Biodegradable Plastic Packaging Size

Biodegradable Plastic Packaging Market Growth Projections and Opportunities

Searching...

What is the projected market valuation of the Biodegradable Plastic Packaging Market by 2035?

The projected market valuation for the Biodegradable Plastic Packaging Market is expected to reach 31.82 USD Billion by 2035.

What was the market valuation of the Biodegradable Plastic Packaging Market in 2024?

The overall market valuation of the Biodegradable Plastic Packaging Market was 8.36 USD Billion in 2024.

What is the expected CAGR for the Biodegradable Plastic Packaging Market during the forecast period 2025 - 2035?

The expected CAGR for the Biodegradable Plastic Packaging Market during the forecast period 2025 - 2035 is 12.92%.

Which companies are considered key players in the Biodegradable Plastic Packaging Market?

Key players in the Biodegradable Plastic Packaging Market include BASF SE, Novamont S.p.A., NatureWorks LLC, and Total Corbion PLA.

What are the main types of biodegradable plastics used in packaging?

The main types of biodegradable plastics used in packaging include Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), starch-based plastics, and cellulose-based plastics.

What is the projected market size for food packaging applications in 2035?

The projected market size for food packaging applications in the Biodegradable Plastic Packaging Market is expected to reach 12.91 USD Billion by 2035.

How does the market for biodegradable plastic packaging in the electronics sector appear?

The market for biodegradable plastic packaging in the electronics sector is projected to grow to 3.9 USD Billion by 2035.

What is the expected growth in the consumer goods packaging segment by 2035?

The consumer goods packaging segment is expected to grow to 8.63 USD Billion by 2035.

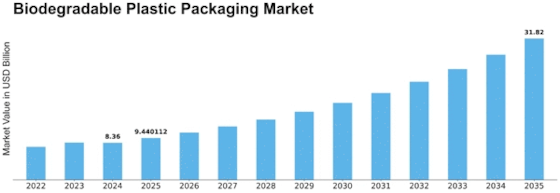

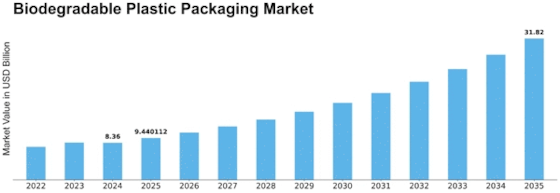

As per Market Research Future analysis, the Biodegradable Plastic Packaging Market was estimated at 8.36 USD Billion in 2024. The biodegradable plastic packaging industry is projected to grow from 9.44 USD Billion in 2025 to 31.82 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 12.92% during the forecast period 2025 - 2035

The Biodegradable Plastic Packaging Market is poised for substantial growth driven by sustainability trends and technological advancements.

| 2024 Market Size | 8.36 (USD Billion) |

| 2035 Market Size | 31.82 (USD Billion) |

| CAGR (2025 - 2035) | 12.92% |

| Largest Regional Market Share in 2024 | Europe |

BASF SE (DE), Novamont S.p.A. (IT), NatureWorks LLC (US), Total Corbion PLA (NL), BioBag International AS (NO), Mitsubishi Chemical Corporation (JP), Cardia Bioplastics (AU), Green Dot Bioplastics (US), Earthpack (US)

The Biodegradable Plastic Packaging Market is currently experiencing a notable transformation driven by increasing environmental awareness and regulatory pressures. Consumers are becoming more conscious of their ecological footprint, leading to a rising demand for sustainable packaging solutions. This shift is prompting manufacturers to innovate and develop materials that not only meet functional requirements but also align with eco-friendly practices. As a result, the market is witnessing a surge in the adoption of biodegradable materials derived from renewable resources, which are perceived as viable alternatives to traditional plastics. Moreover, advancements in technology are facilitating the production of biodegradable plastics that exhibit enhanced performance characteristics. These innovations are likely to expand the applications of biodegradable packaging across various sectors, including food and beverage, cosmetics, and consumer goods. Companies are increasingly investing in research and development to create products that not only decompose efficiently but also maintain the integrity and safety of the packaged goods. This evolving landscape suggests a promising future for the Biodegradable Plastic Packaging Market, as stakeholders strive to balance consumer needs with environmental sustainability.

There is a growing trend among consumers who prioritize sustainable products, influencing brands to adopt biodegradable packaging solutions. This shift reflects a broader societal movement towards environmental responsibility, compelling companies to rethink their packaging strategies.

