Market Trends

Key Emerging Trends in the Bioherbicides Market

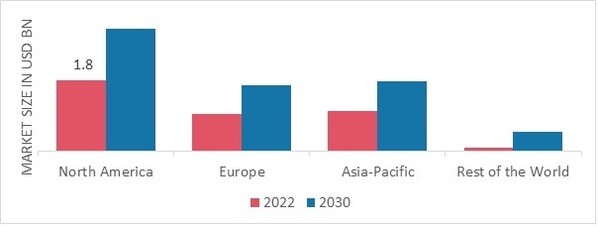

In the growing Bioherbicides market, firms use several approaches to gain market share. One key tactic is product innovation and differentiation. Companies study and produce bioherbicides that manage weeds sustainably. These firms want to stand out from competition, attract environmentally concerned customers, and dominate the bioherbicides industry by creating distinctive, high-quality products. Asia-Pacific dominates the worldwide bioherbicides market, followed by North America and Europe. Bioherbicide market share positioning depends on pricing tactics. Some organizations choose cost leadership to become the lowest-cost manufacturer through efficient production, economies of scale, and smart sourcing. This method might attract cost-conscious clients and give you an edge. Long-term commercial success requires balancing bioherbicide effectiveness and cost.

Market segmentation is another important bioherbicides market share factor. Companies target segments by crop type, regional weed types, or application methods. Companies can dominate niche markets and specialized client groups by tailoring bioherbicides to specific segments. Successful segmentation increases consumer happiness and loyalty, increasing market share within categories.

Bioherbicides companies are increasingly forming strategic partnerships. Companies can cooperate with agricultural research institutions, ecological specialists, and distributors to harness capabilities. Cooperative research, pooled resources, and a wider knowledge base can boost organizations' competitiveness and market share.

Geographical expansion is a common strategy for Bioherbicides firms seeking market share. This comprises entering new markets or extending regional businesses. Understanding local agricultural, regulatory environments, and weed issues is essential for geographical growth. By adapting bioherbicide products to regional demands, enterprises may reach varied customers, minimize market dependence, and enhance market share.

Bioherbicides market share positioning requires effective marketing and branding. Companies develop strong brands and promote their products through focused marketing. Bioherbicides' environmental sustainability, efficacy, and safety requirements help environmentally concerned customers see them favorably. Successful bioherbicide marketing tactics require online presence, channel involvement, and education about their benefits.

The Bioherbicides market is highly competitive, forcing players to use various techniques to gain market share. Innovative product diversification, price tactics, market segmentation, strategic partnerships, regional growth, and effective marketing are essential in this dynamic and environmentally sensitive business. By properly applying these tactics, organizations may overcome market problems, expand their client base, and increase their Bioherbicides market position.

Leave a Comment