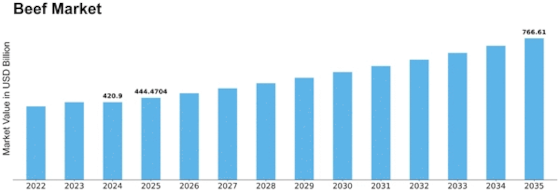

Beef Size

Beef Market Growth Projections and Opportunities

The beef market is influenced by a myriad of market factors that collectively shape its dynamics. One primary determinant is consumer demand, which is heavily influenced by factors such as income levels, cultural preferences, and dietary trends. As disposable incomes rise, consumers often opt for higher-quality beef products, leading to shifts in market demand. Additionally, cultural preferences play a crucial role, as different regions may have varying preferences for specific cuts or preparation methods. The rise of health-conscious consumer behavior also impacts the beef market, with increasing demand for leaner cuts and organic or grass-fed options.

Government policies and regulations constitute another significant market factor. Import and export regulations, subsidies, and safety standards imposed by governments can profoundly impact the international trade of beef products. For example, trade agreements or tariffs may affect the cost and availability of beef in certain regions, influencing market prices and supply chains. Moreover, regulatory measures related to food safety and environmental sustainability can shape industry practices and impact production costs.

The beef market is inherently linked to the livestock industry, and factors affecting cattle production have a direct impact on beef prices. Climate conditions, feed costs, and disease outbreaks can disrupt cattle farming, leading to fluctuations in beef supply and pricing. Natural disasters, such as droughts or floods, can affect the availability and cost of livestock feed, impacting the overall cost of raising cattle. Disease outbreaks, like foot-and-mouth disease, not only affect the health of cattle but can also lead to trade restrictions, affecting the global beef market.

Global economic conditions and currency exchange rates are additional influential factors in the beef market. Economic downturns can lead to decreased consumer spending, affecting demand for beef products. Fluctuations in currency values can impact the cost of imported and exported beef, influencing trade dynamics. Exchange rate shifts can also affect the competitiveness of domestic beef producers in the international market.

Technological advancements play a role in shaping the beef market as well. Innovations in farming practices, such as precision agriculture and genetic engineering, can improve efficiency and production yields. Additionally, advancements in processing and packaging technologies can impact the shelf life and quality of beef products, influencing consumer choices and market trends.

Environmental considerations have become increasingly important in recent years, impacting the beef market. Concerns about deforestation, greenhouse gas emissions, and water usage associated with cattle farming have led to a growing demand for sustainable and environmentally friendly beef production practices. This shift in consumer preferences has prompted some producers to adopt more sustainable methods and invest in eco-friendly certifications to meet market demands.

Leave a Comment