Advancements in material science are leading to the creation of new biodegradable plastics that offer improved durability and functionality. These innovations are essential for expanding the range of applications and enhancing the performance of biodegradable packaging.

Governments worldwide are implementing regulations and incentives to promote the use of biodegradable materials. This supportive framework is likely to accelerate the transition from conventional plastics to more sustainable packaging options, shaping the future of the market.

The increasing awareness regarding environmental issues is a pivotal driver for the Biodegradable Plastic Packaging Market. Consumers are becoming more conscious of the ecological impact of traditional plastic packaging, which has led to a surge in demand for sustainable alternatives. This shift in consumer behavior is reflected in market data, indicating that the biodegradable plastic packaging segment is expected to grow at a compound annual growth rate of approximately 15% over the next five years. As individuals and organizations alike prioritize eco-friendly practices, the industry is likely to witness a significant transformation, with biodegradable options becoming a preferred choice for packaging solutions.

Government regulations aimed at reducing plastic waste are significantly influencing the Biodegradable Plastic Packaging Market. Various countries are implementing stringent policies to limit the use of single-use plastics, thereby encouraging the adoption of biodegradable alternatives. For instance, recent legislation in several regions mandates the use of biodegradable materials in packaging, which is expected to propel market growth. Market data suggests that regions with strict regulations are likely to see a 20% increase in the adoption of biodegradable packaging solutions over the next few years. This regulatory landscape is creating a favorable environment for the industry to thrive.

Many corporations are adopting sustainability initiatives as part of their corporate social responsibility strategies, which is driving the Biodegradable Plastic Packaging Market. Companies are increasingly recognizing the importance of reducing their carbon footprint and enhancing their brand image through sustainable practices. This trend is supported by market data showing that over 60% of consumers are willing to pay more for products packaged in environmentally friendly materials. As businesses strive to meet consumer expectations and regulatory requirements, the demand for biodegradable packaging solutions is anticipated to rise, fostering innovation and investment in this sector.

Technological advancements in the production of biodegradable plastics are enhancing the viability of the Biodegradable Plastic Packaging Market. Innovations in material science are leading to the development of new biodegradable polymers that offer improved performance and cost-effectiveness. For example, advancements in biopolymer production techniques have resulted in materials that not only decompose more efficiently but also maintain the functional properties required for packaging. Market data indicates that the introduction of these technologies could reduce production costs by up to 30%, making biodegradable options more accessible to manufacturers and consumers alike.

The growing consumer preference for eco-friendly products is a crucial driver for the Biodegradable Plastic Packaging Market. As consumers increasingly seek products that align with their values, the demand for biodegradable packaging solutions is on the rise. Market data reveals that nearly 70% of consumers are actively looking for sustainable packaging options when making purchasing decisions. This trend is prompting manufacturers to innovate and expand their product lines to include biodegradable materials, thereby enhancing their market competitiveness. The shift in consumer preferences is likely to continue shaping the industry landscape in the coming years.

In the Biodegradable Plastic Packaging Market, Polylactic Acid (PLA) continues to dominate, holding the largest market share among biodegradable materials. PLA's popularity is driven by its versatility, ease of processing, and compatibility with existing manufacturing technologies, making it the preferred choice among manufacturers. Following closely, Polyhydroxyalkanoates (PHA) is emerging as a strong competitor, capturing significant attention due to its biodegradability in various environments and its potential for large-scale production from renewable resources. The growth in demand for biodegradable packaging is largely fueled by increasing environmental awareness and stricter regulations against single-use plastics. Manufacturers are innovating within the PHA segment to enhance its performance attributes, appealing to eco-conscious consumers. Notably, brands are increasingly considering PHA as a suitable alternative in specialized applications, thereby positioning it for rapid growth in the upcoming years.

Polylactic Acid (PLA) (Dominant) vs. Polyhydroxyalkanoates (PHA) (Emerging)

Polylactic Acid (PLA) is currently the dominant player in the biodegradable plastic packaging market, primarily due to its favorable properties like clarity, tensile strength, and ease of processing. It is widely used in applications such as <a href="https://www.marketresearchfuture.com/reports/pet-food-packaging-market-1248">food packaging</a> and disposable tableware because it meets both consumer expectations for sustainability and manufacturers' performance criteria. Meanwhile, Polyhydroxyalkanoates (PHA) is recognized as an emerging segment, distinguished by its unique capability to decompose in marine environments and composting settings. This biopolymer is manufactured through microbial fermentation, tapping into renewable resources, which positions it favorably within the growing market for sustainable solutions. PHA's development is still in an evolving stage, but its versatility in applications such as packaging films and flexible materials is gaining traction.

