Market Trends

Key Emerging Trends in the Biological Computers Market

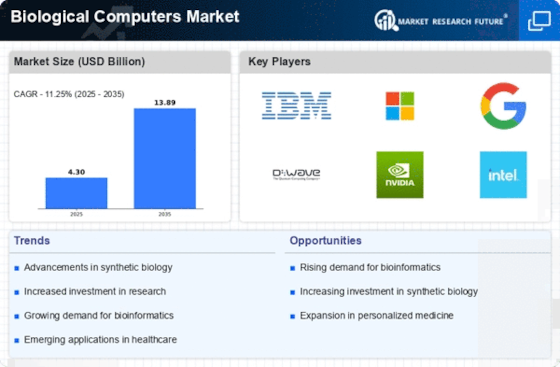

The biological computer market represents a revolutionary and evolving discipline that harnesses biological systems for computing programs. As the intersection of biology and PC science progresses, market traits are influenced with the aid of breakthroughs in bioinformatics, synthetic biology, and the development of bio-stimulated computing technology. Biological circuit layout and engineering play a pivotal position in market tendencies. Researchers are growing synthetic biological circuits that mimic digital circuits, taking into account the creation of programmable and customizable biological computers with programs in statistics processing and signal transduction. Bio-stimulated algorithms and neural networks make contributions to the evolution of the biological computer market. Drawing notions from organic systems, algorithms, and neural networks replicate complex procedures like studying and pattern recognition, providing capacity solutions for synthetic intelligence and machine studying programs. The market developments include a focal point on programs in medicinal drugs and healthcare. Biological computers are explored for their capacity in medical diagnostics, drug discovery, and customized medication, leveraging biological records for extra accurate and tailor-made healthcare solutions. Environmental monitoring and biosensing applications are on the upward thrust. Biological computers provide particular capabilities for actual-time tracking of environmental parameters and the detection of unique biomolecules, contributing to advancements in environmental science and sustainable practices. Quantum biology and the exploration of quantum computing ideas in organic structures are rising developments. Researchers are investigating quantum phenomena in organic methods, exploring the possibility of leveraging quantum houses for more desirable computational power in biological computers. Cross-disciplinary collaborations among biologists, pc scientists, and engineers are shaping market dynamics. Collaborative efforts harness diverse information to cope with challenges in organic computing, fostering innovation and accelerating the development of sensible applications. The moral implications of biological computing technology are gaining attention. As the market evolves, discussions on responsible research, privacy worries related to organic facts, and the established order of moral frameworks and policies are becoming crucial to the development and deployment of biological computers. Trends within the biological computer market include a growing emphasis on training and skill development. Training applications and academic tasks are aware of preparing researchers and professionals with the interdisciplinary information needed to contribute to the sector's development. The international growth of the biological computer market is obvious, with expanded industry investments and collaborations on a global scale. Companies and international studies establishments are investing in the studies and development of organic computing technology, contributing to the market's rapid growth.

Leave a Comment