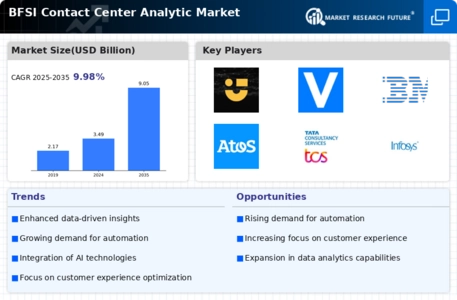

The BFSI Contact Center Analytic Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for enhanced customer experience and operational efficiency. Key players such as NICE (IL), Verint (IL), and Genesys (US) are at the forefront, each adopting distinct strategies to solidify their market positions. NICE (IL) focuses on innovation through advanced analytics and AI-driven solutions, aiming to optimize customer interactions and streamline operations. Verint (IL), on the other hand, emphasizes a comprehensive approach to customer engagement, integrating workforce optimization with analytics to enhance service delivery. Genesys (US) is leveraging its cloud-based solutions to facilitate digital transformation for financial institutions, thereby enhancing customer journey mapping and real-time decision-making capabilities. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological advancement and customer-centric solutions.In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to respond swiftly to market demands. The BFSI Contact Center Analytic Market appears moderately fragmented, with a mix of established players and emerging startups vying for market share. The collective influence of these key players is shaping a landscape where agility and responsiveness are paramount, allowing them to adapt to the evolving needs of the BFSI sector.

In August NICE (IL) announced a strategic partnership with a leading AI firm to enhance its analytics capabilities. This collaboration is expected to bolster NICE's offerings in predictive analytics, enabling financial institutions to anticipate customer needs more effectively. The strategic importance of this partnership lies in its potential to provide clients with deeper insights into customer behavior, thereby improving retention rates and overall satisfaction.

In September Verint (IL) launched a new suite of cloud-based solutions tailored specifically for the BFSI sector. This initiative aims to streamline compliance processes and enhance customer engagement through integrated analytics. The launch signifies Verint's commitment to addressing the unique challenges faced by financial institutions, particularly in regulatory compliance and customer service excellence, thereby reinforcing its competitive edge in the market.

In October Genesys (US) unveiled an innovative AI-driven customer engagement platform designed to optimize interactions across multiple channels. This platform is particularly significant as it aligns with the growing trend of omnichannel communication in the BFSI sector. By enhancing the customer experience through seamless integration, Genesys positions itself as a leader in the digital transformation of contact centers, catering to the evolving expectations of consumers.

As of October the competitive trends in the BFSI Contact Center Analytic Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are playing a crucial role in shaping the current landscape, enabling companies to pool resources and expertise to drive innovation. Looking ahead, it is likely that competitive differentiation will evolve, with a pronounced shift from price-based competition to a focus on technological innovation, customer experience enhancement, and supply chain reliability.