In the Biodegradable Plastic Packaging Market, the application segment exhibits varied distribution in terms of market share. Food Packaging stands out as the largest segment, capturing a significant portion due to the high demand for sustainable solutions in the food industry. This sector's growth is driven by increasing consumer awareness regarding environmental issues and the need for eco-friendly packaging materials that can decompose after use. In contrast, Cosmetic Packaging has emerged as the fastest-growing segment, driven by the beauty industry's shifting focus towards sustainable practices. As brands prioritize biodegradable alternatives, this segment is witnessing rapid adoption. Growth trends in the biodegradable plastic packaging sector are largely influenced by regulatory changes and consumer preferences. With stricter regulations on plastic usage and a surge in environmentally conscious consumers, manufacturers are compelled to innovate. The food packaging segment benefits from its established presence and the constant need for freshness and safety in products. Meanwhile, the cosmetics packaging segment is evolving due to emerging brands that prioritize sustainability, technology advancements in biodegradable materials, and changing consumer buying patterns where eco-friendliness is a decisive factor.

Food Packaging (Dominant) vs. Cosmetics Packaging (Emerging)

The Food Packaging segment holds a dominant position within the biodegradable plastic packaging market, primarily due to its critical role in safeguarding food products while addressing environmental concerns. This sector typically includes items like bags, containers, and wraps that must meet stringent regulations for food safety and quality. On the other hand, the <a href="https://www.marketresearchfuture.com/reports/cosmetic-packaging-market-1778">Cosmetics Packaging</a> segment is characterized as emerging, reflecting its rapid growth in response to the beauty industry's evolution toward sustainable practices. Brands are increasingly opting for biodegradable options to attract eco-conscious consumers, implementing innovative designs and materials while maintaining the aesthetic appeal essential in cosmetics. Both segments, while distinct, underline the overarching shift toward greener solutions across various industries, driven by consumer demand for environmentally friendly products.

The end use industry segment of the biodegradable plastic packaging market shows distinct dynamics. The food and beverage sector captures the largest share, driven by the increasing demand for sustainable packaging solutions as consumers become more environmentally conscious. This segment's expansive growth is propelled by the ongoing shift from traditional plastics to biodegradable alternatives in food service, which is now a priority among manufacturers. In contrast, the pharmaceuticals sector represents the fastest-growing segment. Pharmaceutical companies are under increasing regulatory pressure to adopt eco-friendly packaging, leading to a surge in interest for biodegradable plastics. This demand stems from the industry's commitment to sustainability, thus reinforcing the need for innovative packaging solutions that minimize environmental impact and enhance product shelf life.

Food & Beverage (Dominant) vs. Pharmaceuticals (Emerging)

The food and beverage industry stands as the dominant player in the biodegradable plastic packaging market, where the shift towards sustainable packaging is vital. This segment not only leads in market adoption but has also set the standards for biodegradable materials that can safely contain food items. Manufacturers are innovating new materials that offer durability while ensuring compliance with environmental regulations. Meanwhile, the pharmaceuticals segment is emerging rapidly, fueled by increasing awareness of sustainability within the healthcare sector. This segment is characterized by stringent packaging requirements that prioritize safety and efficacy, creating opportunities for adapted biodegradable solutions tailored specifically for medicinal products. As both sectors evolve, the interplay between dominant and emerging trends will shape the future landscape of biodegradable packaging.

The biodegradable plastic packaging market is characterized by various forms, including films, containers, pouches, and trays. Among these, films emerge as the largest segment, capturing a significant share of the market. Pouches, while smaller in market share, are rapidly gaining traction due to their versatile applications and increasing consumer preference for lightweight, convenient packaging solutions. The distinction between these segments highlights a dynamic landscape where consumer choices significantly influence market trends.

Films (Dominant) vs. Pouches (Emerging)

In the biodegradable plastic packaging market, films are the dominant segment, widely used for their flexibility, strength, and ability to be produced in various thicknesses. They cater to a wide array of applications, from food packaging to industrial uses, making them essential for sustaining organic material integrity. On the other hand, pouches represent an emerging segment, driven by trends favoring convenience and portability. Their growth is fueled by innovations in design and functionality, including resealable features and multi-layering, enabling better protection and extending product shelf life. These attributes are attracting a broader range of manufacturers and end-users.

