manufacturers and a growing trend towards healthier, gluten-free products. Europe is characterized by a wide variety of culinary influences, which in turn influence the available premixes. The Asia-Pacific region is characterized by rapid urbanization, which has resulted in a growing demand for convenient foods. The Middle East and Africa (MEA) region is characterized by the rising number of fast-food chains, which in turn has resulted in a higher demand for batter and breading premixes. In Latin America, on the other hand, rich culinary traditions are being used to develop new premixes.

North America

- The demand for gluten-free and organic batter and breading mixes has increased in the last few years. Pinnacle Foods and General Mills are developing these products.

- The demand for new and varied tastes has led to innovations in the flavors and blends of the seasonings.

- Regulations concerning the labelling of foods and the making of health claims have forced manufacturers to reformulate their products in order to comply with the new regulations.

Europe

- Local traditions are strong in Europe, and companies like Unilever and the Kerry Group emphasize the local tastes and ingredients.

- There are more and more manufacturers who, with the help of the European Food Safety Authority (EFSA), are launching projects to promote sustainable production methods and to source locally.

- The increasing importance of food delivery and fast food is driving demand for batter and breading premixes, as seen with the growth of Just Eat and Deliveroo.

Asia-Pacific

- Ajinomoto and Nestlé are the leading companies in this business. The rapid urbanization and the growing middle class in China and India are driving the market for convenience foods, which is driving the demand for the sale of the company's breading and frying mixtures.

- Local companies like ITC have a role to play in the formulation of new products, such as the agri-business company ITC, which is trying to respond to the growing health consciousness of consumers.

- Influenced by the street-food phenomenon, consumers are looking for authentic flavors and products that reproduce traditional recipes.

MEA

- The fast-food chains are expanding in the Middle East and Africa, especially in the United Arab Emirates and Saudi Arabia, and are thus increasing the demand for batter and breading mixes. Leading companies are Al Baik and KFC.

- Agricultural policy measures which aim to promote domestic food production and to limit imports, stimulate the development of local producers to produce their own mixes and thus to improve their market competitiveness.

- The seasonable increase in the demand for batter and breading, especially during the festive season, provides opportunities for manufacturers to launch special products.

Latin America

- The rich gastronomic tradition of Latin America is influencing the development of unique batter and breading mixes, with companies like Grupo Bimbo and JBS focusing on local tastes and gastronomic preferences.

- Premixes have enjoyed an increased popularity since the COVID-19 pandemic. As the craze for home cooking has grown, the convenience of preparing familiar dishes has increased.

- Changing regulations in the field of food safety and labeling are causing manufacturers to increase the transparency of their products, with organizations like ANVISA in Brazil imposing stricter guidelines.

Did You Know?

“The world market for batters and breadings is going to see a significant shift towards plant-based options, as a growing number of consumers are looking for healthier alternatives to traditional fried foods.” — Market Research Future

Segmental Market Size

The Batter and Breader Premixes Market plays a key role in the food industry, especially in enhancing the taste and texture of fried foods. This market is currently growing, owing to the growing demand for ready-to-eat foods and the rising popularity of fried foods in various cuisines. The expansion of the food service sector in emerging economies has also driven the demand for batter and breader premixes.

Premixes for breading and batter are now widely used. The market is dominated by the Kerry Group and Associated British Foods. They are used mainly in restaurants, mobile catering, and in the manufacture of frozen foods where a uniform flavour and quality are essential. But the growth of the market is also being driven by the trend towards clean labelling and the trend towards more sustainable production. In this area, too, advanced coating systems and flavour enhancement techniques are determining the development of the market and enabling manufacturers to meet the diverse needs of their customers.

Future Outlook

Batter and Breading Premixes Market is expected to grow at a CAGR of 5% from 2024 to 2025. This growth is driven by the increasing demand for convenience foods and the rising popularity of fried and baked foods in various cuisines. As the demand for quick meal solutions increases, the use of batter and breading premixes is expected to increase significantly in both the commercial and domestic food service industry in the coming years.

The market for premixes is a growing market, with key technological developments such as the development of gluten-free and clean-label premixes driving market growth. As health-conscious consumers demand greater transparency in the composition of products, manufacturers will be under pressure to provide clean-label products. Also, the expansion of foodservice and the increasing trend for home delivery are expected to open up new opportunities for batter and breading premixes, as food service operators are increasingly relying on these products to improve the flavour and texture of their dishes while ensuring operational efficiency. In summary, the batter and breading premixes market is set to grow as a result of changing consumer preferences and strategic innovations in the industry.

Batter Breader Premixes Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.