Market Analysis

In-depth Analysis of Bioherbicides Market Industry Landscape

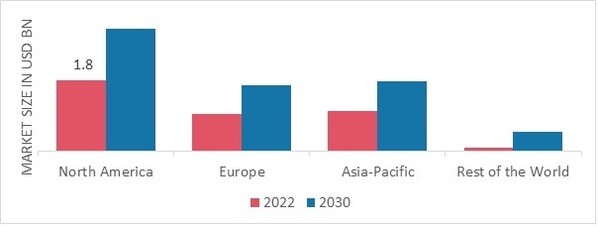

Bioherbicide market size is determined by several elements that affect its growth and effect. The bioherbicides Market is expected to reach USD 4.33 billion by 2030, growing 13.4% from 2022 to 2030. To reduce synthetic chemical usage in farming, governments and regulators are endorsing bio-based products. Bioherbicide research and development incentives, subsidies and supportive policies accelerate market growth rates. Bioherbicides grow well in regulatory regimes that facilitate sustainable and friendly solutions.

Consumer preference for organic and organically cultivated goods also drives the bioherbicides business. The demand for chemical free goods increases as food consumers become more conscious about what they eat. As a result of such demand, farmers are using herbicides that do not inhibit their organic crops from growing whilst at the same time helping keep weeds in check without hurting their organic plants.Meanwhile, the utilization of bioherbicides continues to increase because customers want cleaner agriculture.

Additionally, the use of these products influences the dynamics of their market by IWM techniques. Integrated weed management employs cultural practices such as crop rotation or intercropping, mechanical control including tillage and biological means such as competition using cereal cover crops or allelopathic control with sunnhemp or sorghum and sudangrass hybrids . It has been found effective when combined with biological means which include certain types of bacteria that can kill weeds by secreting substances inhibiting germination.Widespread adoption of IWM principles among farmers globally has sparked an increased demand for these agents.

However, low efficacy against some weed species and requirement for farmer education may act as barriers to market expansion. On the other hand, non-selective systemic herbicides, such as glyphosate, can control most broadleaf weeds and grasses in a wide range of crops . Ongoing research and development are essential to improving the effectiveness of bioherbicides and their acceptance by farmers. Educating farmers about the benefits, application methods, and proper integration into weed management strategies is critical to integrating bioherbicides well into agriculture systems.

Leave a Comment