North America is witnessing a significant surge in the biodegradable plastic packaging market, driven by increasing consumer awareness and stringent regulations aimed at reducing plastic waste. The region holds approximately 40% of the global market share, making it the largest market for biodegradable packaging. Key drivers include government initiatives promoting sustainable practices and rising demand from industries such as food and beverage, which are shifting towards eco-friendly alternatives. The United States and Canada are the leading countries in this market, with major players like NatureWorks LLC and BASF SE establishing a strong presence. The competitive landscape is characterized by innovation and collaboration among companies to develop advanced biodegradable materials. As consumer preferences shift towards sustainable products, the market is expected to grow, supported by investments in research and development to enhance product performance and reduce costs.

Europe is emerging as a regulatory pioneer in the biodegradable plastic packaging market, holding approximately 35% of the global market share, making it the second largest region. The growth is fueled by stringent EU regulations aimed at reducing plastic waste and promoting circular economy practices. Countries like Germany and France are leading the charge, with increasing consumer demand for sustainable packaging solutions driving innovation and investment in biodegradable materials. Leading players in this region include Novamont S.p.A. and Total Corbion PLA, which are at the forefront of developing innovative biodegradable products. The competitive landscape is marked by collaboration between manufacturers and regulatory bodies to ensure compliance with environmental standards. As the market evolves, Europe is expected to continue its leadership role in promoting sustainable packaging solutions, supported by a robust regulatory framework.

Asia-Pacific is rapidly emerging as a significant player in the biodegradable plastic packaging market, driven by increasing environmental awareness and government initiatives promoting sustainable practices. The region holds approximately 20% of the global market share, with countries like Japan and Australia leading the way. The demand for biodegradable packaging is being propelled by the food and beverage sector, which is increasingly adopting eco-friendly alternatives to meet consumer expectations and regulatory requirements. The competitive landscape in Asia-Pacific is characterized by a mix of local and international players, including Mitsubishi Chemical Corporation and Cardia Bioplastics. These companies are focusing on innovation and product development to capture market share. As the region continues to grow, investments in research and development will play a crucial role in enhancing the performance and affordability of biodegradable packaging solutions, positioning Asia-Pacific as a key market in the coming years.

The Middle East and Africa region is gradually recognizing the potential of biodegradable plastic packaging, driven by increasing environmental concerns and a shift towards sustainable practices. This region currently holds about 5% of the global market share, with growth primarily seen in countries like South Africa and the UAE. The demand for biodegradable packaging is being influenced by government initiatives aimed at reducing plastic waste and promoting eco-friendly alternatives in various sectors, including food and retail. The competitive landscape is still developing, with local players beginning to explore biodegradable options. Companies are increasingly collaborating with international firms to enhance their product offerings and meet the growing demand for sustainable packaging solutions. As awareness of environmental issues rises, the Middle East and Africa are expected to see a gradual increase in the adoption of biodegradable packaging, supported by favorable regulations and market trends.

The Biodegradable Plastic Packaging Market is currently characterized by a dynamic competitive landscape, driven by increasing environmental awareness and regulatory pressures aimed at reducing plastic waste. Key players such as BASF SE (Germany), Novamont S.p.A. (Italy), and NatureWorks LLC (United States) are at the forefront of this market, each adopting distinct strategies to enhance their market positioning. BASF SE (Germany) focuses on innovation in material science, developing advanced biodegradable polymers that cater to diverse applications. In contrast, Novamont S.p.A. (Italy) emphasizes sustainability through its comprehensive product lifecycle approach, integrating renewable resources into its manufacturing processes. NatureWorks LLC (United States) leverages its expertise in bioplastics to expand its global footprint, particularly in North America and Europe, thereby enhancing its competitive edge.

The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing. The market structure appears moderately fragmented, with a mix of established players and emerging startups. This fragmentation allows for a variety of innovative solutions to coexist, fostering a competitive environment where collaboration and strategic partnerships are increasingly common. The collective influence of these key players shapes market dynamics, as they strive to meet the growing demand for sustainable packaging solutions.

In August 2025, BASF SE (Germany) announced a strategic partnership with a leading food packaging company to develop a new line of biodegradable packaging solutions tailored for the food industry. This collaboration is poised to enhance BASF's product offerings while addressing the pressing need for sustainable packaging in a sector heavily scrutinized for its environmental impact. The partnership underscores BASF's commitment to innovation and its proactive approach to meeting customer demands for eco-friendly alternatives.

In July 2025, Novamont S.p.A. (Italy) launched a new initiative aimed at increasing the availability of its biodegradable products in the Asian market. This strategic move is indicative of Novamont's ambition to expand its global reach and capitalize on the growing demand for sustainable packaging solutions in emerging economies. By localizing production and distribution, Novamont aims to enhance its competitive positioning while contributing to regional sustainability goals.

In September 2025, NatureWorks LLC (United States) unveiled a new biopolymer that significantly reduces carbon emissions during production. This innovation not only strengthens NatureWorks' product portfolio but also aligns with global sustainability targets. The introduction of this biopolymer is likely to attract environmentally conscious consumers and businesses, further solidifying NatureWorks' leadership in the bioplastics sector.

As of October 2025, the competitive trends within the Biodegradable Plastic Packaging Market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming pivotal, as companies recognize the value of collaboration in driving innovation and enhancing supply chain reliability. Looking ahead, competitive differentiation is expected to evolve, shifting from traditional price-based competition to a focus on technological advancements and sustainable practices. This transition may redefine market dynamics, compelling companies to innovate continuously to maintain their competitive edge.

The Biodegradable Plastic Packaging Market is projected to grow at a 12.92% CAGR from 2025 to 2035, driven by increasing environmental regulations, consumer demand for sustainable products, and technological advancements.

New opportunities lie in:

By 2035, the market is expected to achieve substantial growth, positioning itself as a leader in sustainable packaging solutions.

| MARKET SIZE 2024 | 8.36(USD Billion) |

| MARKET SIZE 2025 | 9.44(USD Billion) |

| MARKET SIZE 2035 | 31.82(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 12.92% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | BASF SE (DE), Novamont S.p.A. (IT), NatureWorks LLC (US), Total Corbion PLA (NL), BioBag International AS (NO), Mitsubishi Chemical Corporation (JP), Cardia Bioplastics (AU), Green Dot Bioplastics (US), Earthpack (US) |

| Segments Covered | Type of Biodegradable Plastic, Application, End Use Industry, Form, Regional |

| Key Market Opportunities | Growing consumer demand for sustainable packaging solutions drives innovation in the Biodegradable Plastic Packaging Market. |

| Key Market Dynamics | Rising consumer demand for sustainable solutions drives innovation and competition in the biodegradable plastic packaging sector. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

What is the projected market valuation of the Biodegradable Plastic Packaging Market by 2035?

The projected market valuation for the Biodegradable Plastic Packaging Market is expected to reach 31.82 USD Billion by 2035.

What was the market valuation of the Biodegradable Plastic Packaging Market in 2024?

The overall market valuation of the Biodegradable Plastic Packaging Market was 8.36 USD Billion in 2024.

What is the expected CAGR for the Biodegradable Plastic Packaging Market during the forecast period 2025 - 2035?

The expected CAGR for the Biodegradable Plastic Packaging Market during the forecast period 2025 - 2035 is 12.92%.

Which companies are considered key players in the Biodegradable Plastic Packaging Market?

Key players in the Biodegradable Plastic Packaging Market include BASF SE, Novamont S.p.A., NatureWorks LLC, and Total Corbion PLA.

What are the main types of biodegradable plastics used in packaging?

The main types of biodegradable plastics used in packaging include Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), starch-based plastics, and cellulose-based plastics.

What is the projected market size for food packaging applications in 2035?

The projected market size for food packaging applications in the Biodegradable Plastic Packaging Market is expected to reach 12.91 USD Billion by 2035.

How does the market for biodegradable plastic packaging in the electronics sector appear?

The market for biodegradable plastic packaging in the electronics sector is projected to grow to 3.9 USD Billion by 2035.

What is the expected growth in the consumer goods packaging segment by 2035?

The consumer goods packaging segment is expected to grow to 8.63 USD Billion by 2035.

North America Outlook (USD Billion, 2019-2035)

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Regional Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Europe Outlook (USD Billion, 2019-2035)

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Regional Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

APAC Outlook (USD Billion, 2019-2035)

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Regional Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

South America Outlook (USD Billion, 2019-2035)

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Regional Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

MEA Outlook (USD Billion, 2019-2035)

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Regional Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Biodegradable Plastic Packaging Market by Type of Biodegradable Plastic Type

Biodegradable Plastic Packaging Market by Application Type

Biodegradable Plastic Packaging Market by End Use Industry Type

Biodegradable Plastic Packaging Market by Form Type

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment